Trade-in credit reduces the amount owed on a leased vehicle by applying the value of a traded-in car directly to the lease balance, lowering monthly payments without requiring an upfront cash outlay. A down payment, however, involves paying a lump sum at lease signing to decrease the financed amount, which can also reduce monthly costs but requires immediate cash. Choosing between trade-in credit and down payment depends on available resources and financial goals, as each impacts the lease structure differently.

Table of Comparison

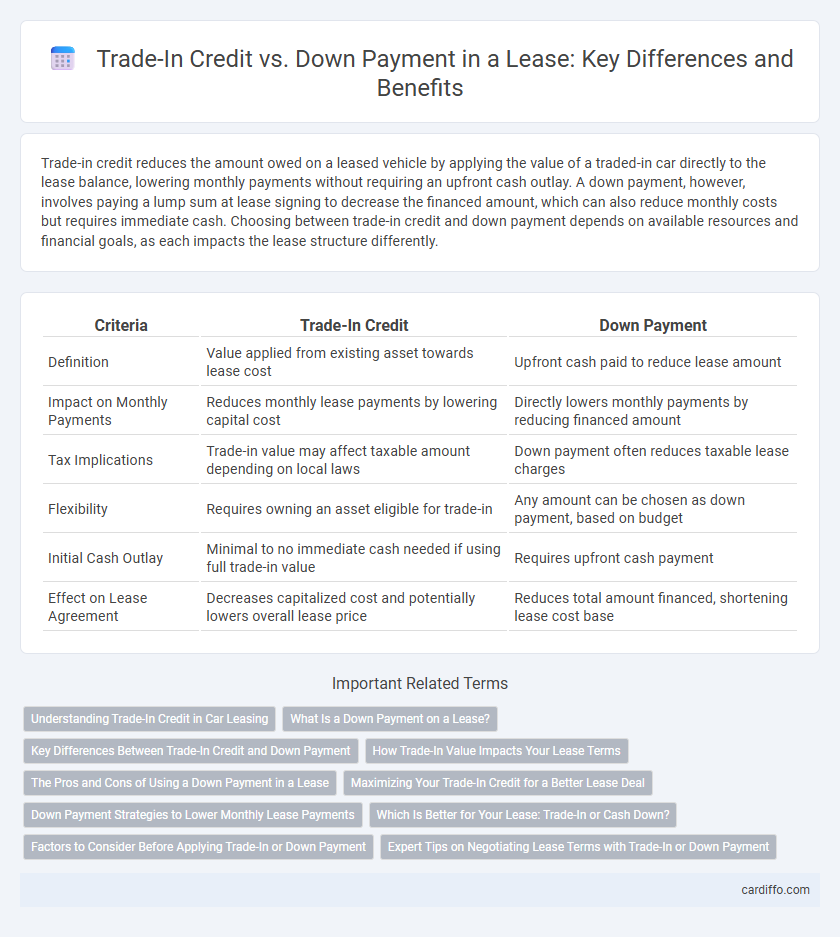

| Criteria | Trade-In Credit | Down Payment |

|---|---|---|

| Definition | Value applied from existing asset towards lease cost | Upfront cash paid to reduce lease amount |

| Impact on Monthly Payments | Reduces monthly lease payments by lowering capital cost | Directly lowers monthly payments by reducing financed amount |

| Tax Implications | Trade-in value may affect taxable amount depending on local laws | Down payment often reduces taxable lease charges |

| Flexibility | Requires owning an asset eligible for trade-in | Any amount can be chosen as down payment, based on budget |

| Initial Cash Outlay | Minimal to no immediate cash needed if using full trade-in value | Requires upfront cash payment |

| Effect on Lease Agreement | Decreases capitalized cost and potentially lowers overall lease price | Reduces total amount financed, shortening lease cost base |

Understanding Trade-In Credit in Car Leasing

Trade-in credit in car leasing allows the value of your current vehicle to be applied directly toward your new lease, reducing the total amount financed and lowering monthly payments. Unlike a down payment, which is an upfront cash expense, trade-in credit leverages equity in your existing car, effectively serving as a non-cash down payment that can improve lease terms. Understanding the precise trade-in valuation and its impact on the capitalized cost is essential for optimizing lease deals and minimizing overall costs.

What Is a Down Payment on a Lease?

A down payment on a lease, often called a capitalized cost reduction, is an upfront sum paid to lower the vehicle's total lease amount and monthly payments. This payment reduces the amount financed over the lease term, impacting both the residual value and depreciation costs. Understanding down payments helps lessees manage cash flow and potentially negotiate better lease terms.

Key Differences Between Trade-In Credit and Down Payment

Trade-in credit applies the value of a used vehicle directly to reduce the capitalized cost or monthly lease payments, whereas a down payment is a cash amount paid upfront to lower the leased vehicle's initial cost. Trade-in credit is dependent on the appraised worth of the trade-in vehicle, impacting the lease balance, while a down payment provides immediate equity without requiring vehicle valuation. Both methods effectively reduce monthly payments but differ in their application and financial source.

How Trade-In Value Impacts Your Lease Terms

Trade-in value directly reduces the capitalized cost of your lease, lowering monthly payments and potentially improving your residual value. Applying a high trade-in credit can decrease your upfront cash requirement compared to a traditional down payment, making leases more affordable. Understanding how dealers apply trade-in credits versus down payments helps optimize your lease terms and overall financial benefit.

The Pros and Cons of Using a Down Payment in a Lease

Using a down payment in a lease reduces monthly payments and the overall financed amount, improving cash flow management during the lease term. However, it increases the initial out-of-pocket cost and may not provide significant financial advantage if the vehicle is totaled or stolen early in the lease. Lessors often limit the down payment's effect on early termination fees, making it less flexible compared to other payment structures.

Maximizing Your Trade-In Credit for a Better Lease Deal

Maximizing your trade-in credit can significantly reduce your lease's upfront cost by applying the full appraised value toward your down payment. Ensure accurate vehicle valuation from reputable sources to leverage the highest trade-in offer, enhancing your negotiation position. Using trade-in credit efficiently lowers your monthly lease payments, improving overall affordability and lease terms.

Down Payment Strategies to Lower Monthly Lease Payments

A larger down payment reduces the total amount financed, directly lowering monthly lease payments by decreasing the principal balance subject to depreciation and interest. Implementing a down payment strategy that maximizes upfront cash can improve lease affordability and reduce financial strain throughout the lease term. Allocating funds to a higher initial payment optimizes leasing costs more effectively than relying solely on trade-in credit, which may vary in value and impact on monthly payments.

Which Is Better for Your Lease: Trade-In or Cash Down?

Trade-in credit reduces your lease balance by applying the vehicle's resale value directly to the lease, often lowering monthly payments without the need for extra cash upfront. A down payment decreases your capitalized cost, offering immediate equity and potentially lower interest charges, but requires liquid funds at lease signing. Choosing between trade-in credit and cash down depends on your financial flexibility, credit goals, and whether you prefer leveraging vehicle equity or preserving cash reserves during the lease term.

Factors to Consider Before Applying Trade-In or Down Payment

Assess the overall financial impact by comparing the trade-in credit value with potential down payment benefits to lower monthly lease payments and reduce financing charges. Evaluate the condition and market value of the trade-in vehicle to ensure the credit offered aligns with its true worth and balances against upfront cash liquidity requirements. Consider lease terms, such as mileage limits and fees, as well as tax implications, to optimize cost efficiency and avoid unexpected expenses during the lease period.

Expert Tips on Negotiating Lease Terms with Trade-In or Down Payment

Negotiating lease terms effectively involves understanding the difference between trade-in credit and down payment to maximize financial benefits. Trade-in credit reduces the capitalized cost of the vehicle, lowering monthly lease payments, while down payment directly decreases the amount financed, impacting the lease structure differently. Experts recommend obtaining an accurate trade-in appraisal and leveraging it during negotiations to ensure the trade-in value is fairly applied, while also considering the impact of upfront down payments on total lease costs and residual value.

Trade-In Credit vs Down Payment Infographic

cardiffo.com

cardiffo.com