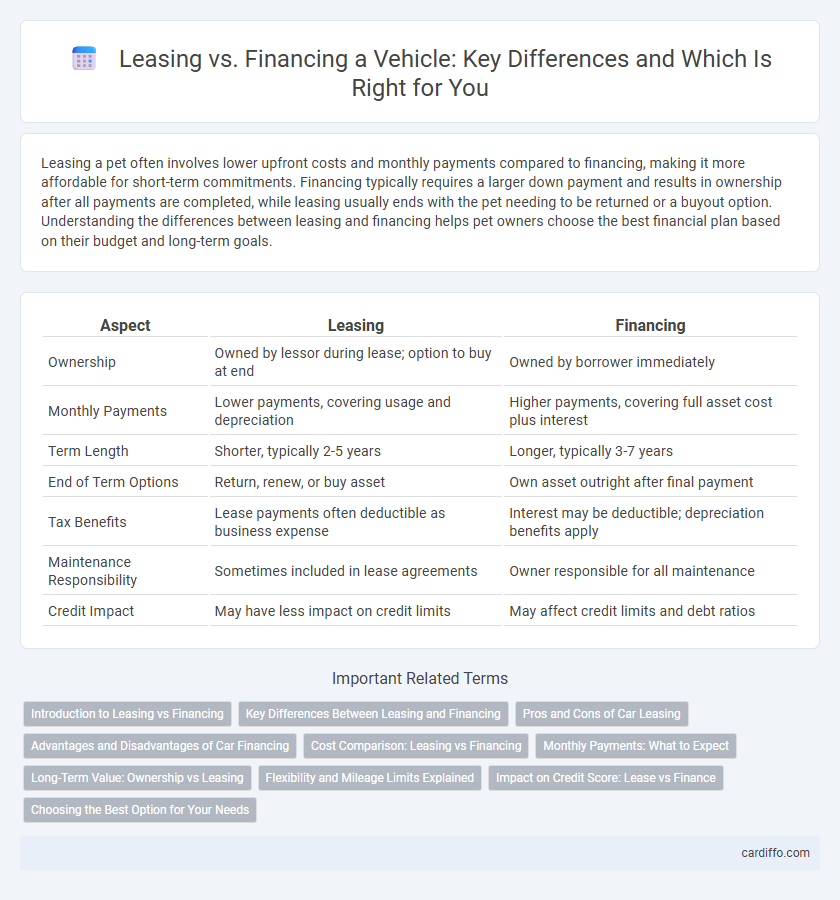

Leasing a pet often involves lower upfront costs and monthly payments compared to financing, making it more affordable for short-term commitments. Financing typically requires a larger down payment and results in ownership after all payments are completed, while leasing usually ends with the pet needing to be returned or a buyout option. Understanding the differences between leasing and financing helps pet owners choose the best financial plan based on their budget and long-term goals.

Table of Comparison

| Aspect | Leasing | Financing |

|---|---|---|

| Ownership | Owned by lessor during lease; option to buy at end | Owned by borrower immediately |

| Monthly Payments | Lower payments, covering usage and depreciation | Higher payments, covering full asset cost plus interest |

| Term Length | Shorter, typically 2-5 years | Longer, typically 3-7 years |

| End of Term Options | Return, renew, or buy asset | Own asset outright after final payment |

| Tax Benefits | Lease payments often deductible as business expense | Interest may be deductible; depreciation benefits apply |

| Maintenance Responsibility | Sometimes included in lease agreements | Owner responsible for all maintenance |

| Credit Impact | May have less impact on credit limits | May affect credit limits and debt ratios |

Introduction to Leasing vs Financing

Leasing involves renting an asset for a fixed period with lower upfront costs, while financing allows ownership through loan payments over time. Leasing provides flexibility and tax advantages for businesses needing equipment without long-term commitment. Financing builds equity and asset ownership but requires higher initial investment and credit qualifications.

Key Differences Between Leasing and Financing

Leasing involves renting an asset for a fixed period with lower monthly payments and no ownership at the end, while financing requires borrowing funds to purchase the asset, leading to full ownership after loan repayment. Lease agreements typically include mileage limits and maintenance responsibilities, whereas financing allows for unrestricted use and complete control over the asset. Tax implications also differ, as lease payments may be deductible as business expenses, while financing involves interest deductions and asset depreciation.

Pros and Cons of Car Leasing

Car leasing offers lower monthly payments and the ability to drive newer models with fewer maintenance concerns, making it attractive for budget-conscious drivers seeking flexibility. However, leasing limits mileage, imposes fees for excessive wear and tear, and provides no vehicle ownership equity, which can be disadvantageous for long-term users. Financing a car builds ownership and allows unlimited use, but requires higher monthly payments and depreciates value over time.

Advantages and Disadvantages of Car Financing

Car financing allows ownership after loan completion, offering long-term equity and unlimited mileage, but often requires higher monthly payments and interest costs. Financing provides flexibility in vehicle modifications and eventual resale value benefits, while depreciation risks remain with the owner. However, potential credit impact and upfront down payments can be significant drawbacks compared to leasing.

Cost Comparison: Leasing vs Financing

Leasing often offers lower monthly payments compared to financing, making it a cost-effective option for businesses aiming to preserve cash flow. Financing typically involves higher upfront costs and interest payments, increasing the total expense over the loan term. Evaluating the total cost of ownership, including maintenance and depreciation, is essential to determine the financial advantage between leasing and financing.

Monthly Payments: What to Expect

Lease monthly payments typically remain lower than financing payments due to paying only for the vehicle's depreciation during the lease term rather than the full purchase price. Financing monthly payments cover the entire loan amount plus interest, resulting in higher costs but eventual ownership. Expect lower upfront costs and predictable monthly expenses with leasing, while financing involves higher payments but builds equity over time.

Long-Term Value: Ownership vs Leasing

Leasing offers lower initial costs and flexibility with regular upgrades, but financing builds long-term equity through ownership, providing asset value retention and potential tax benefits. While leasing shifts maintenance responsibilities to the lessor, financing requires the lessee to manage upkeep, impacting total cost of ownership over time. Businesses aiming for long-term asset accumulation often prefer financing, whereas those prioritizing operational agility might select leasing.

Flexibility and Mileage Limits Explained

Leasing offers greater flexibility by allowing lessees to drive newer vehicles with lower monthly payments and the option to upgrade every few years. Mileage limits in leases are typically set between 10,000 to 15,000 miles per year, with fees applied for excess miles, which can impact overall cost-effectiveness. Financing provides unlimited mileage and full ownership but often requires higher upfront costs and monthly payments, making it less adaptable to changing driving needs.

Impact on Credit Score: Lease vs Finance

Leasing typically has less impact on credit scores compared to financing, as lease payments are reported as regular expenses rather than long-term debt. Financing a vehicle appears as a loan on credit reports, which can lower credit scores due to increased debt-to-income ratios and payment obligations. Consistent, on-time payments for both leasing and financing positively influence credit scores, but financing affects credit utilization more significantly.

Choosing the Best Option for Your Needs

Leasing offers lower monthly payments and flexibility with vehicle upgrades, making it ideal for those who prefer driving new models without ownership commitment. Financing builds equity and offers long-term cost benefits, suitable for individuals planning to keep the asset and maximize investment value. Evaluate your financial goals, usage patterns, and budget to determine if leasing's convenience or financing's ownership benefits better align with your needs.

Leasing vs Financing Infographic

cardiffo.com

cardiffo.com