A wear-and-tear waiver protects tenants from being charged for normal pet-related damage during their lease, while an excess wear fee applies when pet damage exceeds typical wear standards. Tenants opting for a wear-and-tear waiver often pay a set fee upfront to avoid unexpected charges later. Understanding the differences between these options helps renters manage potential costs associated with having pets in leased properties.

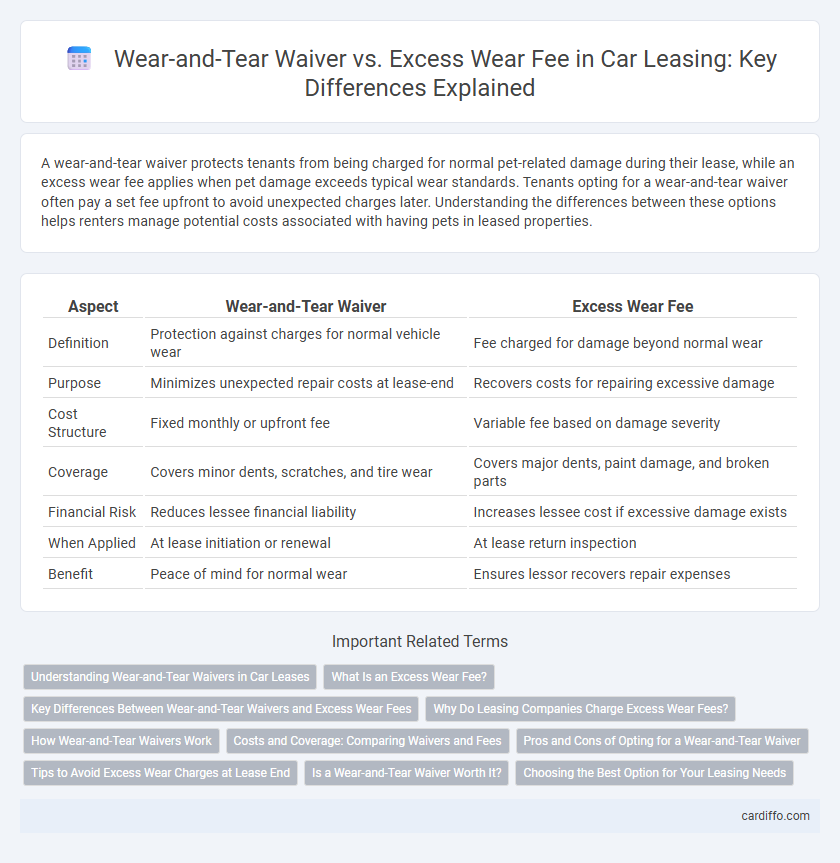

Table of Comparison

| Aspect | Wear-and-Tear Waiver | Excess Wear Fee |

|---|---|---|

| Definition | Protection against charges for normal vehicle wear | Fee charged for damage beyond normal wear |

| Purpose | Minimizes unexpected repair costs at lease-end | Recovers costs for repairing excessive damage |

| Cost Structure | Fixed monthly or upfront fee | Variable fee based on damage severity |

| Coverage | Covers minor dents, scratches, and tire wear | Covers major dents, paint damage, and broken parts |

| Financial Risk | Reduces lessee financial liability | Increases lessee cost if excessive damage exists |

| When Applied | At lease initiation or renewal | At lease return inspection |

| Benefit | Peace of mind for normal wear | Ensures lessor recovers repair expenses |

Understanding Wear-and-Tear Waivers in Car Leases

Wear-and-tear waivers in car leases protect lessees from being charged for minor damages that are considered normal deterioration, such as small scratches or tire wear, during the lease term. These waivers shift the financial responsibility from the lessee to the lessor, avoiding excess wear fees that typically occur when damage exceeds normal use. Understanding the specific terms of a wear-and-tear waiver is crucial to determining which damages are covered and how it can mitigate unexpected charges at lease-end inspections.

What Is an Excess Wear Fee?

An excess wear fee is a charge landlords impose on tenants for damage or deterioration beyond normal wear and tear during a lease term. This fee covers repairs or replacements that result from tenant negligence, misuse, or abuse rather than typical aging or usage. Understanding the excess wear fee is crucial for tenants to manage potential end-of-lease costs effectively.

Key Differences Between Wear-and-Tear Waivers and Excess Wear Fees

Wear-and-tear waivers offer protection by covering minor, expected damages during a lease, preventing additional charges at lease end. Excess wear fees apply when damage exceeds normal use, imposing extra costs on lessees for repairs or replacement. The key difference lies in coverage scope: waivers limit financial risk, while excess wear fees enforce penalties for beyond-normal damage.

Why Do Leasing Companies Charge Excess Wear Fees?

Leasing companies charge excess wear fees to cover the cost of repairs for damage that goes beyond normal use outlined in the lease agreement. These fees protect the lessor's asset value by ensuring lessees maintain the vehicle's condition, preventing depreciation from excessive wear. Excess wear charges incentivize responsible use and minimize financial loss when the vehicle is returned at lease end.

How Wear-and-Tear Waivers Work

Wear-and-tear waivers protect lessees from charges for minor damage or deterioration that occurs during normal use of a leased property or vehicle, ensuring they avoid excess wear fees at lease-end. These waivers typically cover issues such as small scratches, dents, or carpet stains that fall within accepted maintenance standards. Lessees must carefully review the waiver terms to understand coverage limits and any exclusions to avoid unexpected costs after the lease term concludes.

Costs and Coverage: Comparing Waivers and Fees

Wear-and-tear waivers typically offer fixed upfront costs that cover minor damages, reducing unexpected expenses during lease returns. Excess wear fees, on the other hand, charge lessees based on the extent of damage beyond normal use, potentially resulting in higher, variable costs. Understanding these cost structures helps lessees decide between predictable fee waivers and conditional charges linked to actual vehicle wear.

Pros and Cons of Opting for a Wear-and-Tear Waiver

Opting for a wear-and-tear waiver in a lease typically protects tenants from unexpected charges by covering normal property deterioration, offering peace of mind and financial predictability. However, the waiver often comes with an upfront cost or higher monthly rent, which might not be cost-effective if minimal wear occurs. Tenants should weigh the potential savings against the fee, considering factors like the property condition, lease duration, and their likelihood of causing excess damage.

Tips to Avoid Excess Wear Charges at Lease End

Understanding the distinction between a wear-and-tear waiver and an excess wear fee is crucial for lease-end cost management. Implementing regular maintenance, addressing minor damages promptly, and documenting the vehicle's condition with photos can prevent excess wear charges. Reviewing lease agreements for specific wear definitions and opting for a wear-and-tear waiver when available provides financial protection against unexpected end-of-lease fees.

Is a Wear-and-Tear Waiver Worth It?

A Wear-and-Tear Waiver can be worth it for tenants who want to avoid unexpected charges related to minor damages that occur during normal use, as it typically covers standard wear like scuffs, small stains, and carpet wear. Without the waiver, tenants risk paying excess wear fees that can range from hundreds to thousands of dollars depending on the landlord's assessment of damage severity. Evaluating the cost of the waiver versus potential repair fees and the lease's specific terms helps determine if this waiver offers financial protection and peace of mind during move-out.

Choosing the Best Option for Your Leasing Needs

A wear-and-tear waiver offers peace of mind by covering minor damages that naturally occur during the lease term, potentially saving you from unexpected excess wear fees. Excess wear fees are charged when the vehicle returns with damages beyond normal use, making it essential to evaluate your driving habits and condition of the leased vehicle before deciding. Choosing the best option depends on your budget, risk tolerance, and how meticulously you maintain the leased property throughout the lease duration.

Wear-and-tear waiver vs excess wear fee Infographic

cardiffo.com

cardiffo.com