High mileage leases cater to drivers who exceed standard mileage limits, offering higher mileage allowances but typically with increased monthly payments and potential end-of-lease fees. Low mileage leases appeal to those who drive less, featuring lower monthly costs and reduced wear-and-tear charges, making them ideal for infrequent drivers. Choosing between high and low mileage leases depends on driving habits, budget constraints, and lease-end financial considerations.

Table of Comparison

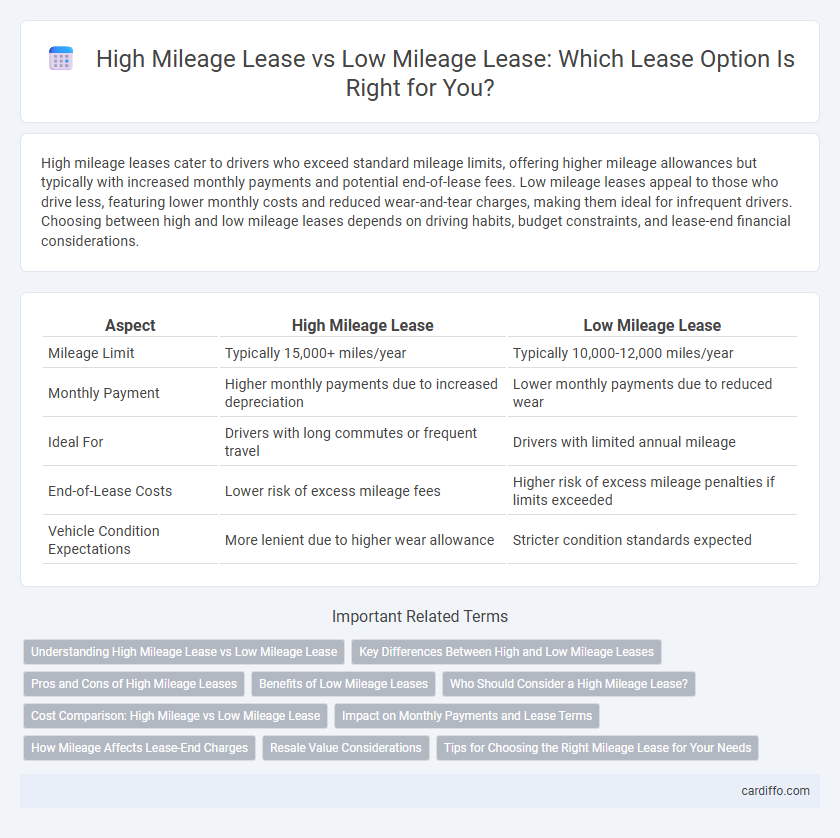

| Aspect | High Mileage Lease | Low Mileage Lease |

|---|---|---|

| Mileage Limit | Typically 15,000+ miles/year | Typically 10,000-12,000 miles/year |

| Monthly Payment | Higher monthly payments due to increased depreciation | Lower monthly payments due to reduced wear |

| Ideal For | Drivers with long commutes or frequent travel | Drivers with limited annual mileage |

| End-of-Lease Costs | Lower risk of excess mileage fees | Higher risk of excess mileage penalties if limits exceeded |

| Vehicle Condition Expectations | More lenient due to higher wear allowance | Stricter condition standards expected |

Understanding High Mileage Lease vs Low Mileage Lease

High mileage leases typically allow annual mileage limits of 15,000 to 20,000 miles, making them ideal for drivers with long commutes or frequent travel, while low mileage leases usually cap annual miles at 10,000 to 12,000, targeting infrequent drivers. Choosing a lease with the correct mileage allowance helps avoid costly penalties for exceeding limits, which are often charged per extra mile driven. Understanding the differences in mileage thresholds, surplus mile fees, and lease-end residual values is critical for selecting a lease that aligns with your driving habits and budget.

Key Differences Between High and Low Mileage Leases

High mileage leases typically allow annual mileages of 15,000 to 20,000 miles, offering more flexibility but often with higher monthly payments and potential excess mileage fees. Low mileage leases commonly restrict usage to 10,000 to 12,000 miles per year, resulting in lower monthly costs but stringent penalties if limits are exceeded. The key differences include mileage allowance, monthly lease rates, and financial consequences for surpassing the agreed mileage caps.

Pros and Cons of High Mileage Leases

High mileage leases offer the advantage of higher annual mileage limits, making them ideal for drivers with long commutes or frequent travel, thereby avoiding excessive mileage penalties. However, they usually come with higher monthly payments compared to low mileage leases, increasing overall leasing costs. Additionally, high mileage leases may lead to accelerated vehicle depreciation, affecting lease-end residual values and potential charges.

Benefits of Low Mileage Leases

Low mileage leases offer significant savings by reducing excess mileage fees, which can be costly when exceeding the vehicle's predetermined mileage limit. They help maintain the car's resale value, as fewer miles typically correlate with less wear and tear, preserving the vehicle's condition. Choosing a low mileage lease is ideal for drivers with predictable, limited driving needs, ensuring financial advantages and better end-of-lease terms.

Who Should Consider a High Mileage Lease?

Drivers exceeding 15,000 miles annually should consider a high mileage lease to avoid costly excess mileage penalties. High mileage leases cater to commuters, business professionals, and long-distance travelers requiring greater flexibility. These leases often include adjusted monthly payments that reflect the expected vehicle depreciation due to increased usage.

Cost Comparison: High Mileage vs Low Mileage Lease

High mileage leases typically incur higher monthly payments and increased fees due to greater vehicle depreciation and wear, reflecting the increased risk for lessors. Low mileage leases benefit from lower overall costs, including reduced excess mileage charges and better residual values, making them more cost-effective for those with predictable, limited driving needs. Choosing the right lease depends on balancing expected usage with the cost implications embedded in residual value calculations and excess mileage penalties.

Impact on Monthly Payments and Lease Terms

High mileage leases typically result in higher monthly payments due to increased depreciation rates caused by greater vehicle wear. Low mileage leases offer lower monthly payments by limiting the allowed miles, reducing depreciation and maintenance costs over the lease term. Lease terms for high mileage agreements may be shorter or include stricter maintenance requirements to mitigate accelerated vehicle value loss.

How Mileage Affects Lease-End Charges

High mileage leases typically incur higher end-of-lease charges due to excessive wear and tear and excess mileage penalties, which can significantly increase total lease costs. Low mileage leases reduce the risk of additional fees by staying within the agreed-upon mileage limits, preserving the vehicle's residual value and minimizing depreciation. Understanding the mileage allowance is crucial for calculating potential lease-end charges and avoiding unexpected expenses.

Resale Value Considerations

High mileage leases typically result in greater wear and tear, which can significantly reduce the vehicle's resale value due to higher depreciation rates. Low mileage leases help maintain a car's condition, preserving its market value and attracting more potential buyers at lease-end. Choosing a low mileage lease often leads to better resale outcomes and lower end-of-lease penalties.

Tips for Choosing the Right Mileage Lease for Your Needs

Selecting the right mileage lease involves assessing your average annual driving distance and choosing between high mileage and low mileage options accordingly. High mileage leases typically offer allowances of 15,000 miles or more per year, suitable for drivers with extensive daily commuting or frequent travel, while low mileage leases usually cap at 10,000 to 12,000 miles, fitting those with shorter, less frequent trips. Consider potential excess mileage fees, residual value impacts, and your driving habits to avoid costly penalties and ensure the lease aligns with your lifestyle and budget.

High Mileage Lease vs Low Mileage Lease Infographic

cardiffo.com

cardiffo.com