Selecting a purchase option at lease-end allows pet owners to keep their leased pets permanently, often with a predetermined buyout price. In contrast, a lease return involves giving the pet back to the leasing company or facility, freeing the owner from further financial commitment. Understanding the differences between purchase options and lease returns helps pet owners make informed decisions based on financial flexibility and long-term care preferences.

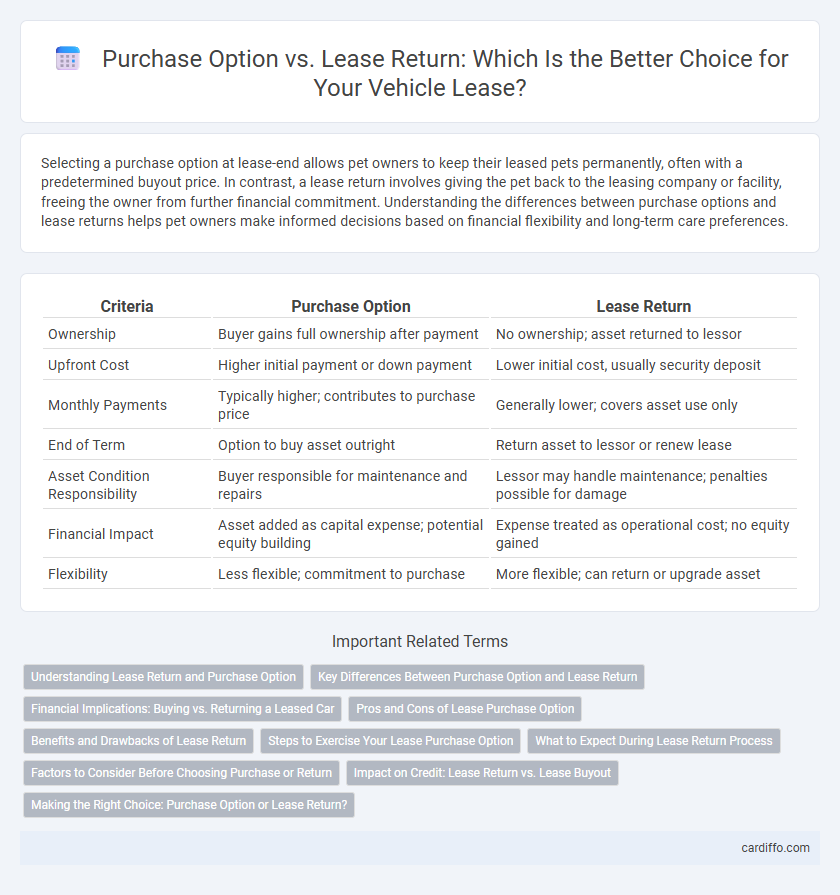

Table of Comparison

| Criteria | Purchase Option | Lease Return |

|---|---|---|

| Ownership | Buyer gains full ownership after payment | No ownership; asset returned to lessor |

| Upfront Cost | Higher initial payment or down payment | Lower initial cost, usually security deposit |

| Monthly Payments | Typically higher; contributes to purchase price | Generally lower; covers asset use only |

| End of Term | Option to buy asset outright | Return asset to lessor or renew lease |

| Asset Condition Responsibility | Buyer responsible for maintenance and repairs | Lessor may handle maintenance; penalties possible for damage |

| Financial Impact | Asset added as capital expense; potential equity building | Expense treated as operational cost; no equity gained |

| Flexibility | Less flexible; commitment to purchase | More flexible; can return or upgrade asset |

Understanding Lease Return and Purchase Option

Lease returns involve the process where lessees return the leased asset to the lessor at the end of the lease term, typically without ownership transfer. Purchase options grant lessees the right to buy the leased asset at a predetermined price, often the residual value, providing flexibility to acquire the asset after the lease period. Understanding these concepts helps lessees make informed decisions regarding asset retention, financial planning, and end-of-lease obligations.

Key Differences Between Purchase Option and Lease Return

Purchase option allows lessees to buy the leased asset at a predetermined price at the end of the lease term, providing ownership flexibility. Lease return requires the lessee to return the asset to the lessor without purchase rights, often incurring fees for excess wear or mileage. Key differences center on ownership transfer potential, financial obligations at lease end, and asset control post-lease.

Financial Implications: Buying vs. Returning a Leased Car

Choosing a purchase option at lease-end typically requires paying the residual value, which can lead to higher upfront costs but may offer long-term savings if the vehicle's market value exceeds this price. Returning a leased car avoids large purchase payments and potential depreciation risks but may incur end-of-lease fees such as excess mileage or wear-and-tear charges. Evaluating total financial implications involves comparing the residual cost against expected market value, potential fees, and personal financial goals.

Pros and Cons of Lease Purchase Option

Lease purchase options allow tenants to apply a portion of their rent toward the eventual purchase price, offering a path to homeownership with lower upfront costs compared to traditional financing. This option provides flexibility and the potential benefit of locking in a purchase price in a rising market but can risk losing invested credits if the tenant decides not to buy or defaults on the lease. Unlike a standard lease return, where the tenant simply moves out at lease end, the lease purchase option requires a long-term commitment and careful evaluation of financial stability and market conditions.

Benefits and Drawbacks of Lease Return

Lease return offers the benefit of avoiding large upfront costs and provides flexibility to lease a new vehicle with the latest features, aligning with budget-conscious consumers seeking short-term commitments. However, lease return drawbacks include mileage limits and potential wear-and-tear charges that can increase overall expenses, limiting ownership freedom. This option suits those who prioritize lower monthly payments and frequent vehicle updates over long-term equity accumulation.

Steps to Exercise Your Lease Purchase Option

To exercise your lease purchase option, first review the lease agreement to confirm the purchase option period and price. Notify the leasing company in writing within the specified time frame, indicating your intent to buy the vehicle or asset. Complete all required paperwork, pay the purchase price plus any applicable fees, and arrange for title transfer and ownership documentation.

What to Expect During Lease Return Process

During the lease return process, expect a thorough vehicle inspection assessing mileage, wear and tear, and condition against lease agreement standards. Lease return fees may apply for excess mileage or damages beyond normal use, potentially impacting final costs. Understanding purchase option terms can provide clarity on buyout price if choosing to purchase the leased vehicle instead of returning it.

Factors to Consider Before Choosing Purchase or Return

Evaluating residual value, total lease cost, and monthly payments is essential before deciding between a purchase option or lease return. Consider the vehicle's depreciation rate, lease contract terms, and your long-term ownership goals to maximize financial benefits. Analyzing market value trends and potential buyout fees helps ensure the most cost-effective decision for your lease agreement.

Impact on Credit: Lease Return vs. Lease Buyout

Returning a leased vehicle typically has minimal impact on credit scores, as it concludes the lease agreement without additional financial obligations, while a lease buyout involves financing that affects credit reports through new loan inquiries and ongoing payment history. Opting for a lease buyout may improve credit by adding installment payments if managed responsibly, whereas lease return avoids potential credit risks associated with new debt. Credit impact from lease buyout depends on timely payments and credit utilization, making lease return a lower-risk option for maintaining credit stability.

Making the Right Choice: Purchase Option or Lease Return?

Choosing between a purchase option and lease return hinges on factors like vehicle usage, financial goals, and market conditions. Opting for a purchase option provides long-term ownership benefits and potential equity, while lease return offers a hassle-free way to upgrade to a newer model with minimal upfront cost. Analyzing total costs, depreciation rates, and personal driving habits ensures an informed decision that aligns with budget and lifestyle needs.

Purchase Option vs Lease Return Infographic

cardiffo.com

cardiffo.com