Choosing between an early termination fee and a purchase buyout in a lease pet agreement depends on your financial goals and long-term plans. The early termination fee often results in a one-time cost to end the lease prematurely, while a purchase buyout allows you to own the pet by paying a predetermined amount. Evaluating the total expenses and your attachment to the pet helps determine the best option for ending your lease agreement.

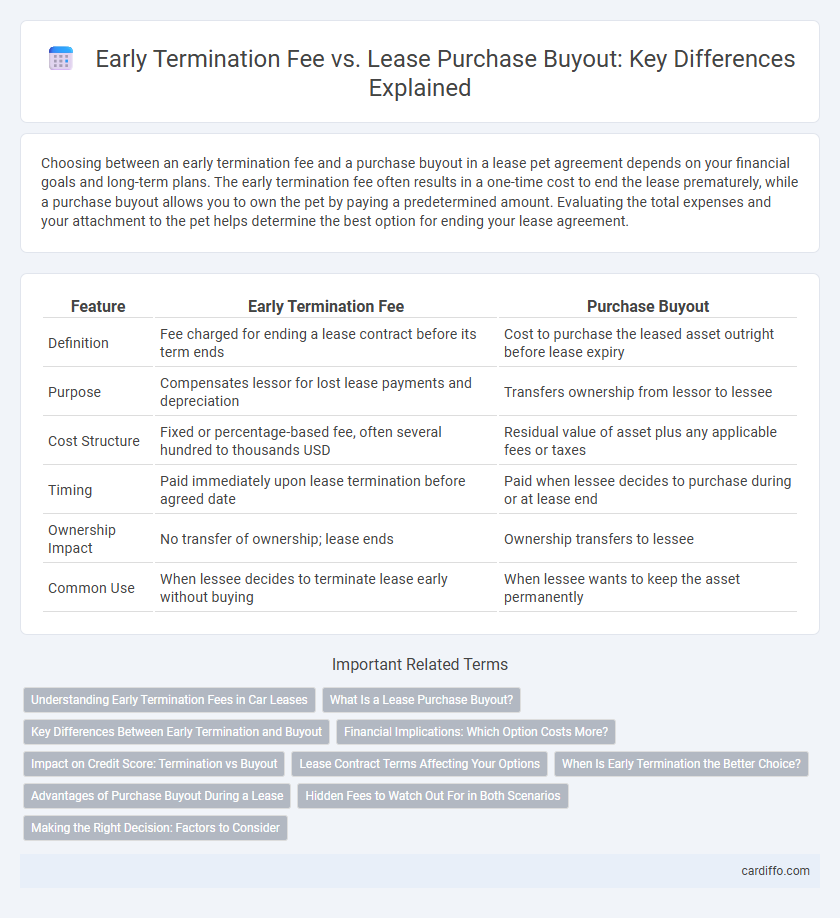

Table of Comparison

| Feature | Early Termination Fee | Purchase Buyout |

|---|---|---|

| Definition | Fee charged for ending a lease contract before its term ends | Cost to purchase the leased asset outright before lease expiry |

| Purpose | Compensates lessor for lost lease payments and depreciation | Transfers ownership from lessor to lessee |

| Cost Structure | Fixed or percentage-based fee, often several hundred to thousands USD | Residual value of asset plus any applicable fees or taxes |

| Timing | Paid immediately upon lease termination before agreed date | Paid when lessee decides to purchase during or at lease end |

| Ownership Impact | No transfer of ownership; lease ends | Ownership transfers to lessee |

| Common Use | When lessee decides to terminate lease early without buying | When lessee wants to keep the asset permanently |

Understanding Early Termination Fees in Car Leases

Early termination fees in car leases are charges imposed when a lessee ends the lease agreement before its scheduled expiration date, often calculated as the remaining lease payments plus additional penalties. These fees protect leasing companies from financial losses due to early contract termination and can significantly increase total cost. Understanding the early termination fee structure helps lessees evaluate whether purchasing the car through a buyout option might be more cost-effective than paying these penalties.

What Is a Lease Purchase Buyout?

A lease purchase buyout allows the lessee to buy the leased asset before the lease term ends by paying a predetermined amount, often specified in the lease agreement. This option differs from an early termination fee, which is a penalty paid for ending the lease contract prematurely without purchasing the asset. Understanding the buyout price helps lessees evaluate the financial benefits of owning the asset versus continuing lease payments or paying early termination fees.

Key Differences Between Early Termination and Buyout

Early termination fees are charges incurred when a lessee ends the lease agreement before the scheduled term, typically calculated as a percentage of remaining payments or a flat fee specified in the contract. Purchase buyout involves paying a predetermined price to own the leased asset outright, often the residual value stated in the lease agreement. The key difference lies in ownership transfer: early termination fees end the lease without ownership, whereas buyout options transition the lessee into owner status.

Financial Implications: Which Option Costs More?

Early Termination Fees typically involve paying a predetermined penalty to end a lease contract early, often resulting in substantial upfront costs based on remaining lease payments and mileage limits. Purchase Buyouts require paying the residual value of the leased asset, which may exceed the total cost of termination fees but ultimately leads to asset ownership and potential equity. Comparing financial implications, early termination fees usually present higher short-term expenses, while buyouts might offer long-term value despite higher initial outlay.

Impact on Credit Score: Termination vs Buyout

Early termination fees on a lease can negatively impact your credit score if the remaining payments go unpaid and the lender reports the delinquency; this may lead to a lower credit rating and difficulty securing future loans. A purchase buyout typically has less risk to credit since the lessee either pays off the residual value upfront or finances the buyout amount, maintaining positive payment history. Choosing a buyout over early termination generally results in a more favorable impact on credit by avoiding default or collections.

Lease Contract Terms Affecting Your Options

Lease contract terms significantly influence your options between an early termination fee and a purchase buyout. Early termination fees are often predetermined penalties outlined in the lease agreement, designed to compensate the lessor for lost payments and depreciation. Purchase buyout clauses specify the residual value or fixed price to buy the leased asset outright, offering a clear financial boundary compared to the variable costs of early termination.

When Is Early Termination the Better Choice?

Early termination of a lease is often the better choice when the remaining lease payments and early termination fee total less than the buyout amount, making it more cost-effective to end the lease contract early. This option suits lessees facing unforeseen financial difficulties or changes in personal circumstances who want to avoid a larger lump-sum buyout payment. Evaluating the specific terms of the lease agreement and comparing penalties and residual values helps determine if early termination minimizes overall expenses compared to a purchase buyout.

Advantages of Purchase Buyout During a Lease

Purchase buyout during a lease allows lessees to gain ownership of the vehicle without facing the punitive costs associated with early termination fees, preserving their financial investment. This option often results in lower total expenses compared to paying early termination fees and then purchasing a new vehicle, making it a cost-effective alternative. Ownership through buyout also provides flexibility, enabling lessees to keep, sell, or trade the vehicle based on market conditions and personal preferences.

Hidden Fees to Watch Out For in Both Scenarios

Early termination fees often include hidden charges such as administrative fees, disposition fees, and remaining depreciation costs that can significantly increase the cost of ending a lease prematurely. In contrast, purchase buyouts may involve unexpected expenses like taxes, registration fees, and potential penalties for excess mileage or wear and tear not covered under the lease terms. Carefully reviewing the lease agreement for all fine print related to these fees is crucial to avoid costly surprises in both early lease termination and buyout scenarios.

Making the Right Decision: Factors to Consider

Evaluating early termination fees versus purchase buyout options requires analyzing the total cost implications, including potential penalties and remaining lease payments. Consider vehicle depreciation, your financial flexibility, and future transportation needs to determine which option minimizes overall expenses. Understanding contract terms and market value trends ensures a well-informed decision aligned with your long-term goals.

Early Termination Fee vs Purchase Buyout Infographic

cardiffo.com

cardiffo.com