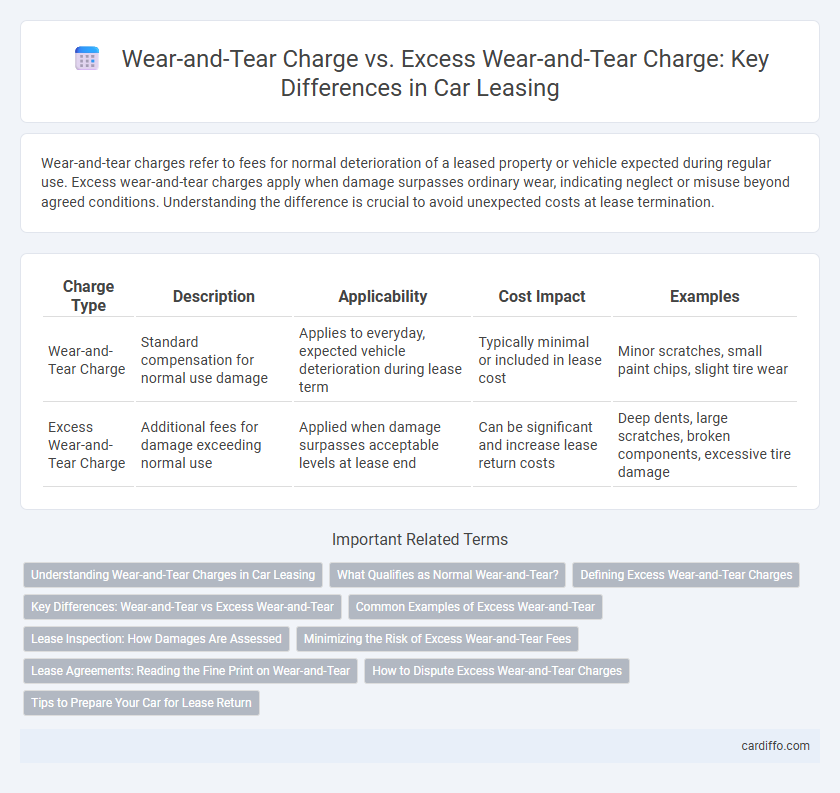

Wear-and-tear charges refer to fees for normal deterioration of a leased property or vehicle expected during regular use. Excess wear-and-tear charges apply when damage surpasses ordinary wear, indicating neglect or misuse beyond agreed conditions. Understanding the difference is crucial to avoid unexpected costs at lease termination.

Table of Comparison

| Charge Type | Description | Applicability | Cost Impact | Examples |

|---|---|---|---|---|

| Wear-and-Tear Charge | Standard compensation for normal use damage | Applies to everyday, expected vehicle deterioration during lease term | Typically minimal or included in lease cost | Minor scratches, small paint chips, slight tire wear |

| Excess Wear-and-Tear Charge | Additional fees for damage exceeding normal use | Applied when damage surpasses acceptable levels at lease end | Can be significant and increase lease return costs | Deep dents, large scratches, broken components, excessive tire damage |

Understanding Wear-and-Tear Charges in Car Leasing

Wear-and-tear charges in car leasing cover the cost of normal vehicle depreciation and minor damages incurred during the lease term. Excess wear-and-tear charges apply when damage exceeds what is considered reasonable, such as deep scratches, dents, or interior stains beyond typical use. Understanding these distinctions helps lessees avoid unexpected fees by properly maintaining the vehicle and addressing damages before lease-end inspections.

What Qualifies as Normal Wear-and-Tear?

Normal wear-and-tear in a lease context refers to minor, expected deterioration such as small scratches, light stains, or slight carpet wear that occurs through everyday use of the vehicle or property. These conditions do not affect functionality or safety and are typically excluded from charges at lease-end. Excess wear-and-tear charges apply when damage exceeds this normal range, including deep scratches, large stains, or mechanical issues caused by neglect or abuse.

Defining Excess Wear-and-Tear Charges

Excess wear-and-tear charges refer to fees applied when a leased asset, such as a vehicle, exhibits damage or deterioration beyond what is considered normal use under the lease agreement. These charges cover repairs for issues like deep scratches, dents, or mechanical problems not attributable to regular depreciation. Lease contracts typically specify allowable wear limits, making excess wear-and-tear charges a financial responsibility for lessees exceeding those predefined thresholds.

Key Differences: Wear-and-Tear vs Excess Wear-and-Tear

Wear-and-tear charges cover normal, expected depreciation and minor damages during a lease term, such as small scratches or light carpet wear, reflecting standard vehicle aging. Excess wear-and-tear charges apply when damage exceeds typical use, including deep dents, broken parts, or severe stains, indicating neglect or misuse beyond ordinary conditions. Understanding these key differences helps lessees anticipate potential costs and maintain compliance with lease agreements.

Common Examples of Excess Wear-and-Tear

Excess wear-and-tear charges typically arise from damages beyond normal use, such as deep carpet stains, large dents or scratches on the vehicle's exterior, and broken interior components like torn upholstery or malfunctioning electronics. Common examples include cracked windshields, missing floor mats, and excessive tire wear that exceeds manufacturer specifications. These charges differ from standard wear-and-tear fees, which cover minor blemishes and expected deterioration over the lease term.

Lease Inspection: How Damages Are Assessed

Lease inspections differentiate between standard wear-and-tear charges and excess wear-and-tear charges based on the vehicle's condition relative to normal usage guidelines set by manufacturers and leasing companies. Standard wear-and-tear charges cover minor, expected deterioration such as small scratches or tire wear, whereas excess wear-and-tear charges apply to severe damage including dents, broken parts, or interior stains beyond acceptable limits. Certified inspectors document damages using detailed reports and photographic evidence to ensure accurate assessment and fair billing under the lease agreement.

Minimizing the Risk of Excess Wear-and-Tear Fees

Minimizing the risk of excess wear-and-tear fees involves regular vehicle maintenance and thorough cleaning before lease return. Documenting the condition with dated photos helps verify normal wear-and-tear versus excessive damage. Understanding the lease agreement's specific wear-and-tear criteria enables lessees to avoid unexpected charges and negotiate disputes effectively.

Lease Agreements: Reading the Fine Print on Wear-and-Tear

Lease agreements often include clauses specifying both Wear-and-Tear Charges and Excess Wear-and-Tear Charges to address normal versus abnormal property deterioration. Standard Wear-and-Tear Charges cover expected usage damage, while Excess Wear-and-Tear Charges apply to damages exceeding typical use, such as holes in walls or deep carpet stains. Carefully reviewing the lease's fine print on these charges helps tenants avoid unexpected fees and ensures compliance with maintenance obligations.

How to Dispute Excess Wear-and-Tear Charges

Disputing excess wear-and-tear charges on a lease requires documenting the vehicle's condition with dated photos and obtaining a professional inspection report. Review the lease agreement and wear-and-tear guidelines to identify discrepancies in the charges or standards applied. Present evidence in writing to the leasing company, highlighting inconsistencies and requesting a reassessment or third-party mediation if necessary.

Tips to Prepare Your Car for Lease Return

Inspect your vehicle thoroughly to document existing wear and tear, focusing on scratches, dents, and tire condition to avoid excess wear-and-tear charges. Address minor repairs such as paint touch-ups, tire rotations, and interior cleaning to restore the car's appearance and functionality within lease guidelines. Reviewing your lease agreement for specific wear allowances ensures you meet return standards and minimize potential charges.

Wear-and-Tear Charge vs Excess Wear-and-Tear Charge Infographic

cardiffo.com

cardiffo.com