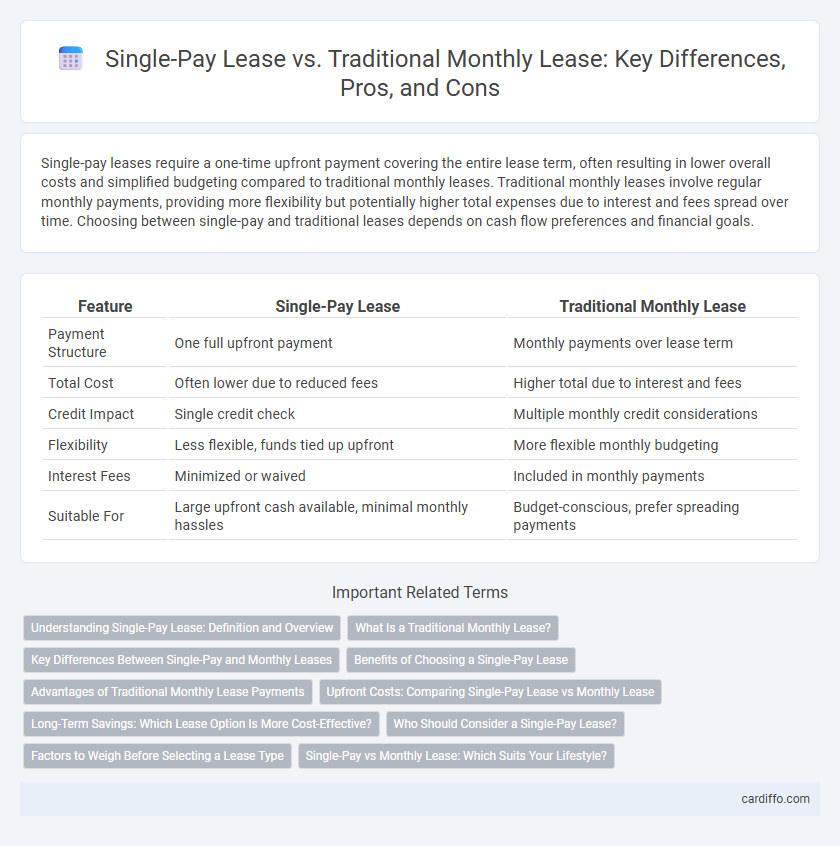

Single-pay leases require a one-time upfront payment covering the entire lease term, often resulting in lower overall costs and simplified budgeting compared to traditional monthly leases. Traditional monthly leases involve regular monthly payments, providing more flexibility but potentially higher total expenses due to interest and fees spread over time. Choosing between single-pay and traditional leases depends on cash flow preferences and financial goals.

Table of Comparison

| Feature | Single-Pay Lease | Traditional Monthly Lease |

|---|---|---|

| Payment Structure | One full upfront payment | Monthly payments over lease term |

| Total Cost | Often lower due to reduced fees | Higher total due to interest and fees |

| Credit Impact | Single credit check | Multiple monthly credit considerations |

| Flexibility | Less flexible, funds tied up upfront | More flexible monthly budgeting |

| Interest Fees | Minimized or waived | Included in monthly payments |

| Suitable For | Large upfront cash available, minimal monthly hassles | Budget-conscious, prefer spreading payments |

Understanding Single-Pay Lease: Definition and Overview

A single-pay lease requires the lessee to make a one-time, upfront payment covering the entire lease term rather than monthly installments. This type of lease often results in lower overall costs due to reduced finance charges and can simplify budgeting by eliminating monthly payments. Understanding the distinction from traditional monthly leases helps consumers assess their cash flow preferences and financial goals when selecting a lease agreement.

What Is a Traditional Monthly Lease?

A traditional monthly lease requires lessees to make fixed monthly payments throughout the lease term, typically lasting two to three years. This type of lease includes mileage limits and potential fees for excess wear and tear or mileage overruns. Monthly leases are popular for providing predictable budgeting and flexibility to upgrade vehicles at the end of the contract.

Key Differences Between Single-Pay and Monthly Leases

A single-pay lease requires one upfront payment covering the entire lease term, reducing monthly financial obligations and often yielding interest savings compared to traditional monthly leases. Traditional monthly leases spread payments evenly over the lease duration, offering lower initial costs and greater budgeting flexibility. Key differences include cash flow impact, total lease cost, and potential for early lease termination fees.

Benefits of Choosing a Single-Pay Lease

A Single-Pay Lease offers significant cost savings by eliminating monthly interest charges typically associated with traditional monthly leases, resulting in a lower overall lease cost. This option provides convenience by requiring just one upfront payment, reducing the hassle of monthly billing and the risk of late fees. Lessees also benefit from enhanced budgeting ease and often receive incentives or discounts not available with standard monthly lease agreements.

Advantages of Traditional Monthly Lease Payments

Traditional monthly leases offer consistent, manageable payments that enhance budgeting flexibility for both individuals and businesses. They provide opportunities to build credit history through regular, timely payments and often include maintenance packages, reducing unexpected expenses. Monthly leases also allow easier upgrades or adjustments at lease end, accommodating evolving needs without large upfront costs.

Upfront Costs: Comparing Single-Pay Lease vs Monthly Lease

Single-pay leases require a large upfront payment that covers the entire lease term, significantly reducing or eliminating monthly payments. In contrast, traditional monthly leases spread costs over monthly installments, resulting in lower initial expenses but higher overall upfront payments due to down payments, taxes, and fees. Evaluating upfront costs in a single-pay lease versus monthly lease helps determine cash flow impact and total cost efficiency.

Long-Term Savings: Which Lease Option Is More Cost-Effective?

A Single-Pay Lease often results in long-term savings by eliminating monthly interest charges and fees commonly associated with Traditional Monthly Leases, reducing the overall lease cost. By paying the entire lease amount upfront, lessees benefit from discounted rates that improve cost-effectiveness compared to spreading payments over time. This option is especially advantageous for individuals seeking lower total expenditure without the burden of recurring monthly payments.

Who Should Consider a Single-Pay Lease?

Single-Pay Leases benefit individuals with stable finances who prefer paying upfront to avoid monthly payments and potential interest costs. They are ideal for those aiming to reduce administrative hassle and secure lower overall leasing expenses, especially when expecting minimal usage during the lease term. Consumers confident in their credit stability and with access to lump-sum funds should consider Single-Pay Lease options for better financial predictability.

Factors to Weigh Before Selecting a Lease Type

Evaluating Single-Pay Lease versus Traditional Monthly Lease requires understanding upfront cost implications, total payment amounts, and impact on credit score. Single-Pay Leases involve a lump sum payment that can reduce financing charges but may limit liquidity, while Traditional Monthly Leases spread costs over time, affecting cash flow and potentially increasing total interest paid. Assessing mileage limits, potential penalties, and tax considerations also plays a critical role in selecting the optimal lease type for individual financial situations.

Single-Pay vs Monthly Lease: Which Suits Your Lifestyle?

A single-pay lease requires an upfront lump sum payment covering the entire lease term, offering lower overall costs and eliminating monthly bills, ideal for those with stable finances and no cash flow concerns. Traditional monthly leases spread payments over the lease duration, providing flexibility and easier budgeting for individuals preferring predictable monthly expenses. Single-pay leases suit financially secure lessees seeking savings, while traditional leases benefit those prioritizing consistent monthly cash flow management.

Single-Pay Lease vs Traditional Monthly Lease Infographic

cardiffo.com

cardiffo.com