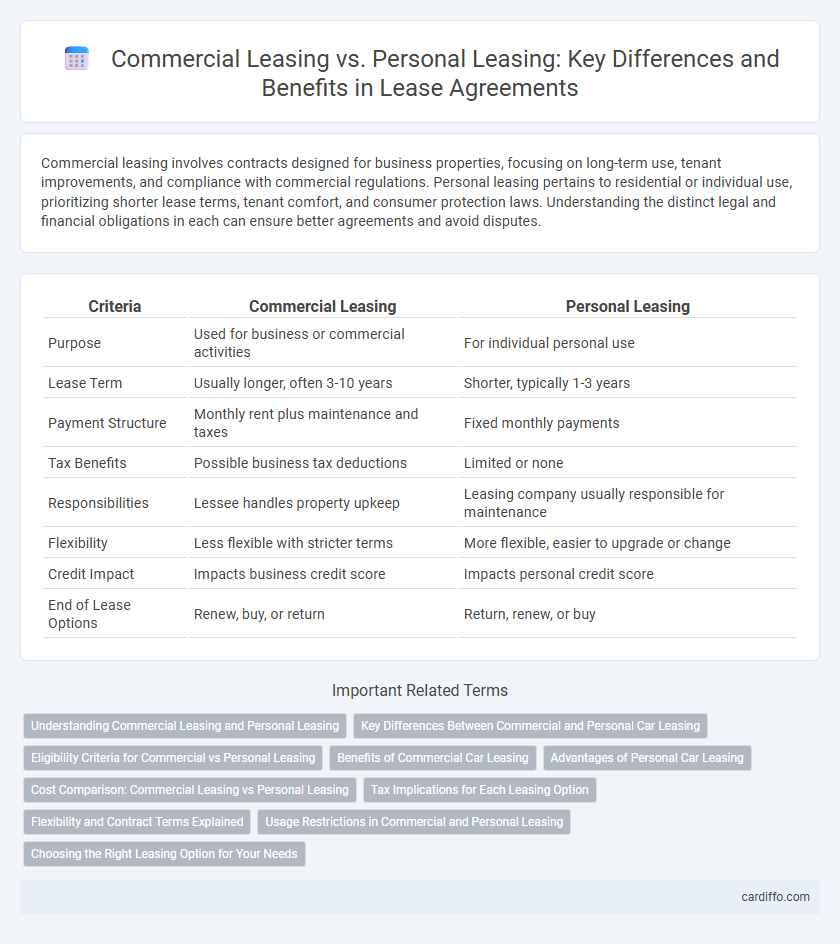

Commercial leasing involves contracts designed for business properties, focusing on long-term use, tenant improvements, and compliance with commercial regulations. Personal leasing pertains to residential or individual use, prioritizing shorter lease terms, tenant comfort, and consumer protection laws. Understanding the distinct legal and financial obligations in each can ensure better agreements and avoid disputes.

Table of Comparison

| Criteria | Commercial Leasing | Personal Leasing |

|---|---|---|

| Purpose | Used for business or commercial activities | For individual personal use |

| Lease Term | Usually longer, often 3-10 years | Shorter, typically 1-3 years |

| Payment Structure | Monthly rent plus maintenance and taxes | Fixed monthly payments |

| Tax Benefits | Possible business tax deductions | Limited or none |

| Responsibilities | Lessee handles property upkeep | Leasing company usually responsible for maintenance |

| Flexibility | Less flexible with stricter terms | More flexible, easier to upgrade or change |

| Credit Impact | Impacts business credit score | Impacts personal credit score |

| End of Lease Options | Renew, buy, or return | Return, renew, or buy |

Understanding Commercial Leasing and Personal Leasing

Commercial leasing involves renting property or equipment primarily for business purposes, typically including office spaces, retail stores, or industrial facilities with longer lease terms and more complex contractual obligations. Personal leasing usually refers to leasing goods or services for individual use, such as vehicles or electronics, featuring shorter durations and simpler agreements tailored to consumer needs. Understanding the distinctions between commercial and personal leasing is crucial for selecting appropriate terms, managing financial commitments, and complying with relevant legal frameworks.

Key Differences Between Commercial and Personal Car Leasing

Commercial leasing typically involves vehicles used for business purposes, often with higher mileage limits and customized terms to accommodate company needs, while personal leasing is tailored for individual use with standard mileage and maintenance packages. Lease agreements for commercial vehicles may include tax benefits and options for fleet management services, contrasting with personal leases focused on convenience and lower monthly payments. Understanding these distinctions helps lessees optimize cost efficiency and compliance according to usage and business or personal requirements.

Eligibility Criteria for Commercial vs Personal Leasing

Commercial leasing eligibility requires proof of business registration, a stable revenue stream, and a good credit history to ensure the lessee's ability to meet lease obligations. Personal leasing eligibility typically involves verifying individual credit scores, employment status, and income level to assess financial reliability. Lenders or lessors assess risk differently, prioritizing business financials for commercial leases and personal financial stability for personal leases.

Benefits of Commercial Car Leasing

Commercial car leasing offers significant tax advantages, including deductions on lease payments and maintenance expenses, which reduce overall business costs. It also preserves capital and improves cash flow by eliminating large upfront payments, allowing companies to allocate resources more efficiently. Flexible lease terms and the ability to upgrade vehicles regularly ensure businesses maintain a professional fleet with the latest technology and safety features.

Advantages of Personal Car Leasing

Personal car leasing offers lower monthly payments compared to commercial leasing due to reductions in taxes and insurance costs, making it more affordable for individual use. Lease agreements for personal vehicles typically include maintenance packages and warranty coverage, reducing unexpected expenses and providing peace of mind. Flexibility in contract terms and easy upgrade options allow personal lessees to drive the latest models without long-term commitments or large upfront investments.

Cost Comparison: Commercial Leasing vs Personal Leasing

Commercial leasing generally involves higher monthly payments and larger upfront costs compared to personal leasing due to the inclusion of business-related expenses such as maintenance, insurance, and taxes. Personal leasing typically offers lower overall costs with simpler contract terms and limited additional fees, making it more cost-effective for individual consumers. Businesses may benefit from tax deductions and depreciation advantages in commercial leases, partially offsetting the higher payment structure.

Tax Implications for Each Leasing Option

Commercial leasing often allows businesses to deduct lease payments as a business expense, reducing taxable income and offering potential VAT reclaim options in many jurisdictions. Personal leasing, primarily intended for individual use, typically lacks tax deductions and may involve different tax treatments such as personal use restrictions and non-deductible VAT. Understanding specific tax codes and local regulations is essential to optimize financial benefits and ensure compliance for both commercial and personal leasing arrangements.

Flexibility and Contract Terms Explained

Commercial leasing offers greater flexibility with negotiable contract terms tailored to business needs, including adjustable lease durations, renewal options, and subleasing rights. Personal leasing typically involves fixed contract terms, shorter durations, and limited flexibility regarding early termination or modifications. Understanding these differences is crucial for selecting the appropriate lease type based on usage and financial planning.

Usage Restrictions in Commercial and Personal Leasing

Commercial leasing agreements often impose strict usage restrictions tailored to specific business activities, limiting tenants to conduct operations aligned with the leased property's designated commercial purpose. Personal leasing generally allows for more flexible usage, as it is primarily intended for residential living without stringent limitations on daily activities. Understanding these usage restrictions is crucial for tenants to ensure compliance and avoid breaches that can lead to lease termination or legal disputes.

Choosing the Right Leasing Option for Your Needs

Choosing the right leasing option depends on your specific requirements and financial goals; commercial leasing offers tailored solutions for businesses seeking office space, equipment, or vehicles with flexible terms and tax advantages. Personal leasing suits individuals who prefer lower monthly payments and the ability to upgrade vehicles frequently without ownership responsibilities. Evaluating factors such as usage, duration, budget, and end-of-lease options ensures the best alignment with your lifestyle or business objectives.

Commercial Leasing vs Personal Leasing Infographic

cardiffo.com

cardiffo.com