Gap insurance covers the difference between the vehicle's actual cash value and the remaining lease balance if the car is totaled or stolen, protecting lessees from significant out-of-pocket expenses. Traditional insurance provides coverage for damages, liability, and theft based on the vehicle's current market value, but does not cover any outstanding lease payments. Choosing gap insurance is essential for leaseholders to avoid financial loss from depreciation not covered by standard auto insurance policies.

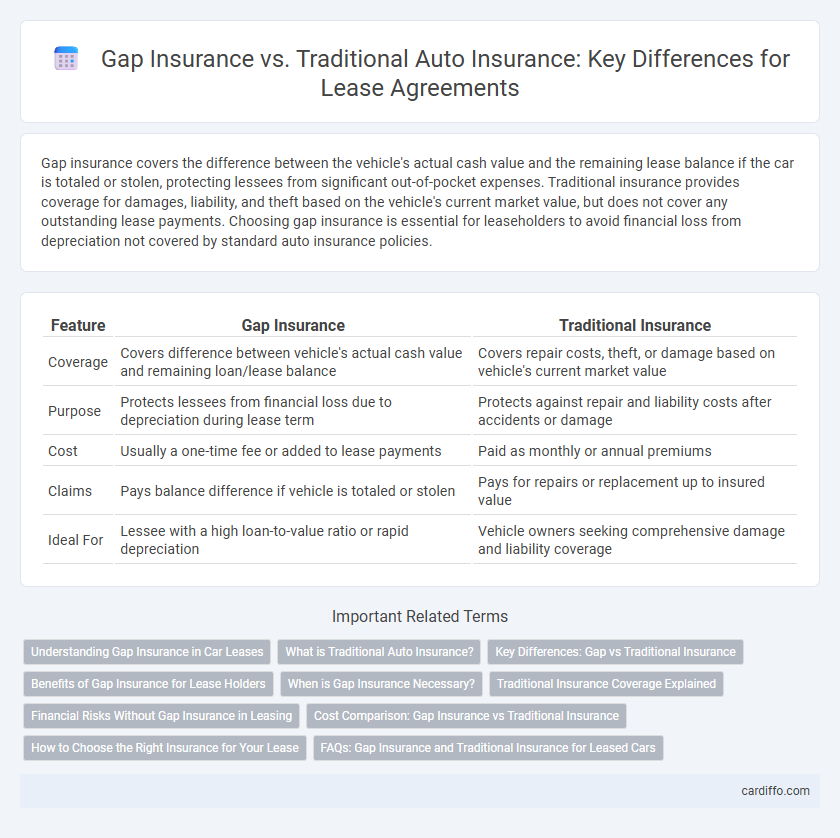

Table of Comparison

| Feature | Gap Insurance | Traditional Insurance |

|---|---|---|

| Coverage | Covers difference between vehicle's actual cash value and remaining loan/lease balance | Covers repair costs, theft, or damage based on vehicle's current market value |

| Purpose | Protects lessees from financial loss due to depreciation during lease term | Protects against repair and liability costs after accidents or damage |

| Cost | Usually a one-time fee or added to lease payments | Paid as monthly or annual premiums |

| Claims | Pays balance difference if vehicle is totaled or stolen | Pays for repairs or replacement up to insured value |

| Ideal For | Lessee with a high loan-to-value ratio or rapid depreciation | Vehicle owners seeking comprehensive damage and liability coverage |

Understanding Gap Insurance in Car Leases

Gap insurance in car leases covers the difference between the vehicle's actual cash value and the remaining lease balance if the car is totaled or stolen. Traditional insurance typically compensates only for the current market value, which can leave lessees financially responsible for the outstanding lease payments. Understanding gap insurance is essential for lessees to avoid significant out-of-pocket expenses during total loss situations.

What is Traditional Auto Insurance?

Traditional auto insurance provides coverage for damages to your vehicle and liability for injuries or property damage caused in an accident, typically including liability, collision, and comprehensive coverage. It reimburses for repair or replacement costs but may not cover the full payoff balance on a leased vehicle if it is totaled. This type of insurance is essential for protecting your financial responsibility and is usually required by law and lease agreements.

Key Differences: Gap vs Traditional Insurance

Gap insurance specifically covers the difference between the actual cash value of a leased vehicle and the remaining balance on the lease in case of total loss, whereas traditional insurance covers the vehicle's repair or replacement costs up to the policy limit. Traditional insurance pays for damages or theft based on the vehicle's market value, but does not cover financial gaps in lease payoff obligations. Key differences lie in gap insurance's focus on lease payoff protection and traditional insurance's broader coverage for vehicle damage and liability.

Benefits of Gap Insurance for Lease Holders

Gap insurance protects leaseholders by covering the difference between the vehicle's actual cash value and the remaining lease balance if the car is stolen or totaled. This coverage prevents substantial out-of-pocket expenses that traditional insurance policies do not address, especially during depreciation periods. Leaseholders benefit from financial security and peace of mind, avoiding unexpected debt even when the market value of the leased vehicle falls rapidly.

When is Gap Insurance Necessary?

Gap insurance is necessary when leasing a vehicle that depreciates faster than the loan balance, commonly seen in new car leases with high residual values. It covers the difference between the vehicle's actual cash value and the remaining lease payoff amount if the car is totaled or stolen. Traditional insurance only pays the market value, leaving lessees at financial risk without gap coverage.

Traditional Insurance Coverage Explained

Traditional insurance coverage in a lease typically includes liability protection, collision, comprehensive, and personal injury protection, ensuring the lessee is financially protected against damages and injuries. This coverage reimburses costs for accidents, theft, and property damage up to the policy limits, but often excludes coverage for the vehicle's depreciation or lease-end obligations. Lessees must carefully review their policy terms to understand deductibles, coverage limits, and exclusions to avoid unexpected out-of-pocket expenses.

Financial Risks Without Gap Insurance in Leasing

Without gap insurance in leasing, lessees face significant financial risks, including being liable for the difference between the vehicle's actual cash value and the remaining lease balance after a total loss. Traditional insurance typically covers only the current market value, which may depreciate rapidly, leaving substantial out-of-pocket expenses. This gap in coverage exposes lessees to unexpected financial burdens, especially in high-depreciation or accident-prone scenarios.

Cost Comparison: Gap Insurance vs Traditional Insurance

Gap insurance typically costs between $20 to $40 per year or can be included in lease payments, while traditional auto insurance premiums vary widely based on factors like coverage level, driver history, and vehicle type, often ranging from $600 to $1,200 annually. Gap insurance specifically covers the difference between the vehicle's actual cash value and the lease payoff amount in case of total loss, which traditional insurance does not cover. Comparing costs requires evaluating the added financial protection gap insurance provides against the potential premium increases for higher traditional insurance coverage.

How to Choose the Right Insurance for Your Lease

Choosing the right insurance for your lease depends on understanding the differences between gap insurance and traditional insurance. Gap insurance covers the difference between your vehicle's depreciated value and the remaining lease balance in case of total loss, while traditional insurance covers damages from accidents, theft, or liability. Evaluate lease terms, vehicle value, and financial risk to determine whether gap insurance is necessary alongside standard coverage to protect your investment effectively.

FAQs: Gap Insurance and Traditional Insurance for Leased Cars

Gap insurance covers the difference between a leased car's actual cash value and the remaining lease balance if the vehicle is totaled, while traditional insurance reimburses the current market value of the car. Lease agreements often require gap insurance to protect lessees from financial liability after a total loss, whereas traditional insurance focuses on repairs and replacement costs. Understanding coverage limits, deductibles, and claim processes helps lessees choose appropriate insurance based on their lease terms and financial risk tolerance.

Gap Insurance vs Traditional Insurance Infographic

cardiffo.com

cardiffo.com