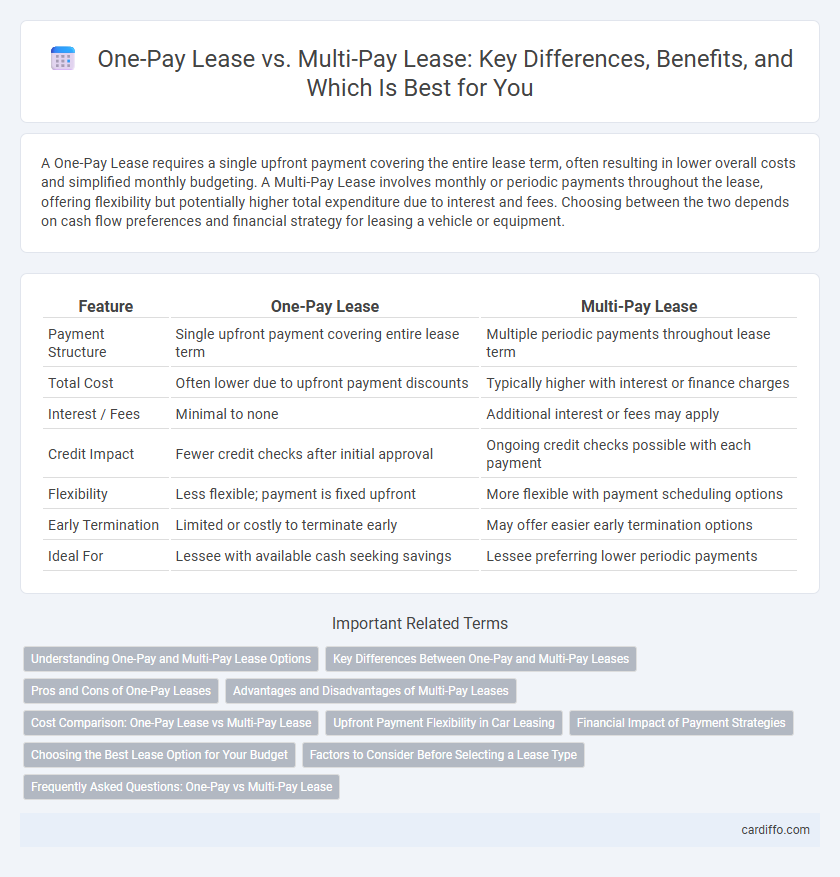

A One-Pay Lease requires a single upfront payment covering the entire lease term, often resulting in lower overall costs and simplified monthly budgeting. A Multi-Pay Lease involves monthly or periodic payments throughout the lease, offering flexibility but potentially higher total expenditure due to interest and fees. Choosing between the two depends on cash flow preferences and financial strategy for leasing a vehicle or equipment.

Table of Comparison

| Feature | One-Pay Lease | Multi-Pay Lease |

|---|---|---|

| Payment Structure | Single upfront payment covering entire lease term | Multiple periodic payments throughout lease term |

| Total Cost | Often lower due to upfront payment discounts | Typically higher with interest or finance charges |

| Interest / Fees | Minimal to none | Additional interest or fees may apply |

| Credit Impact | Fewer credit checks after initial approval | Ongoing credit checks possible with each payment |

| Flexibility | Less flexible; payment is fixed upfront | More flexible with payment scheduling options |

| Early Termination | Limited or costly to terminate early | May offer easier early termination options |

| Ideal For | Lessee with available cash seeking savings | Lessee preferring lower periodic payments |

Understanding One-Pay and Multi-Pay Lease Options

One-Pay Leases require a single upfront payment covering the entire lease term, resulting in lower overall costs due to reduced finance charges. Multi-Pay Leases involve monthly or periodic payments, offering more flexibility but typically higher total costs because of ongoing interest and fees. Choosing between One-Pay and Multi-Pay Lease options depends on cash flow preferences and long-term budget planning.

Key Differences Between One-Pay and Multi-Pay Leases

One-pay leases require a single upfront payment covering the entire lease term, often resulting in lower overall costs due to reduced finance charges. Multi-pay leases spread payments over monthly installments, offering flexibility but potentially higher total costs from interest accrual. Key differences include cash flow impact, total lease cost, and administrative convenience, with one-pay leases favoring cost savings and multi-pay leases prioritizing budget manageability.

Pros and Cons of One-Pay Leases

One-pay leases offer the advantage of lower total interest costs and simplified budgeting by requiring a single upfront payment instead of monthly installments. This type of lease reduces the risk of late payments and can improve credit scores due to consistent payment history. However, the significant initial cash outlay may strain finances, and early termination of a one-pay lease often results in forfeiting the prepaid amount without refunds.

Advantages and Disadvantages of Multi-Pay Leases

Multi-pay leases offer the advantage of spreading monthly payments over the lease term, improving cash flow and making budgeting easier for lessees. However, these leases typically result in higher overall interest costs compared to one-pay leases due to the extended payment period. Lessees may also face increased risk of late fees or penalties with multiple payments to manage throughout the lease duration.

Cost Comparison: One-Pay Lease vs Multi-Pay Lease

One-pay leases typically offer lower overall costs compared to multi-pay leases by consolidating payments into a single upfront amount, reducing interest and fees over the lease term. Multi-pay leases spread payments across several months, which may increase total cost due to finance charges and potential added fees. Comparing total lease payments and interest rates is essential to determine the more cost-effective option for specific lease agreements.

Upfront Payment Flexibility in Car Leasing

One-Pay Lease offers a significant upfront payment advantage by requiring a single lump sum, eliminating monthly payments and often resulting in lower overall leasing costs due to reduced administrative fees and interest. Multi-Pay Lease divides the total lease cost into monthly installments, providing greater cash flow flexibility but potentially increasing the total cost through interest charges and additional fees. Choosing between One-Pay and Multi-Pay Lease depends on the lessee's financial capacity and preference for upfront payment versus long-term budget management during the lease period.

Financial Impact of Payment Strategies

One-Pay Lease requires a single upfront payment covering the entire lease term, resulting in significant immediate cash outflow but often lower overall cost due to reduced finance charges. Multi-Pay Lease spreads payments monthly, easing short-term cash flow but potentially increasing total lease expense through added interest and fees. Choosing between these strategies impacts budget management, total lease cost, and financial planning precision for businesses or individuals.

Choosing the Best Lease Option for Your Budget

One-Pay Lease requires a single upfront payment, often resulting in lower overall costs and avoiding monthly fees, making it ideal for budgets with available lump sums. Multi-Pay Lease divides payments into monthly installments, providing flexibility and ease of cash flow management for those preferring spread-out expenses. Evaluating your monthly income, total lease cost, and financial priorities ensures selecting the best lease option to fit your budget effectively.

Factors to Consider Before Selecting a Lease Type

When choosing between a One-Pay Lease and a Multi-Pay Lease, consider cash flow impact, total lease cost, and financial flexibility. One-Pay Leases require a lump sum upfront, often reducing overall interest but limiting liquidity, while Multi-Pay Leases spread payments over time, preserving cash but potentially increasing total expenses. Evaluate your budget stability, tax implications, and vehicle usage duration to determine the optimal lease structure for your financial goals.

Frequently Asked Questions: One-Pay vs Multi-Pay Lease

One-Pay Lease requires a single, upfront payment covering the entire lease term, often resulting in lower overall costs and reduced finance charges compared to Multi-Pay Lease, which involves monthly payments spread over the lease duration. One-Pay Leases can provide savings on interest and simplify budgeting, while Multi-Pay Leases offer more flexibility with lower initial cash outlay. Understanding your cash flow and credit situation is essential when choosing between One-Pay and Multi-Pay Lease options for vehicles or equipment.

One-Pay Lease vs Multi-Pay Lease Infographic

cardiffo.com

cardiffo.com