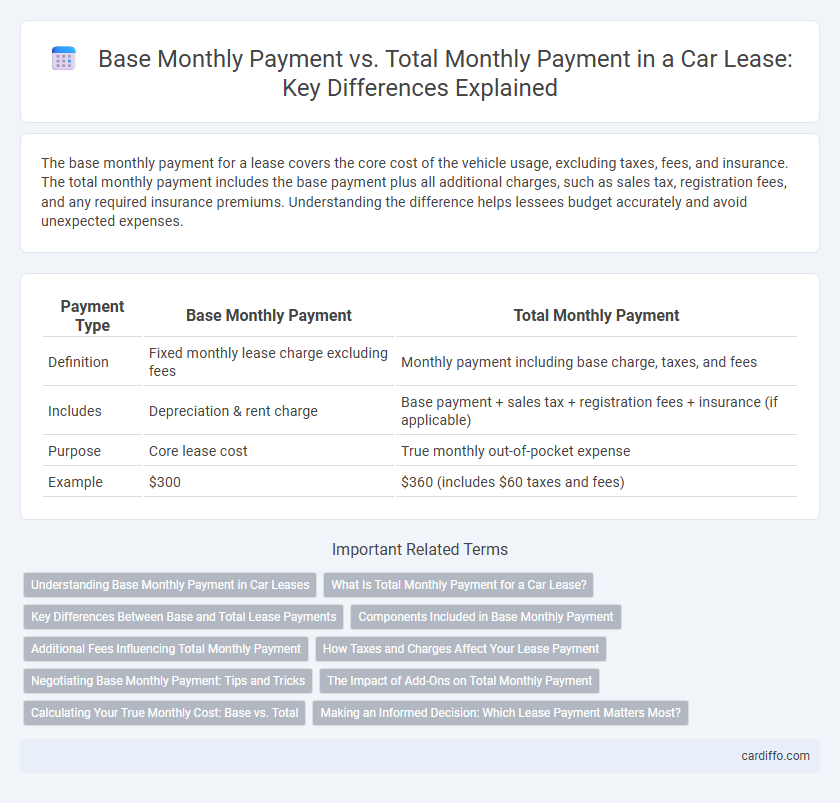

The base monthly payment for a lease covers the core cost of the vehicle usage, excluding taxes, fees, and insurance. The total monthly payment includes the base payment plus all additional charges, such as sales tax, registration fees, and any required insurance premiums. Understanding the difference helps lessees budget accurately and avoid unexpected expenses.

Table of Comparison

| Payment Type | Base Monthly Payment | Total Monthly Payment |

|---|---|---|

| Definition | Fixed monthly lease charge excluding fees | Monthly payment including base charge, taxes, and fees |

| Includes | Depreciation & rent charge | Base payment + sales tax + registration fees + insurance (if applicable) |

| Purpose | Core lease cost | True monthly out-of-pocket expense |

| Example | $300 | $360 (includes $60 taxes and fees) |

Understanding Base Monthly Payment in Car Leases

The Base Monthly Payment in car leases represents the primary cost calculated from the vehicle's depreciation and the lease term, excluding taxes, fees, and optional add-ons. This amount serves as the foundation for the total monthly payment, which incorporates additional charges like insurance, monthly taxes, and maintenance packages. Understanding the Base Monthly Payment is crucial for evaluating the core financial commitment and comparing lease offers effectively.

What Is Total Monthly Payment for a Car Lease?

Total Monthly Payment for a car lease includes the Base Monthly Payment along with additional fees such as taxes, insurance, maintenance, and any applicable dealer or finance charges. The Base Monthly Payment is the initial amount calculated based on the car's depreciation, lease term, and interest rate, but the Total Monthly Payment reflects the full cost a lessee must pay each month. Understanding this distinction helps potential lessees budget more accurately and avoid unexpected expenses during the lease term.

Key Differences Between Base and Total Lease Payments

Base monthly payment refers to the agreed-upon rental amount for a lease excluding any additional fees or taxes. Total monthly payment includes the base payment plus extra charges such as taxes, maintenance fees, insurance, and other lease-related costs. Understanding these differences is crucial for accurately budgeting and comparing lease offers.

Components Included in Base Monthly Payment

The Base Monthly Payment in a lease typically includes depreciation, vehicle financing charges, and applicable taxes, excluding additional fees such as insurance, maintenance, and mileage overages. It covers the core cost of renting the vehicle and is calculated based on the vehicle's capitalized cost minus residual value, divided by the lease term. Understanding the components within the Base Monthly Payment helps lessees evaluate the true cost of the lease before factoring in variable expenses reflected in the Total Monthly Payment.

Additional Fees Influencing Total Monthly Payment

Base monthly payment represents the agreed-upon rent before any extra charges. Total monthly payment includes the base rent plus additional fees such as maintenance, utilities, and amenity access. These supplementary costs can significantly increase the tenant's overall monthly financial obligation.

How Taxes and Charges Affect Your Lease Payment

Taxes and charges directly increase your total monthly lease payment beyond the base monthly payment, which covers only the vehicle's depreciation and finance costs. State and local sales taxes, registration fees, and lease acquisition charges are added to the base payment, resulting in a higher overall cost. Understanding these components helps lessees budget accurately and avoid unexpected expenses throughout the lease term.

Negotiating Base Monthly Payment: Tips and Tricks

Negotiating the base monthly payment in a lease starts with thorough research on the vehicle's residual value and money factor, which directly influence the calculation. Leverage your credit score and shop multiple dealerships to compare offers, aiming to lower the money factor and negotiate incentives or rebates that reduce the base payment. Understanding these key lease components enables you to secure a base monthly payment that aligns with your budget before considering taxes and fees that compose the total monthly payment.

The Impact of Add-Ons on Total Monthly Payment

Base Monthly Payment reflects the initial lease cost calculated from the vehicle's depreciated value and residual amount, excluding additional fees or products. Total Monthly Payment increases as add-ons such as insurance packages, maintenance plans, and extended warranties are incorporated, directly impacting the lessee's financial obligation. Understanding the difference between these payments helps lessees manage overall lease affordability and avoid unexpected expenses.

Calculating Your True Monthly Cost: Base vs. Total

Calculating your true monthly lease cost requires understanding the difference between the base monthly payment and the total monthly payment. The base monthly payment covers the depreciation and rent charge, while the total monthly payment includes additional fees such as taxes, insurance, and maintenance costs. Accurately comparing lease offers demands factoring in these hidden expenses to avoid underestimating your financial commitment.

Making an Informed Decision: Which Lease Payment Matters Most?

Base monthly payment refers to the fixed amount agreed upon in the lease contract, excluding taxes, fees, and optional add-ons, while total monthly payment includes all those additional costs, reflecting the actual amount paid each month. Understanding the distinction between these figures is crucial for budgeting accurately and avoiding unexpected financial strain. Prioritizing the total monthly payment ensures a clear picture of the lease's true cost, aiding in making an informed decision.

Base Monthly Payment vs Total Monthly Payment Infographic

cardiffo.com

cardiffo.com