Zero-down leases require no initial payment, making them ideal for drivers looking to minimize upfront costs, while sign-and-drive leases bundle the first month's payment and other fees into the monthly installments, simplifying the leasing process. Zero-down typically offers lower monthly payments but may involve higher credit requirements, whereas sign-and-drive provides ease of entry with predictable monthly expenses. Choosing between these options depends on your financial flexibility and preference for upfront versus ongoing costs.

Table of Comparison

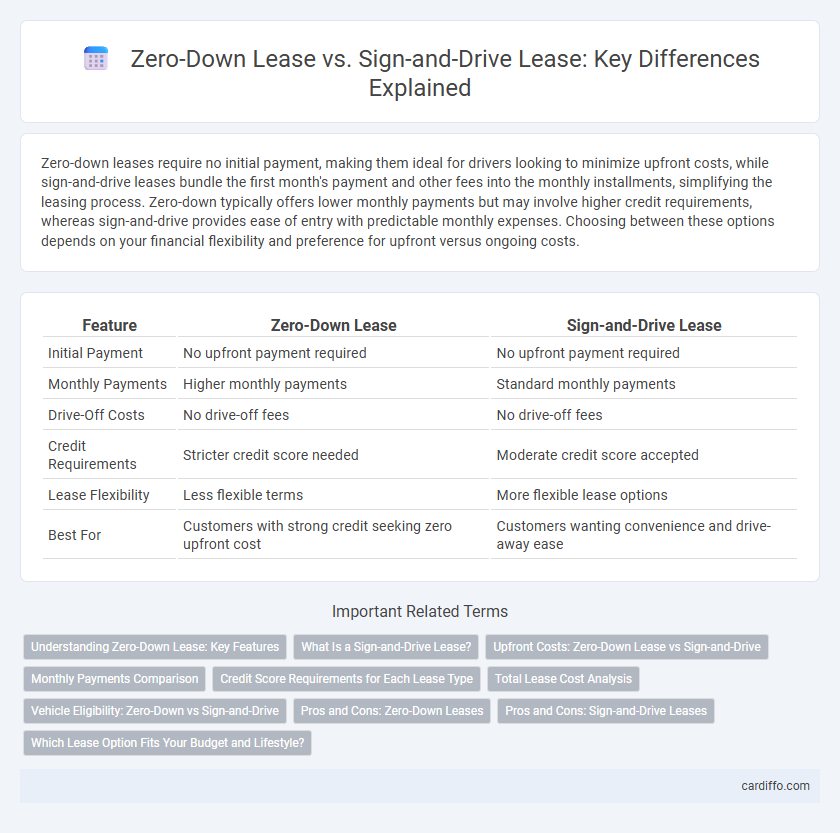

| Feature | Zero-Down Lease | Sign-and-Drive Lease |

|---|---|---|

| Initial Payment | No upfront payment required | No upfront payment required |

| Monthly Payments | Higher monthly payments | Standard monthly payments |

| Drive-Off Costs | No drive-off fees | No drive-off fees |

| Credit Requirements | Stricter credit score needed | Moderate credit score accepted |

| Lease Flexibility | Less flexible terms | More flexible lease options |

| Best For | Customers with strong credit seeking zero upfront cost | Customers wanting convenience and drive-away ease |

Understanding Zero-Down Lease: Key Features

A zero-down lease requires no initial payment, allowing lessees to start driving without a large upfront cost, which improves cash flow management. This type of lease typically includes monthly payments that cover depreciation, interest, and fees, spreading the total cost over the lease term. Understanding key features like residual value, mileage limits, and potential fees helps lessees maximize benefits and avoid unexpected expenses.

What Is a Sign-and-Drive Lease?

A sign-and-drive lease requires no upfront payment beyond the first month's lease fee, making it distinct from zero-down leases that may still include other initial costs such as taxes or fees. This type of lease offers financial convenience by minimizing out-of-pocket expenses at signing, allowing drivers to start their lease with immediate vehicle access. Sign-and-drive leases are particularly popular among consumers seeking simplified leasing terms without the burden of large initial deposits.

Upfront Costs: Zero-Down Lease vs Sign-and-Drive

Zero-down leases require no initial payment, eliminating upfront costs such as down payment, acquisition fees, and initial taxes, making the lease more accessible to consumers with limited cash flow. Sign-and-drive leases combine minimal or no down payment with all fees and taxes rolled into monthly payments, simplifying budgeting by avoiding immediate out-of-pocket expenses at signing. Both options reduce upfront financial burden, but sign-and-drive leases provide clearer payment structure by including almost all costs within the monthly lease installments.

Monthly Payments Comparison

Zero-down leases require no upfront payment, resulting in higher monthly payments spread over the lease term to cover the vehicle's total cost. Sign-and-drive leases balance initial costs by including less upfront but slightly increased monthly payments and often encompass fees such as taxes and registration. Comparing monthly payments reveals that zero-down leases typically have more consistent but higher monthly amounts, while sign-and-drive provides lower monthly payments with some additional fees rolled in.

Credit Score Requirements for Each Lease Type

Zero-down leases typically require higher credit scores, often above 700, to mitigate the risk for lessors since no upfront payment is made. Sign-and-drive leases are more accessible to individuals with moderate credit scores around 650, as the initial payment covers part of the lease risk and fees. Understanding credit score requirements helps applicants select the lease type that aligns with their financial profile and approval likelihood.

Total Lease Cost Analysis

Zero-down leases require no upfront payment but often result in higher monthly payments and increased total lease cost due to upfront cost recovery. Sign-and-drive leases typically include all fees and initial payments rolled into the monthly payment, offering predictable budgeting but potentially higher overall lease costs. Analyzing total lease cost involves comparing monthly payments, fees, and residual values to determine the most cost-effective option over the lease term.

Vehicle Eligibility: Zero-Down vs Sign-and-Drive

Zero-down leases often require higher credit scores and are limited to select vehicle models with strong residual values to minimize lender risk. Sign-and-drive leases typically offer broader vehicle eligibility, including a wider range of makes and models, as they include upfront costs rolled into monthly payments. Evaluating vehicle eligibility based on credit qualifications and model availability is crucial when choosing between zero-down and sign-and-drive lease options.

Pros and Cons: Zero-Down Leases

Zero-down leases offer the advantage of lower upfront costs, making it easier for consumers to start a lease without a large initial payment. However, they often come with higher monthly payments and may include stricter eligibility requirements. The absence of a down payment can also lead to higher overall lease costs over the term, impacting long-term affordability.

Pros and Cons: Sign-and-Drive Leases

Sign-and-drive leases offer the advantage of simplicity by requiring minimal upfront payment, often limited to the first month's lease fee, making it easier for lessees to drive off immediately without heavy initial costs. However, these leases may come with higher monthly payments and stricter mileage or maintenance restrictions, which can increase overall expenses over the lease term. The convenience of lower upfront costs must be weighed against possible long-term financial implications and lease-end conditions.

Which Lease Option Fits Your Budget and Lifestyle?

Zero-Down Lease options reduce upfront costs by eliminating initial payments, making them ideal for those seeking lower immediate expenses and flexible cash flow management. Sign-and-Drive Leases bundle all fees, including taxes and registration, into predictable monthly payments, offering convenience and budgeting ease for drivers prioritizing simplicity. Evaluating your financial priorities and driving habits helps determine which lease structure aligns best with your budget and lifestyle goals.

Zero-Down Lease vs Sign-and-Drive Lease Infographic

cardiffo.com

cardiffo.com