Leased vehicles typically offer lower monthly payments and the ability to drive a new car every few years without the long-term commitment of ownership. Owned vehicles build equity over time, allowing for unlimited mileage and the freedom to customize the car as desired. Choosing between a leased vehicle and an owned vehicle depends on personal financial goals, driving habits, and preferences for vehicle maintenance and flexibility.

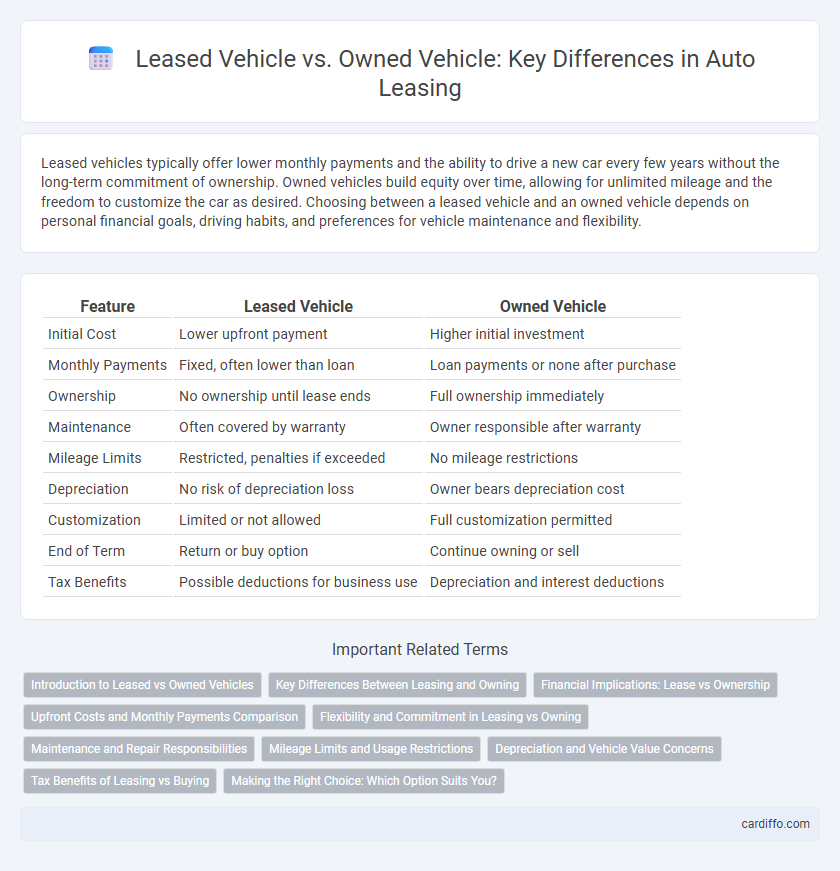

Table of Comparison

| Feature | Leased Vehicle | Owned Vehicle |

|---|---|---|

| Initial Cost | Lower upfront payment | Higher initial investment |

| Monthly Payments | Fixed, often lower than loan | Loan payments or none after purchase |

| Ownership | No ownership until lease ends | Full ownership immediately |

| Maintenance | Often covered by warranty | Owner responsible after warranty |

| Mileage Limits | Restricted, penalties if exceeded | No mileage restrictions |

| Depreciation | No risk of depreciation loss | Owner bears depreciation cost |

| Customization | Limited or not allowed | Full customization permitted |

| End of Term | Return or buy option | Continue owning or sell |

| Tax Benefits | Possible deductions for business use | Depreciation and interest deductions |

Introduction to Leased vs Owned Vehicles

Leased vehicles offer lower monthly payments and the ability to drive a new car every few years, making them ideal for those who prefer flexibility and lower upfront costs. Owned vehicles require a larger initial investment or loan but provide long-term equity and freedom from mileage limits or lease-end penalties. Choosing between leased and owned vehicles depends on financial goals, driving habits, and preferences for vehicle ownership versus temporary use.

Key Differences Between Leasing and Owning

Leased vehicles typically require lower monthly payments and a smaller upfront cost compared to owned vehicles, making them appealing for those seeking lower financial commitment. Ownership grants full equity in the vehicle, allowing no restrictions on mileage or modifications, whereas lease agreements often enforce limits and charge fees for excess wear. Tax benefits vary by region but leases may offer deductions for business use, while ownership provides asset depreciation advantages over time.

Financial Implications: Lease vs Ownership

Leased vehicles often require lower monthly payments and less upfront capital compared to owned vehicles, making them financially attractive for short-term use without the burden of depreciation costs. Ownership entails higher initial expenses and ongoing maintenance costs but allows for long-term asset accumulation and eventual resale value recovery. Evaluating total cost of ownership versus lease payments is crucial for financial decision-making in vehicle acquisition.

Upfront Costs and Monthly Payments Comparison

Leased vehicles typically have lower upfront costs, often requiring only a security deposit and the first month's payment, compared to owned vehicles which demand a substantial down payment or full purchase price. Monthly payments for leased vehicles are generally lower since payments cover depreciation during the lease term rather than the full vehicle value. This cost structure makes leasing more affordable short-term, whereas owning a vehicle involves higher monthly payments but builds equity over time.

Flexibility and Commitment in Leasing vs Owning

Leased vehicles offer greater flexibility through shorter contract terms, allowing drivers to upgrade models every few years without the long-term commitment of ownership. Ownership requires a significant upfront investment and commitment to maintenance over time, but provides full control and potential equity in the vehicle. Leasing minimizes financial risk and depreciation concerns, making it ideal for those who prioritize adaptability and lower monthly payments.

Maintenance and Repair Responsibilities

Leased vehicles typically require the lessee to adhere strictly to manufacturer-recommended maintenance schedules to avoid penalties or fees, with major repairs often covered under warranty. Owned vehicles place full responsibility for maintenance and repairs on the owner, allowing more flexibility in service choices but increasing long-term costs. Understanding these differences is crucial in managing expenses and maintaining vehicle value.

Mileage Limits and Usage Restrictions

Leased vehicles typically come with strict mileage limits, often ranging from 10,000 to 15,000 miles annually, and exceeding these limits results in costly per-mile penalties. In contrast, owned vehicles have no mileage restrictions, allowing unlimited use without incurring additional fees. Usage restrictions on leased vehicles may also include limitations on vehicle modifications and commercial use, which do not apply to owned vehicles.

Depreciation and Vehicle Value Concerns

Leased vehicles typically avoid long-term depreciation losses, as the lessee only pays for the vehicle's value during the lease term, preserving financial flexibility. Owned vehicles face continuous depreciation, reducing resale value and overall equity over time. Concerns about vehicle value are minimized with leasing, while ownership exposes individuals to market fluctuations and potential steep depreciation costs.

Tax Benefits of Leasing vs Buying

Leasing a vehicle often provides significant tax benefits compared to owning, as lease payments can be fully deducted as a business expense, reducing taxable income. When buying, only depreciation and interest on a financed vehicle are deductible, which may result in lower immediate tax savings. Lease agreements also simplify expense tracking for tax purposes, making leased vehicles a more efficient financial choice for businesses aiming to optimize tax deductions.

Making the Right Choice: Which Option Suits You?

Choosing between a leased vehicle and an owned vehicle depends on your financial goals, usage patterns, and long-term plans. Leasing often offers lower monthly payments and access to newer models with fewer maintenance concerns, ideal for those who prefer flexibility and driving the latest technology. Ownership builds equity over time, suits high-mileage drivers, and provides the freedom to modify the vehicle without restrictions.

Leased Vehicle vs Owned Vehicle Infographic

cardiffo.com

cardiffo.com