Residual value represents the estimated worth of a leased asset at the end of the lease term, while depreciated value reflects the asset's reduction in value over time due to usage and wear. Understanding the difference between residual value and depreciated value is crucial for determining lease payments and potential buyout costs. The residual value is often set by the lessor initially, whereas the depreciated value is calculated based on the asset's actual condition and market factors.

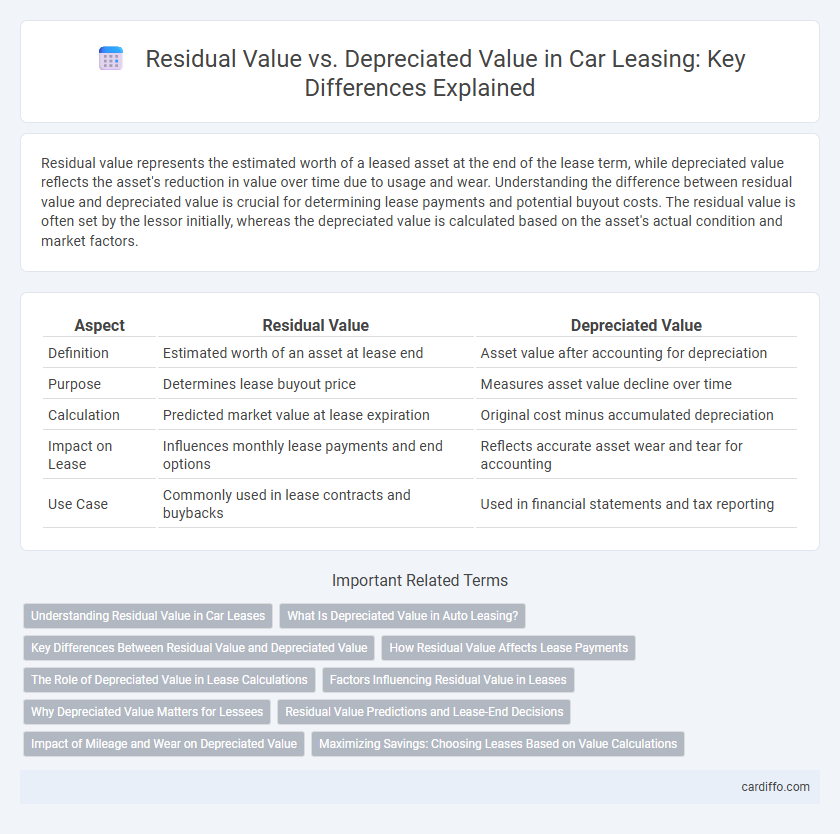

Table of Comparison

| Aspect | Residual Value | Depreciated Value |

|---|---|---|

| Definition | Estimated worth of an asset at lease end | Asset value after accounting for depreciation |

| Purpose | Determines lease buyout price | Measures asset value decline over time |

| Calculation | Predicted market value at lease expiration | Original cost minus accumulated depreciation |

| Impact on Lease | Influences monthly lease payments and end options | Reflects accurate asset wear and tear for accounting |

| Use Case | Commonly used in lease contracts and buybacks | Used in financial statements and tax reporting |

Understanding Residual Value in Car Leases

Residual value in car leases represents the estimated worth of the vehicle at the end of the lease term, influencing monthly payment calculations and buyout options. This value differs from the depreciated value, which reflects the actual loss in market worth due to usage and age. Understanding residual value helps lessees gauge potential costs and benefits when deciding whether to purchase the vehicle after the lease or return it.

What Is Depreciated Value in Auto Leasing?

Depreciated value in auto leasing refers to the reduction in a vehicle's worth over the lease term due to usage, age, and market factors. It represents the actual decline from the original MSRP to the current market value at lease end, impacting monthly payments and lease-end purchase options. Understanding depreciated value helps lessees gauge the fair market price and potential costs when considering lease termination or vehicle buyout.

Key Differences Between Residual Value and Depreciated Value

Residual value represents the estimated worth of a leased asset at the end of the lease term, while depreciated value reflects the asset's reduced value due to wear and tear over time. Residual value is used to calculate lease payments and assess the asset's anticipated market value upon lease expiration. Depreciated value accounts for actual loss in asset value based on usage and age, impacting financial statements and tax calculations.

How Residual Value Affects Lease Payments

Residual value, the estimated worth of a leased asset at the end of the lease term, directly influences monthly lease payments by determining the asset's depreciation over the lease period. Higher residual values result in lower monthly payments since the lessee finances the difference between the original price and the residual value. Accurately assessing residual value is crucial for both lessors and lessees to establish fair lease terms and avoid unexpected costs.

The Role of Depreciated Value in Lease Calculations

Depreciated value plays a critical role in lease calculations by determining the current worth of the asset after accounting for wear and usage during the lease term. Unlike residual value, which is an estimated future worth at lease end, depreciated value reflects the actual reduction in asset value, directly impacting lease payments and accounting accurately for asset consumption. Accurate assessment of depreciated value ensures fair lease pricing and prevents discrepancies between expected and real asset worth.

Factors Influencing Residual Value in Leases

Residual value in leases is influenced by factors such as the vehicle's anticipated market demand, mileage limits set in the lease agreement, and expected condition at lease end. Economic trends, technological advancements impacting vehicle obsolescence, and manufacturer incentives also play crucial roles in determining residual value. Accurate assessment of these elements ensures fair lease payments and minimizes depreciation impact.

Why Depreciated Value Matters for Lessees

Depreciated value represents the actual worth of a leased asset after accounting for wear and tear, directly affecting the lessee's financial responsibility at lease end. Understanding depreciated value is crucial as it determines potential charges or buyout options, preventing unexpected costs. This value reflects real market conditions, offering lessees a transparent benchmark for evaluating lease fairness and negotiating terms.

Residual Value Predictions and Lease-End Decisions

Residual value predictions play a critical role in lease-end decisions by estimating the future worth of an asset, guiding lessees and lessors in determining buyout options or return conditions. Accurate forecasting of residual value depends on factors like asset type, market trends, and usage patterns, influencing financial outcomes and risk management. Comparing residual value with the depreciated value helps assess asset depreciation and informs strategic decisions on lease renewals, returns, or purchase.

Impact of Mileage and Wear on Depreciated Value

Residual value represents the estimated worth of a leased asset at lease-end, while depreciated value reflects actual reduction due to usage and time. Mileage and wear significantly lower the depreciated value as increased miles and physical damage accelerate vehicle aging, thereby reducing its market price. This decline directly influences lease-end charges, making mileage limits and careful maintenance critical for managing costs.

Maximizing Savings: Choosing Leases Based on Value Calculations

Maximizing savings on vehicle leases hinges on understanding residual value versus depreciated value, where residual value represents the estimated worth at lease end and depreciated value reflects actual loss in value over time. Choosing leases with higher residual values typically results in lower monthly payments and reduced overall costs, as less depreciation is factored into the lease price. Evaluating these values carefully allows lessees to select contracts that optimize cost efficiency and financial benefits throughout the lease term.

Residual Value vs Depreciated Value Infographic

cardiffo.com

cardiffo.com