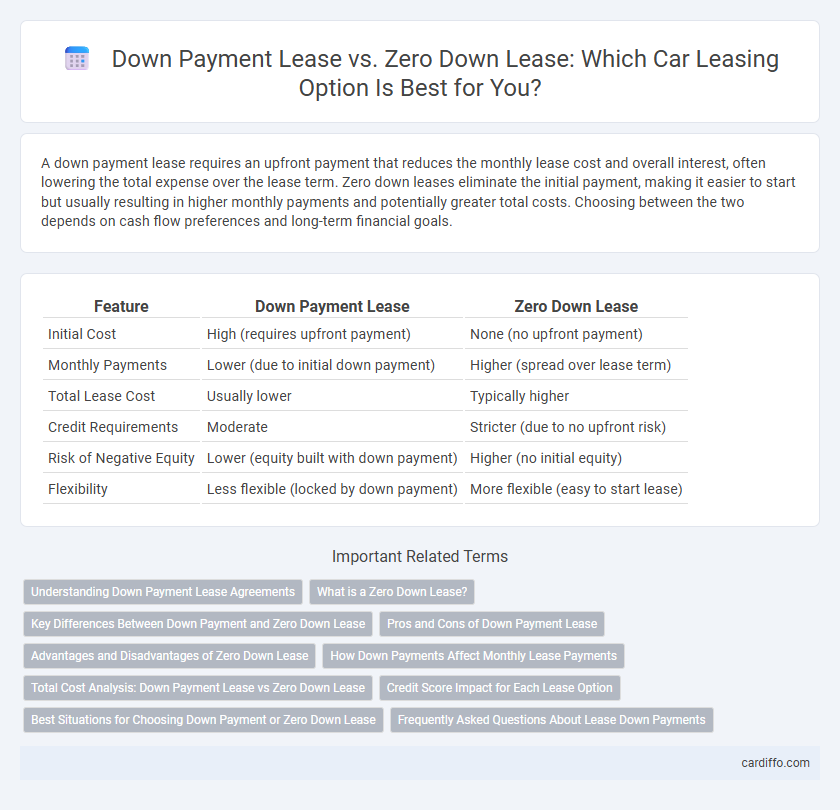

A down payment lease requires an upfront payment that reduces the monthly lease cost and overall interest, often lowering the total expense over the lease term. Zero down leases eliminate the initial payment, making it easier to start but usually resulting in higher monthly payments and potentially greater total costs. Choosing between the two depends on cash flow preferences and long-term financial goals.

Table of Comparison

| Feature | Down Payment Lease | Zero Down Lease |

|---|---|---|

| Initial Cost | High (requires upfront payment) | None (no upfront payment) |

| Monthly Payments | Lower (due to initial down payment) | Higher (spread over lease term) |

| Total Lease Cost | Usually lower | Typically higher |

| Credit Requirements | Moderate | Stricter (due to no upfront risk) |

| Risk of Negative Equity | Lower (equity built with down payment) | Higher (no initial equity) |

| Flexibility | Less flexible (locked by down payment) | More flexible (easy to start lease) |

Understanding Down Payment Lease Agreements

A down payment lease requires an upfront payment that reduces the monthly lease installments and overall financing cost by lowering the vehicle's capitalized cost. This initial payment typically covers the first month's rent, taxes, and fees, providing a financial buffer that lowers risk for both lessee and lessor. Understanding the terms of a down payment lease agreement ensures clarity on how this payment impacts monthly expenses, residual value, and potential penalties at lease end.

What is a Zero Down Lease?

A zero down lease requires no initial cash payment, allowing lessees to start their lease without a large upfront cost, unlike a down payment lease which demands a significant initial fee. This type of lease typically results in higher monthly payments since the vehicle's total cost is amortized over the lease term without any initial reduction. Zero down leases are attractive for budget-conscious consumers seeking lower upfront expenses while leasing cars, trucks, or SUVs.

Key Differences Between Down Payment and Zero Down Lease

A Down Payment Lease requires an upfront payment that reduces monthly installments and overall lease cost, whereas a Zero Down Lease eliminates the initial payment but typically results in higher monthly fees. The key difference lies in upfront financial commitment versus increased long-term monthly expenses. Credit requirements and total lease cost vary significantly between these two options, influencing affordability and budget planning.

Pros and Cons of Down Payment Lease

A down payment lease typically requires an upfront sum, reducing monthly payments and total interest, which benefits lessees seeking lower ongoing costs and better credit approval chances. However, this initial expense can be a financial burden and increases the risk of losing money if the vehicle is totaled or stolen early in the lease term. Opting for a down payment lease often results in a lower overall lease cost compared to zero down leases, making it a more economical choice for those with available cash.

Advantages and Disadvantages of Zero Down Lease

Zero down leases require no upfront payment beyond the first month's rent, providing immediate cash flow relief and easier access to new vehicles, particularly for those with limited savings. However, zero down leases often come with higher monthly payments and potentially increased overall costs due to waived initial fees being spread across the lease term. This option may also lead to higher financial risk if the vehicle is totaled early or if the lessee faces early termination penalties without initial equity.

How Down Payments Affect Monthly Lease Payments

Down payments in lease agreements significantly influence monthly lease payments by reducing the capitalized cost of the vehicle, resulting in lower monthly installments. In a down payment lease, the upfront payment decreases the amount financed, thereby lowering the depreciation and interest portions included in each monthly payment. Conversely, zero down leases eliminate initial costs but increase monthly payments as the full vehicle value is amortized over the lease term.

Total Cost Analysis: Down Payment Lease vs Zero Down Lease

A down payment lease requires an upfront cash payment that reduces monthly installments, resulting in lower overall interest and total lease cost compared to a zero down lease. Zero down leases increase monthly payments to cover the absence of an initial payment, often leading to higher total lease expenses over the term. Analyzing total cost reveals that paying a down payment frequently results in savings by minimizing finance charges and reducing the cumulative lease payments.

Credit Score Impact for Each Lease Option

Down payment leases typically require an upfront payment that can lower monthly payments and reduce the total financed amount, making them more accessible to individuals with lower or average credit scores by mitigating lender risk. Zero down leases, while requiring no initial payment, often result in higher monthly payments and may demand a higher credit score to qualify, as lenders assume greater risk without a down payment cushion. Borrowers with strong credit scores benefit from zero down leases by preserving cash flow, whereas those with weaker credit might secure better terms and approval chances through down payment leases.

Best Situations for Choosing Down Payment or Zero Down Lease

Down Payment Lease is best suited for individuals aiming to reduce monthly lease payments and lower overall financing costs by paying an upfront sum, ideal for those with available cash flow and a stable budget. Zero Down Lease benefits people with limited upfront funds or who prioritize preserving liquidity, as it requires no initial payment but typically results in higher monthly installments. Choosing between Down Payment and Zero Down Lease depends on financial flexibility, monthly budget, and long-term cost considerations aligned with personal financial goals.

Frequently Asked Questions About Lease Down Payments

Lease down payments typically reduce monthly lease payments and lower overall financing costs by covering initial fees and depreciation. Zero down leases eliminate upfront costs, offering greater initial savings but resulting in higher monthly payments and potentially increased total lease costs. Common questions address the impact on monthly payments, the necessity of security deposits, and how down payments affect lease termination or early buyout options.

Down Payment Lease vs Zero Down Lease Infographic

cardiffo.com

cardiffo.com