Upfront payment in a lease offers the advantage of reducing monthly financial obligations and often securing better overall terms or lower interest rates. Monthly payments provide flexibility and ease cash flow management by spreading out costs over the lease duration. Choosing between upfront and monthly payments depends on budget preferences, cash availability, and long-term financial planning.

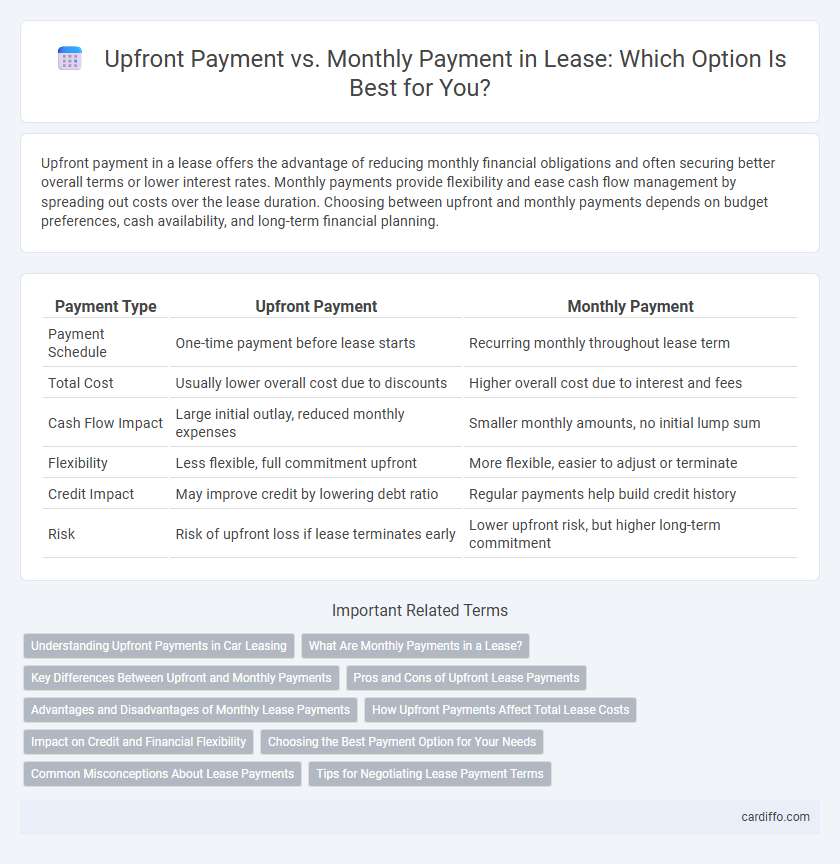

Table of Comparison

| Payment Type | Upfront Payment | Monthly Payment |

|---|---|---|

| Payment Schedule | One-time payment before lease starts | Recurring monthly throughout lease term |

| Total Cost | Usually lower overall cost due to discounts | Higher overall cost due to interest and fees |

| Cash Flow Impact | Large initial outlay, reduced monthly expenses | Smaller monthly amounts, no initial lump sum |

| Flexibility | Less flexible, full commitment upfront | More flexible, easier to adjust or terminate |

| Credit Impact | May improve credit by lowering debt ratio | Regular payments help build credit history |

| Risk | Risk of upfront loss if lease terminates early | Lower upfront risk, but higher long-term commitment |

Understanding Upfront Payments in Car Leasing

Upfront payments in car leasing typically include the first month's rent, a security deposit, acquisition fees, and other initial costs that reduce the monthly lease amount. Understanding these payments helps lessees manage their cash flow by lowering monthly installments and avoiding unexpected charges during the lease term. Evaluating the total lease cost considering upfront payments versus monthly payments is crucial for making cost-effective leasing decisions.

What Are Monthly Payments in a Lease?

Monthly payments in a lease represent the recurring amount a lessee pays to use the vehicle or property over the lease term, typically covering depreciation, interest, taxes, and fees. These payments are calculated based on the capitalized cost minus the residual value divided by the lease duration, ensuring a predictable cash outflow. Unlike upfront payments, monthly payments offer manageable budgeting without requiring a large initial cash outlay.

Key Differences Between Upfront and Monthly Payments

Upfront payment in a lease involves paying the entire lease amount or a significant portion at the beginning of the lease term, offering potential discounts and reducing monthly financial obligations. Monthly payments spread the lease cost over the lease duration, providing budget flexibility but often including interest or fees that increase the total cost. Key differences include cash flow impact, total lease cost, and potential incentives or penalties associated with early full payment versus incremental monthly billing.

Pros and Cons of Upfront Lease Payments

Upfront lease payments reduce the overall interest cost and lower monthly installments, providing financial predictability and potential savings over the lease term. However, they require a significant initial cash outlay, which can strain budgets and limit liquidity. This payment structure also increases the risk if the lessee terminates the lease early, as upfront funds are typically non-refundable.

Advantages and Disadvantages of Monthly Lease Payments

Monthly lease payments offer flexibility by spreading costs over time, making budgeting more manageable and avoiding large upfront expenses. However, they can result in higher overall costs due to interest and fees, and missing payments may lead to penalties or lease termination. Businesses must weigh cash flow benefits against potential financial risks when opting for monthly lease payments.

How Upfront Payments Affect Total Lease Costs

Upfront payments significantly reduce the total lease cost by lowering the capitalized cost, which decreases monthly lease payments and the amount of interest paid over the lease term. Making a larger initial payment can minimize the money factor impact, resulting in overall savings despite the higher initial outlay. However, minimizing upfront costs increases monthly payments and may lead to a higher total amount paid by the end of the lease.

Impact on Credit and Financial Flexibility

Upfront payments in leases often result in lower overall interest costs and can positively impact credit utilization by reducing monthly obligations, thus improving credit scores. Conversely, monthly payments maintain cash flow flexibility, preserving working capital but potentially increasing reported debt balances and affecting credit ratios. Choosing between upfront and monthly payments requires balancing immediate financial impact against long-term credit health and liquidity needs.

Choosing the Best Payment Option for Your Needs

Selecting the best lease payment option depends on your financial situation and cash flow preferences; upfront payments reduce overall interest costs and monthly obligations, often resulting in lower total lease expenses. Monthly payments provide flexibility and improved liquidity by spreading costs over time, which benefits those with limited initial capital or fluctuating income. Analyze your budget, lease terms, and potential tax implications to determine whether an upfront lump sum or consistent monthly payments align better with your financial goals.

Common Misconceptions About Lease Payments

Many lease agreements require an upfront payment commonly mistaken as a security deposit, but it often includes the first month's rent, taxes, and fees, making it more than just a refundable amount. Monthly lease payments are frequently misunderstood as fixed costs, yet they can vary based on mileage overages, wear and tear charges, and lease-end conditions. Understanding the distinction between upfront and monthly payments helps avoid unexpected expenses during and after the lease term.

Tips for Negotiating Lease Payment Terms

When negotiating lease payment terms, prioritize clarifying the total cost implications of upfront payment versus monthly payment options to ensure budget alignment. Emphasize negotiating for reduced upfront fees in exchange for slightly higher monthly payments to maintain cash flow flexibility. Request detailed breakdowns of all initial and ongoing charges to avoid hidden costs and strengthen your negotiating position.

Upfront Payment vs Monthly Payment Infographic

cardiffo.com

cardiffo.com