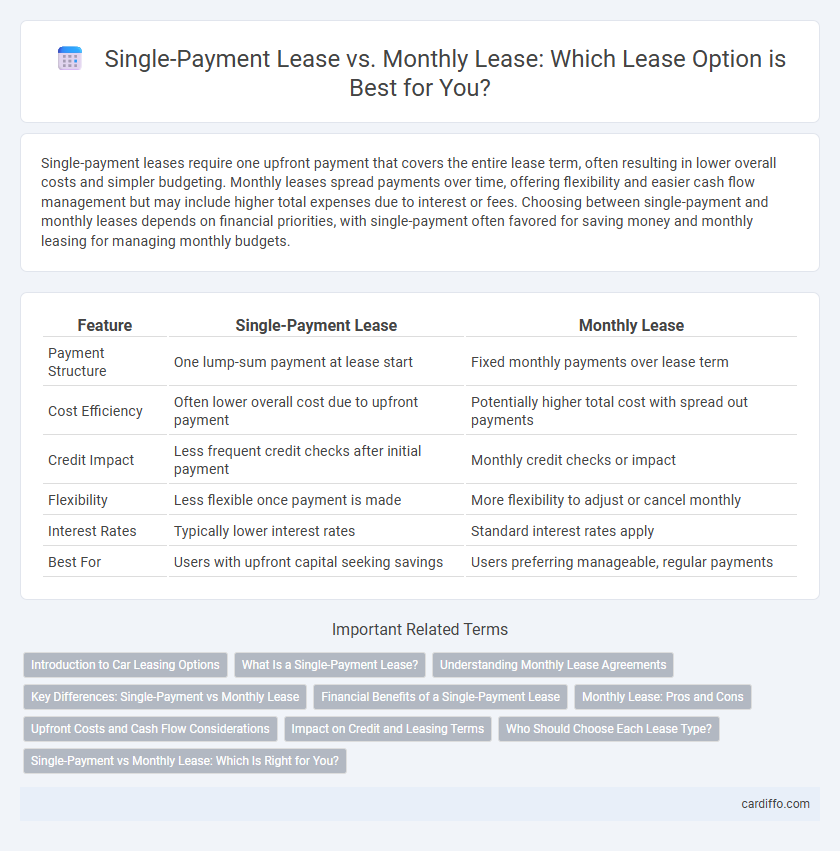

Single-payment leases require one upfront payment that covers the entire lease term, often resulting in lower overall costs and simpler budgeting. Monthly leases spread payments over time, offering flexibility and easier cash flow management but may include higher total expenses due to interest or fees. Choosing between single-payment and monthly leases depends on financial priorities, with single-payment often favored for saving money and monthly leasing for managing monthly budgets.

Table of Comparison

| Feature | Single-Payment Lease | Monthly Lease |

|---|---|---|

| Payment Structure | One lump-sum payment at lease start | Fixed monthly payments over lease term |

| Cost Efficiency | Often lower overall cost due to upfront payment | Potentially higher total cost with spread out payments |

| Credit Impact | Less frequent credit checks after initial payment | Monthly credit checks or impact |

| Flexibility | Less flexible once payment is made | More flexibility to adjust or cancel monthly |

| Interest Rates | Typically lower interest rates | Standard interest rates apply |

| Best For | Users with upfront capital seeking savings | Users preferring manageable, regular payments |

Introduction to Car Leasing Options

Single-payment leases require a one-time upfront payment covering the entire lease term, reducing monthly expenses and simplifying budgeting. Monthly leases spread the cost over regular installments, offering flexibility and lower initial outlay for lessees. Choosing between these options depends on cash flow preferences, credit considerations, and long-term financial goals in vehicle leasing.

What Is a Single-Payment Lease?

A single-payment lease requires the lessee to pay the entire lease amount upfront, covering the entire lease term in one lump sum. This type of lease often results in lower overall costs compared to monthly lease payments because it reduces financing fees and interest charges. Single-payment leases provide the advantage of simplified budgeting by eliminating monthly payment obligations throughout the lease duration.

Understanding Monthly Lease Agreements

Monthly lease agreements specify fixed payments due each month over the lease term, offering predictable budgeting for tenants and landlords alike. Unlike single-payment leases, which require a lump sum upfront, monthly leases distribute the financial obligation evenly, reducing initial cash flow burden. Clear terms regarding payment schedules, late fees, and lease duration are essential to avoid disputes and ensure compliance.

Key Differences: Single-Payment vs Monthly Lease

Single-payment leases require one upfront lump sum payment covering the entire lease term, resulting in lower overall costs and reduced monthly obligations. Monthly leases spread payments evenly across monthly installments, offering flexibility but often higher cumulative expenses. Single-payment leases minimize interest and fees, whereas monthly leases provide easier budget management for lessees.

Financial Benefits of a Single-Payment Lease

A single-payment lease offers significant financial benefits by eliminating monthly interest charges, resulting in lower overall costs compared to monthly leases. This upfront payment structure often leads to reduced lease fees and increased potential tax advantages for businesses. Leaseholders can benefit from improved cash flow management and avoid the risk of missed monthly payments or fees.

Monthly Lease: Pros and Cons

Monthly leases offer flexibility by allowing renters to pay in smaller, manageable installments, making budgeting easier and reducing initial expenses compared to single-payment leases. They provide the advantage of shorter commitments, enabling tenants to adapt quickly to changing circumstances without substantial penalties. However, monthly leases often come with higher overall costs and increased risk of rent hikes, which can outweigh their convenience for long-term occupants.

Upfront Costs and Cash Flow Considerations

A single-payment lease requires a large upfront cost covering the entire lease term, reducing monthly expenses and improving short-term cash flow management for businesses. In contrast, a monthly lease spreads payments evenly over the lease duration, minimizing initial cash outflow but demanding consistent monthly budgeting. Evaluating upfront costs against ongoing cash flow needs is essential for selecting the optimal lease structure that aligns with financial strategies and liquidity requirements.

Impact on Credit and Leasing Terms

Single-payment leases often result in a lower overall interest cost and can positively impact credit scores by showing a lump sum payment, reducing the risk perceived by lenders. Monthly leases provide consistent payment history that can help build credit over time but may incur higher financing charges due to prolonged payment terms. Leasing terms for single-payment leases typically emphasize upfront costs and reduced interest, while monthly leases focus on affordability and flexible budgeting.

Who Should Choose Each Lease Type?

Single-payment leases suit drivers who prefer paying upfront to avoid monthly bills and want lower total costs without long-term financial commitment. Monthly leases benefit those seeking flexibility with cash flow, allowing smaller periodic payments and easier budgeting for individuals or businesses with fluctuating incomes. Choosing depends on financial stability, payment preferences, and long-term vehicle usage plans.

Single-Payment vs Monthly Lease: Which Is Right for You?

A Single-Payment Lease requires paying the entire lease amount upfront, which can reduce monthly financial obligations and avoid interest charges, making it ideal for those with available capital seeking simplicity and potential savings. Monthly Leases spread payments over the term, offering flexibility and preserving cash flow, suitable for individuals prioritizing manageable monthly expenses and budgeting ease. Choosing between Single-Payment and Monthly Lease depends on your financial situation, cash availability, and preference for payment structure.

Single-Payment Lease vs Monthly Lease Infographic

cardiffo.com

cardiffo.com