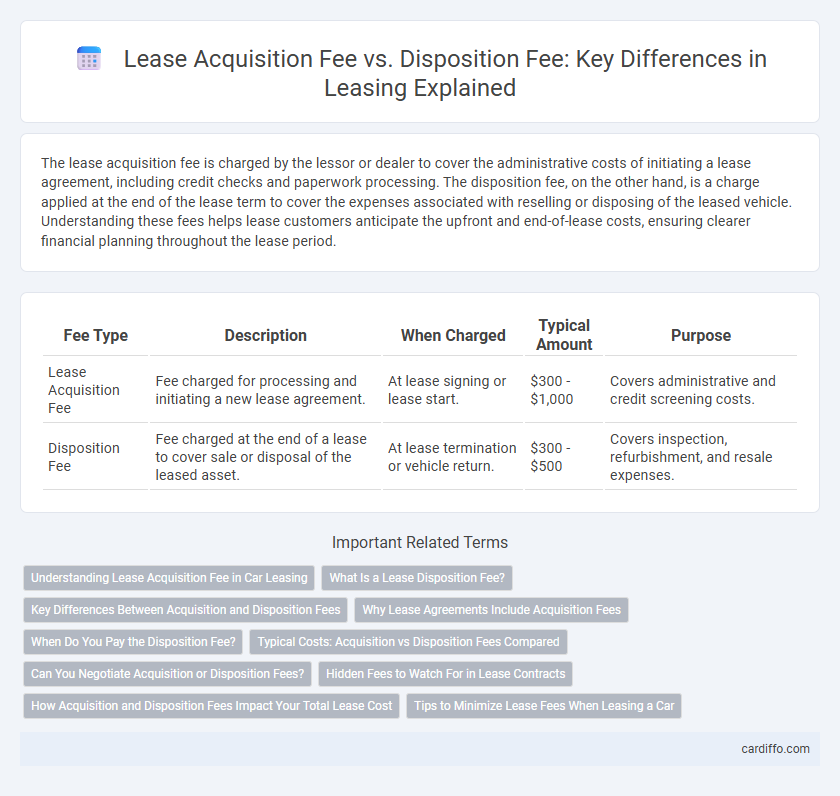

The lease acquisition fee is charged by the lessor or dealer to cover the administrative costs of initiating a lease agreement, including credit checks and paperwork processing. The disposition fee, on the other hand, is a charge applied at the end of the lease term to cover the expenses associated with reselling or disposing of the leased vehicle. Understanding these fees helps lease customers anticipate the upfront and end-of-lease costs, ensuring clearer financial planning throughout the lease period.

Table of Comparison

| Fee Type | Description | When Charged | Typical Amount | Purpose |

|---|---|---|---|---|

| Lease Acquisition Fee | Fee charged for processing and initiating a new lease agreement. | At lease signing or lease start. | $300 - $1,000 | Covers administrative and credit screening costs. |

| Disposition Fee | Fee charged at the end of a lease to cover sale or disposal of the leased asset. | At lease termination or vehicle return. | $300 - $500 | Covers inspection, refurbishment, and resale expenses. |

Understanding Lease Acquisition Fee in Car Leasing

Lease acquisition fees cover the administrative costs involved in processing and initiating a car lease agreement, typically ranging from $400 to $900 depending on the leasing company. These fees include credit checks, documentation, and vehicle preparation, ensuring a smooth and compliant lease start. Understanding the lease acquisition fee is essential for lessees to accurately calculate the total upfront costs and compare lease offers effectively.

What Is a Lease Disposition Fee?

A lease disposition fee is a charge paid by the lessee at the end of a lease term to cover the costs associated with selling or disposing of the leased vehicle. This fee compensates the lessor for expenses such as vehicle inspection, reconditioning, and administrative tasks necessary to prepare the vehicle for resale. Lease disposition fees are distinct from lease acquisition fees, which are upfront costs incurred when initiating the lease agreement.

Key Differences Between Acquisition and Disposition Fees

Lease acquisition fees are upfront charges paid by lessees or dealers to initiate and process a new lease agreement, covering administrative tasks, credit checks, and documentation. Disposition fees are charged at the end of a lease term to cover the costs of inspecting, refurbishing, and reselling the leased asset. Key differences include timing, purpose, and beneficiary: acquisition fees are paid at lease inception and benefit the leasing company or dealer, while disposition fees apply at lease termination and offset end-of-lease expenses.

Why Lease Agreements Include Acquisition Fees

Lease agreements include acquisition fees to cover the dealer's costs associated with originating the lease, such as credit checks, paperwork processing, and administrative expenses. This fee ensures that the lessor recovers expenses incurred upfront before the lease term begins. Unlike acquisition fees, disposition fees are charged at the end of the lease to cover the costs of vehicle resale or return processing.

When Do You Pay the Disposition Fee?

The disposition fee is typically paid at the end of a lease term when the lessee returns the vehicle or property to the lessor. This fee covers the cost of preparing the asset for resale or lease to a new customer. It is not charged during the lease acquisition but exclusively upon lease termination or asset return.

Typical Costs: Acquisition vs Disposition Fees Compared

Typical lease acquisition fees range from $300 to $900, covering administrative tasks such as credit checks, vehicle preparation, and documentation processing. Disposition fees, generally between $300 and $500, are charged at lease end to cover the cost of inspecting, cleaning, and reselling the vehicle. Acquisition fees tend to be higher due to the upfront processing involved, while disposition fees primarily address residual handling and vehicle resale expenses.

Can You Negotiate Acquisition or Disposition Fees?

Lease acquisition fees and disposition fees are often negotiable depending on the dealer or leasing company's policies and your creditworthiness. Customers can request lower acquisition fees, which cover the administrative costs of initiating a lease, or negotiate disposition fees charged at the end of the lease for vehicle turnover. Understanding the typical ranges and justifications for these fees enhances the chances of successful negotiations and saving money on a lease agreement.

Hidden Fees to Watch For in Lease Contracts

Lease acquisition fees, often ranging from $300 to $1,000, are upfront charges lenders impose for processing new lease agreements, while disposition fees, typically $300 to $500, cover costs related to terminating or returning a leased vehicle. Hidden fees to watch for include undocumented add-ons like security deposits, early termination penalties, and excessive wear-and-tear charges that can significantly increase the total cost. Carefully reviewing lease contracts for these obscure fees ensures better financial planning and avoids unexpected expenses at lease-end.

How Acquisition and Disposition Fees Impact Your Total Lease Cost

Lease acquisition fees directly increase your initial lease cost by covering the expenses related to processing and initiating the lease agreement. Disposition fees add to the end-of-lease expenses, impacting your total cost if you don't purchase or lease a new vehicle through the same dealer. Understanding both fees helps you accurately calculate the full financial commitment of leasing, avoiding unexpected charges that raise the overall lease cost.

Tips to Minimize Lease Fees When Leasing a Car

Lease acquisition fees typically cover the administrative costs of initiating a lease, while disposition fees are charged at the end for vehicle return processing. To minimize lease fees, negotiate the acquisition fee upfront or seek lease deals with waived or reduced charges. Opt for leases that include disposition fee waivers if you plan to purchase or lease another vehicle from the same dealer.

Lease Acquisition Fee vs Disposition Fee Infographic

cardiffo.com

cardiffo.com