Choosing between a trade-in and a down payment when leasing a vehicle impacts your initial costs and monthly payments differently. A trade-in vehicle can reduce the capitalized cost of the lease, lowering monthly payments without an upfront cash expense, while a down payment involves paying a lump sum that decreases both the capitalized cost and your monthly obligations. Evaluating the condition and value of your trade-in against available cash allows you to optimize lease terms for affordability and convenience.

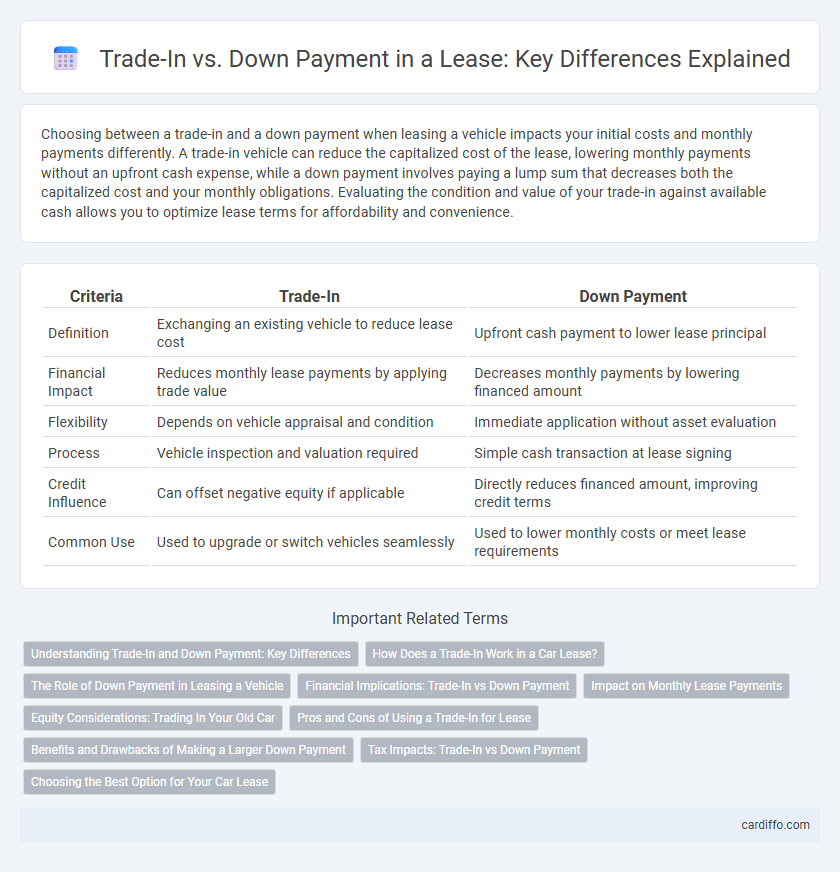

Table of Comparison

| Criteria | Trade-In | Down Payment |

|---|---|---|

| Definition | Exchanging an existing vehicle to reduce lease cost | Upfront cash payment to lower lease principal |

| Financial Impact | Reduces monthly lease payments by applying trade value | Decreases monthly payments by lowering financed amount |

| Flexibility | Depends on vehicle appraisal and condition | Immediate application without asset evaluation |

| Process | Vehicle inspection and valuation required | Simple cash transaction at lease signing |

| Credit Influence | Can offset negative equity if applicable | Directly reduces financed amount, improving credit terms |

| Common Use | Used to upgrade or switch vehicles seamlessly | Used to lower monthly costs or meet lease requirements |

Understanding Trade-In and Down Payment: Key Differences

Trade-in involves exchanging an existing vehicle to reduce the overall lease cost, while a down payment is an upfront cash payment applied directly to lower monthly lease fees. Trade-in values depend on the vehicle's condition, mileage, and market demand, often impacting the residual value calculation. Down payments provide immediate equity, reducing the principal balance, whereas trade-ins may influence credit approval and lease terms based on appraisal results.

How Does a Trade-In Work in a Car Lease?

A trade-in in a car lease involves using the value of your current vehicle to reduce the capitalized cost of the new lease, effectively lowering your monthly payments. The leasing company appraises the trade-in vehicle, and its agreed-upon value is applied as a credit toward the lease agreement. This process differs from a down payment since a trade-in uses equity from an existing asset rather than out-of-pocket cash upfront.

The Role of Down Payment in Leasing a Vehicle

The down payment in vehicle leasing serves as an upfront cost that reduces the capitalized cost, directly lowering monthly lease payments and potentially improving lease terms. Unlike a trade-in, which involves exchanging a current vehicle for credit toward the new lease, the down payment is a cash amount paid at lease signing, impacting the total cost of the lease. A higher down payment decreases depreciation risk and can lead to more favorable residual values and financing offers from lessors.

Financial Implications: Trade-In vs Down Payment

A trade-in reduces the capitalized cost of the lease, which lowers monthly lease payments by decreasing the amount financed, whereas a down payment directly reduces monthly payments by applying cash upfront to the cap cost. Trade-ins may incur sales tax on the vehicle's trade value depending on state laws, impacting total lease cost, while down payments typically involve paying taxes on the full vehicle price. Choosing between trade-in and down payment affects cash flow management and tax liabilities, influencing the overall financial efficiency of the lease agreement.

Impact on Monthly Lease Payments

A higher trade-in value directly reduces the total amount financed in a lease, resulting in lower monthly lease payments. In contrast, a larger down payment decreases the capitalized cost upfront, also lowering monthly payments but affecting cash flow differently. Choosing between trade-in and down payment depends on how immediate cash availability and payment structure align with personal financial goals.

Equity Considerations: Trading In Your Old Car

When trading in your old car as part of a lease agreement, equity considerations play a crucial role in the overall financial outcome. Positive equity occurs when your vehicle's trade-in value exceeds the remaining balance on your loan, which can be applied directly as a down payment, reducing your monthly lease payments. Negative equity, on the other hand, means you owe more than the car's worth, potentially increasing upfront costs or monthly payments if rolled into the new lease.

Pros and Cons of Using a Trade-In for Lease

Using a trade-in for a lease can reduce your monthly payments and lower the upfront cost by applying the vehicle's value toward the lease balance. However, the trade-in payoff amount may exceed the vehicle's market value, potentially resulting in negative equity that rolls into the lease and increases total lease costs. Evaluating the trade-in's fair market value and lease terms helps maximize financial benefits and avoid unforeseen expenses.

Benefits and Drawbacks of Making a Larger Down Payment

Making a larger down payment on a lease reduces monthly payments and lowers interest costs, improving overall affordability and decreasing the total lease expense. However, it ties up more cash upfront, limiting liquidity and increasing financial risk if the vehicle is totaled or stolen early in the lease term. Balancing immediate cash flow against long-term savings is crucial when deciding how much to contribute initially in a lease agreement.

Tax Impacts: Trade-In vs Down Payment

When comparing trade-in versus down payment for a lease, the tax impact varies by state but generally, applying a trade-in credit reduces the capitalized cost before sales tax is calculated, potentially lowering the overall tax owed. In contrast, a down payment does not reduce the taxable base; instead, sales tax is applied to the entire lease price, including the amount covered by the down payment. Understanding local tax laws is crucial, as some states may tax the full vehicle value regardless of trade-in or down payment credits, affecting the total financial obligation during the lease.

Choosing the Best Option for Your Car Lease

Selecting between a trade-in and a down payment significantly impacts your car lease terms and monthly payments. A trade-in can reduce your lease capitalized cost by applying your vehicle's value directly, potentially lowering monthly dues, while a down payment provides immediate upfront equity, minimizing finance charges over the lease period. Evaluating your current vehicle's market value, lease-end residuals, and cash flow preferences ensures the most cost-effective and flexible leasing option.

Trade-In vs Down Payment Infographic

cardiffo.com

cardiffo.com