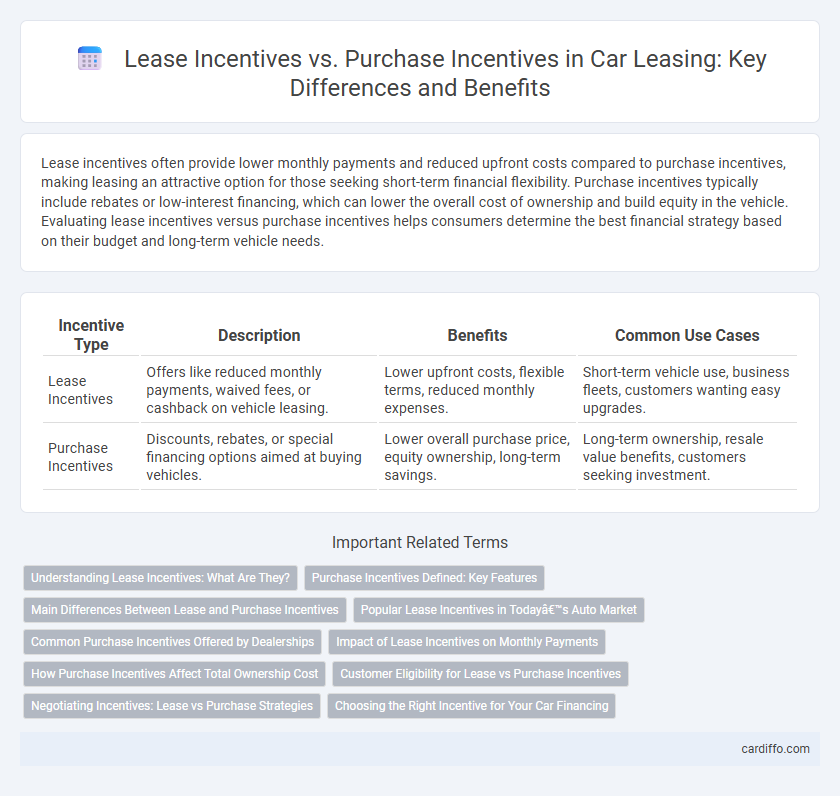

Lease incentives often provide lower monthly payments and reduced upfront costs compared to purchase incentives, making leasing an attractive option for those seeking short-term financial flexibility. Purchase incentives typically include rebates or low-interest financing, which can lower the overall cost of ownership and build equity in the vehicle. Evaluating lease incentives versus purchase incentives helps consumers determine the best financial strategy based on their budget and long-term vehicle needs.

Table of Comparison

| Incentive Type | Description | Benefits | Common Use Cases |

|---|---|---|---|

| Lease Incentives | Offers like reduced monthly payments, waived fees, or cashback on vehicle leasing. | Lower upfront costs, flexible terms, reduced monthly expenses. | Short-term vehicle use, business fleets, customers wanting easy upgrades. |

| Purchase Incentives | Discounts, rebates, or special financing options aimed at buying vehicles. | Lower overall purchase price, equity ownership, long-term savings. | Long-term ownership, resale value benefits, customers seeking investment. |

Understanding Lease Incentives: What Are They?

Lease incentives are financial benefits offered by lessors to attract lessees, often including reduced monthly payments, waived fees, or cash back. These incentives aim to lower the effective cost of leasing a vehicle or property, making lease agreements more appealing compared to purchase options. Understanding lease incentives helps lessees evaluate total costs and savings, differentiating from purchase incentives that typically reduce the upfront price or offer rebates on ownership.

Purchase Incentives Defined: Key Features

Purchase incentives are financial benefits offered by manufacturers or dealers to reduce the purchase price or overall cost of buying a vehicle, including cash rebates, low-interest financing, or trade-in bonuses. These incentives directly lower the buyer's out-of-pocket expenses or monthly loan payments, enhancing affordability and ownership appeal. Unlike lease incentives that focus on reducing lease payments, purchase incentives aim to motivate outright vehicle acquisition and long-term ownership.

Main Differences Between Lease and Purchase Incentives

Lease incentives typically include lower monthly payments, reduced upfront costs, and mileage allowances designed to make leasing more affordable and flexible, while purchase incentives often involve cash rebates, financing deals, or reduced interest rates aimed at lowering the total purchase price. Lease incentives focus on short-term affordability and usage limits, whereas purchase incentives target long-term ownership value and equity building. The main difference lies in how these incentives influence payment structures and customer commitment duration.

Popular Lease Incentives in Today’s Auto Market

Popular lease incentives in today's auto market include low or zero down payment offers, reduced monthly payments, and flexible mileage options designed to attract customers. These incentives often feature manufacturer-sponsored rebates, waived acquisition fees, and loyalty bonuses that lower the overall cost of leasing. In contrast to purchase incentives like cash rebates or low-interest financing, lease incentives primarily emphasize affordability and short-term savings.

Common Purchase Incentives Offered by Dealerships

Common purchase incentives offered by dealerships include cashback offers, low or zero-percent financing rates, and special lease buyout deals that reduce overall cost. These incentives are designed to lower the upfront cost or monthly payments, making vehicle ownership more financially accessible. Buyers often benefit from manufacturer rebates, trade-in bonuses, and seasonal promotions that enhance the affordability of purchasing a new car.

Impact of Lease Incentives on Monthly Payments

Lease incentives directly reduce the effective monthly payments by lowering the capitalized cost or providing rebates, making leases more affordable without increasing upfront expenses. Unlike purchase incentives, which typically affect the vehicle's sale price and final loan amounts, lease incentives target the lease terms to optimize monthly cash flow. This results in reduced monthly lease payments, enhancing affordability and driving lease popularity among budget-conscious consumers.

How Purchase Incentives Affect Total Ownership Cost

Purchase incentives, such as cash rebates and tax credits, directly reduce the total ownership cost by lowering the initial vehicle price or providing ongoing financial benefits. These incentives decrease monthly payments, interest charges, and overall depreciation impact, making ownership more affordable compared to lease scenarios. By contrast, lease incentives primarily affect short-term monthly costs without significantly altering long-term financial commitments.

Customer Eligibility for Lease vs Purchase Incentives

Lease incentives typically target customers who meet specific credit qualifications and choose short-term agreements, offering benefits such as lower monthly payments or reduced down payments. Purchase incentives often require full ownership commitment and may include rebates, cashback offers, or financing deals available only to buyers with approved credit and stable income verification. Eligibility for lease incentives is usually more restrictive due to vehicle return conditions, while purchase incentives focus on long-term equity and creditworthiness.

Negotiating Incentives: Lease vs Purchase Strategies

Negotiating lease incentives often involves leveraging manufacturer rebates, low or zero percent interest rates, and reduced down payments to lower monthly payments and upfront costs. Purchase incentive strategies focus on cash-back offers, trade-in bonuses, and dealer discounts to reduce the overall vehicle price and financing costs. Understanding the differences in these incentives enables buyers to tailor their negotiations to either minimize lease payments or maximize purchase savings effectively.

Choosing the Right Incentive for Your Car Financing

Lease incentives typically offer lower upfront costs and lower monthly payments, making them ideal for drivers who prefer flexibility and frequent vehicle upgrades. Purchase incentives often include cashback offers or reduced interest rates, providing long-term value for buyers committed to ownership and equity building. Assessing your driving habits, financial goals, and how long you plan to keep the vehicle helps determine whether lease or purchase incentives provide the best overall savings and benefits.

Lease Incentives vs Purchase Incentives Infographic

cardiffo.com

cardiffo.com