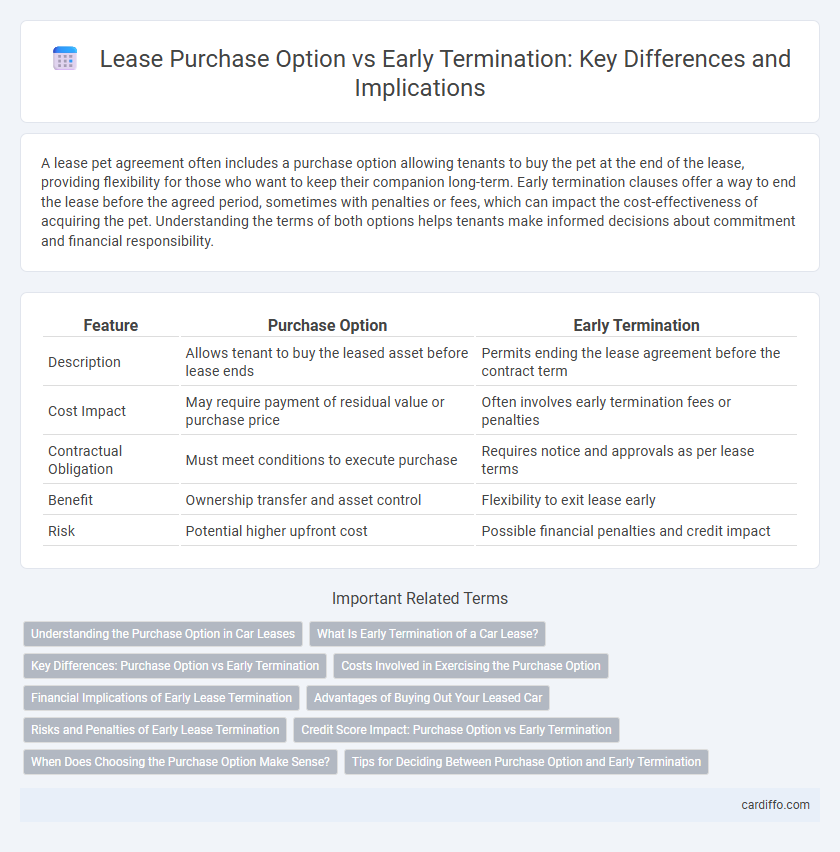

A lease pet agreement often includes a purchase option allowing tenants to buy the pet at the end of the lease, providing flexibility for those who want to keep their companion long-term. Early termination clauses offer a way to end the lease before the agreed period, sometimes with penalties or fees, which can impact the cost-effectiveness of acquiring the pet. Understanding the terms of both options helps tenants make informed decisions about commitment and financial responsibility.

Table of Comparison

| Feature | Purchase Option | Early Termination |

|---|---|---|

| Description | Allows tenant to buy the leased asset before lease ends | Permits ending the lease agreement before the contract term |

| Cost Impact | May require payment of residual value or purchase price | Often involves early termination fees or penalties |

| Contractual Obligation | Must meet conditions to execute purchase | Requires notice and approvals as per lease terms |

| Benefit | Ownership transfer and asset control | Flexibility to exit lease early |

| Risk | Potential higher upfront cost | Possible financial penalties and credit impact |

Understanding the Purchase Option in Car Leases

A purchase option in car leases allows lessees to buy the vehicle at the end of the lease term for a predetermined price, often called the residual value. This option provides financial predictability and flexibility, enabling customers to decide whether to own the car based on its market value and condition. Understanding the purchase option helps lessees weigh long-term costs against early termination penalties that typically involve fees and remaining lease payments.

What Is Early Termination of a Car Lease?

Early termination of a car lease occurs when a lessee decides to end the lease agreement before the scheduled expiration date, often incurring fees or penalties outlined in the lease contract. This option contrasts with a purchase option, which allows the lessee to buy the vehicle at a predetermined price either during or at the end of the lease term. Understanding the financial implications and contract terms of early termination is crucial to avoid unexpected costs and protect credit standing.

Key Differences: Purchase Option vs Early Termination

A purchase option in a lease grants the lessee the right to buy the leased asset at a predetermined price, usually at the end of the lease term, providing a clear path to ownership. Early termination allows the lessee to end the lease before its scheduled expiration but often requires paying penalties or fees, which can be substantial depending on the lease agreement. The key difference lies in the intent and financial implications: purchase options facilitate asset acquisition, whereas early termination focuses on contract cessation with potential cost consequences.

Costs Involved in Exercising the Purchase Option

Exercising a purchase option in a lease typically involves upfront costs such as the predetermined buyout price, taxes, and potential administrative fees set by the leasing agreement. These expenses contrast sharply with early termination fees, which often include penalty charges and outstanding lease payments but do not result in ownership transfer. Understanding the financial implications of the buyout price versus cumulative lease penalties is essential for making an economically sound decision.

Financial Implications of Early Lease Termination

Early termination of a lease often results in significant financial penalties, including lease break fees, forfeiture of security deposits, and the responsibility to cover rent until the unit is re-leased. Lease agreements may specify fixed early termination charges or require tenants to pay rent for remaining months, increasing overall costs. In contrast, purchase options typically involve upfront payments that can be credited toward the property's price, offering a more predictable financial outcome compared to unpredictable early termination fees.

Advantages of Buying Out Your Leased Car

Buying out your leased car offers financial advantages such as avoiding mileage penalties and excess wear-and-tear fees, preserving the vehicle's value you are already familiar with. It provides flexibility by eliminating early termination charges and allows you to build equity rather than losing money on lease-end costs. Ownership after buyout also grants the freedom to sell or trade the vehicle at any time, potentially recouping some investment.

Risks and Penalties of Early Lease Termination

Early lease termination carries significant risks and financial penalties, including forfeiture of the security deposit, payment of remaining lease balance, and potential legal fees. Unlike purchase options that provide structured exit paths, early termination often results in liability for unpaid rent until the unit is re-leased, creating substantial monetary exposure. Tenants must carefully evaluate lease contract clauses to understand the scope of penalties and avoid unexpected costs.

Credit Score Impact: Purchase Option vs Early Termination

Exercising a purchase option at lease-end typically has minimal impact on your credit score since it concludes the lease agreement through fulfillment rather than a break. Early termination often triggers significant credit consequences due to missed or early payoff obligations, potentially lowering your credit score. Lenders and credit bureaus view purchase option usage as responsible financial behavior, while early termination may be flagged as a risk factor.

When Does Choosing the Purchase Option Make Sense?

Choosing the purchase option makes sense when the leased asset's market value is expected to rise or when ownership provides long-term financial benefits, such as equity buildup and potential tax advantages. It is particularly advantageous if the end-of-lease purchase price is below the projected fair market value, offering a cost-effective pathway to acquire the asset. Businesses should evaluate the total cost of ownership versus ongoing lease payments to determine if exercising the purchase option aligns with their financial goals.

Tips for Deciding Between Purchase Option and Early Termination

Evaluate the financial impact of the purchase option cost versus early termination fees to determine which aligns better with your budget and long-term goals. Consider your future plans, including the likelihood of keeping the asset beyond the lease term or returning it early, to make an informed decision. Review the lease agreement's specific terms and conditions, as they often contain critical details that affect the feasibility and benefits of each choice.

Purchase Option vs Early Termination Infographic

cardiffo.com

cardiffo.com