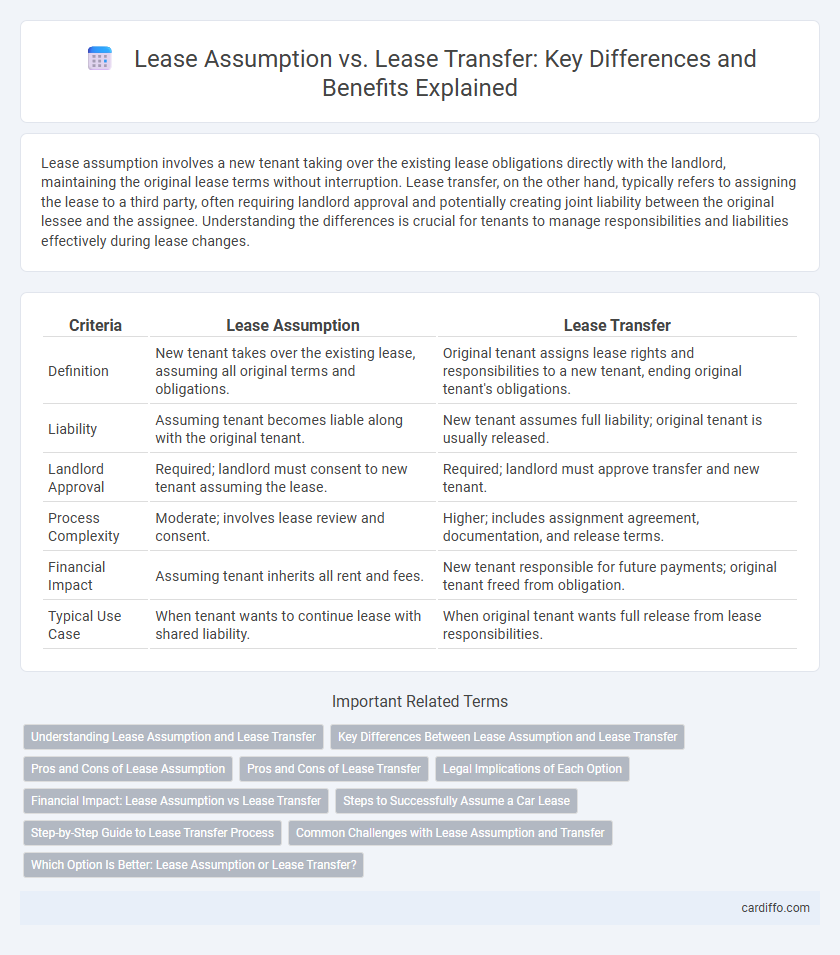

Lease assumption involves a new tenant taking over the existing lease obligations directly with the landlord, maintaining the original lease terms without interruption. Lease transfer, on the other hand, typically refers to assigning the lease to a third party, often requiring landlord approval and potentially creating joint liability between the original lessee and the assignee. Understanding the differences is crucial for tenants to manage responsibilities and liabilities effectively during lease changes.

Table of Comparison

| Criteria | Lease Assumption | Lease Transfer |

|---|---|---|

| Definition | New tenant takes over the existing lease, assuming all original terms and obligations. | Original tenant assigns lease rights and responsibilities to a new tenant, ending original tenant's obligations. |

| Liability | Assuming tenant becomes liable along with the original tenant. | New tenant assumes full liability; original tenant is usually released. |

| Landlord Approval | Required; landlord must consent to new tenant assuming the lease. | Required; landlord must approve transfer and new tenant. |

| Process Complexity | Moderate; involves lease review and consent. | Higher; includes assignment agreement, documentation, and release terms. |

| Financial Impact | Assuming tenant inherits all rent and fees. | New tenant responsible for future payments; original tenant freed from obligation. |

| Typical Use Case | When tenant wants to continue lease with shared liability. | When original tenant wants full release from lease responsibilities. |

Understanding Lease Assumption and Lease Transfer

Lease assumption involves a new tenant taking over the existing lease terms directly from the original tenant, maintaining the same contractual obligations with the landlord. Lease transfer, also known as lease assignment, allows the tenant to transfer their lease rights and responsibilities entirely to a third party, who then becomes the primary lessee. Understanding the differences between lease assumption and lease transfer is crucial for both landlords and tenants to manage liabilities, approval requirements, and legal responsibilities effectively.

Key Differences Between Lease Assumption and Lease Transfer

Lease assumption involves the new tenant taking over all lease obligations and rights directly from the original tenant, often requiring landlord approval and continuing the original lease terms. Lease transfer, or lease assignment, allows the original tenant to transfer their lease interest entirely to a third party, who then becomes solely responsible for the lease, typically relinquishing the original tenant's obligations. Key differences include the extent of tenant liability, with lease assumption maintaining joint responsibility, whereas lease transfer releases the original tenant from future liabilities.

Pros and Cons of Lease Assumption

Lease assumption allows the new tenant to take over the original lease terms, often avoiding the need for a new credit check or deposit, which can streamline the process. However, the original tenant may remain liable if the new tenant defaults, creating potential financial risk. This method is beneficial for tenants seeking flexibility but requires careful consideration of legal responsibilities and landlord approval.

Pros and Cons of Lease Transfer

Lease transfer allows tenants to relieve financial obligations by assigning their lease to another party, offering flexibility in case of relocation or financial hardship. However, lease transfers may involve approval from the landlord, potential fees, and the risk of tenant liability if the new tenant defaults. This option provides a practical exit strategy but requires careful consideration of contractual terms and landlord policies.

Legal Implications of Each Option

Lease assumption involves the legal transfer of all lease obligations and rights from the original tenant to the new tenant, with the landlord's consent often required, making the original tenant typically liable until release is granted. Lease transfer, or lease assignment, legally shifts the tenant's interests but may still hold the original tenant secondarily liable unless the landlord explicitly releases them from the lease. Understanding the differences in legal responsibilities, including potential liabilities and landlord approval requirements, is crucial for both tenants and landlords to mitigate risks.

Financial Impact: Lease Assumption vs Lease Transfer

Lease assumption typically involves the incoming tenant taking over the existing lease under the original terms, which may limit negotiation opportunities and maintain the initial financial obligations, impacting cash flow predictability. Lease transfer often requires landlord approval and may include fees, but allows the original tenant to exit financial liabilities sooner, potentially reducing ongoing financial risk. Understanding the comparative impact on rent responsibility, security deposits, and potential penalties is crucial for accurate financial forecasting in lease management.

Steps to Successfully Assume a Car Lease

To successfully assume a car lease, start by obtaining the current lease agreement and verifying the lease terms with the leasing company. Submit a credit application for approval, as the lessor requires screening of the new lessee. After approval, complete and sign the lease assumption documentation, pay any transfer fees, and ensure all parties receive copies of the updated lease contract.

Step-by-Step Guide to Lease Transfer Process

The lease transfer process involves carefully reviewing the lease agreement, obtaining landlord approval, and signing a formal lease transfer agreement to legally assign the lease obligations to the new tenant. Key steps include notifying the landlord in writing, completing necessary documentation, and ensuring the incoming tenant meets credit and background requirements. Proper execution of each step guarantees a smooth transition of lease responsibility, avoiding potential legal or financial penalties.

Common Challenges with Lease Assumption and Transfer

Lease assumption and lease transfer often present challenges such as stringent landlord approval requirements and potential creditworthiness evaluations, which can delay or block the process. Both scenarios may involve complex documentation and legal obligations, including liability for lease terms and obligations post-transfer or assumption. Disputes over security deposits and unclear responsibilities for property damages further complicate these transactions, increasing the risk for both parties.

Which Option Is Better: Lease Assumption or Lease Transfer?

Lease assumption allows the new tenant to take over the existing lease with the original terms intact, often requiring landlord approval and credit checks, making it a straightforward option for tenants wanting to maintain the current lease conditions. Lease transfer, or lease assignment, involves transferring all lease obligations to a new party, which may include renegotiation of terms and release of the original tenant from liabilities, providing more flexibility but potentially more complexity and landlord scrutiny. Choosing between lease assumption and lease transfer depends on the tenant's need for liability release and the landlord's willingness to approve the new occupant, with lease transfer generally offering better protection for the original tenant.

Lease assumption vs lease transfer Infographic

cardiffo.com

cardiffo.com