Choosing between trade-in and cash down for a lease pet agreement affects your initial financial commitment and monthly payments. A trade-in reduces your out-of-pocket expenses by applying the pet's current value toward the lease, while a cash down payment lowers monthly installments but requires immediate cash. Evaluating your budget and the pet's market worth helps determine the most cost-effective option.

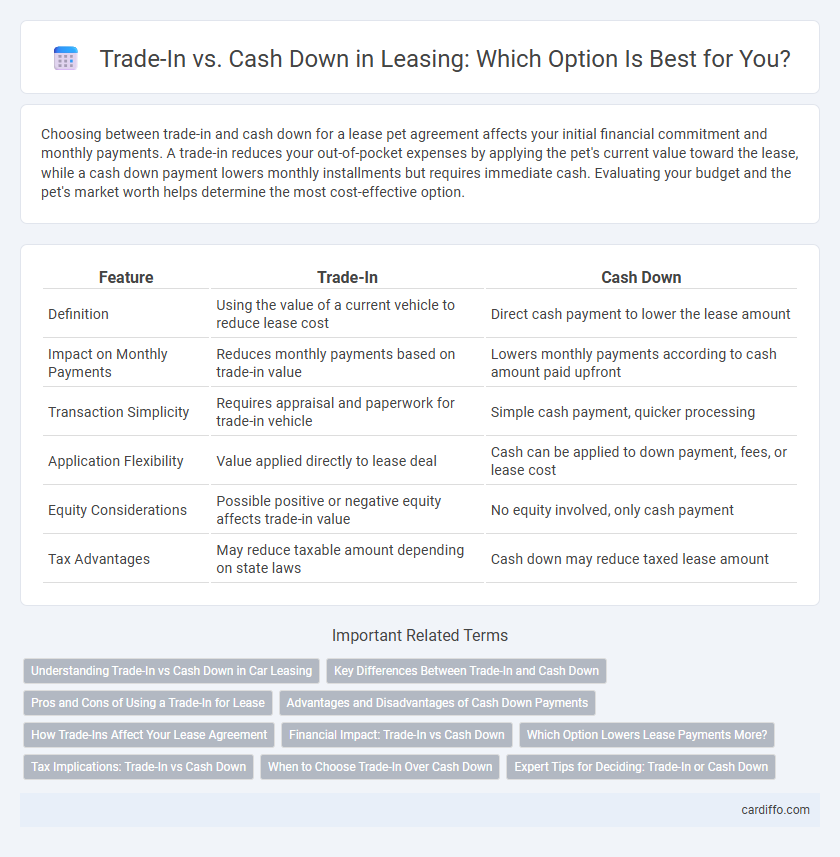

Table of Comparison

| Feature | Trade-In | Cash Down |

|---|---|---|

| Definition | Using the value of a current vehicle to reduce lease cost | Direct cash payment to lower the lease amount |

| Impact on Monthly Payments | Reduces monthly payments based on trade-in value | Lowers monthly payments according to cash amount paid upfront |

| Transaction Simplicity | Requires appraisal and paperwork for trade-in vehicle | Simple cash payment, quicker processing |

| Application Flexibility | Value applied directly to lease deal | Cash can be applied to down payment, fees, or lease cost |

| Equity Considerations | Possible positive or negative equity affects trade-in value | No equity involved, only cash payment |

| Tax Advantages | May reduce taxable amount depending on state laws | Cash down may reduce taxed lease amount |

Understanding Trade-In vs Cash Down in Car Leasing

Trade-in value applies directly to the capitalized cost of a lease, reducing the amount financed and monthly payments by offsetting the vehicle's residual value. Cash down payment lowers the lease balance upfront, which can also reduce monthly installments but does not involve vehicle equity. Evaluating trade-in versus cash down requires analyzing your current car's market value, lease terms, and monthly budget to optimize total leasing costs.

Key Differences Between Trade-In and Cash Down

Trade-in involves using the value of an existing vehicle to reduce the lease balance, directly decreasing the amount financed and monthly payments. Cash down requires an upfront payment that lowers the lease cost but does not affect the vehicle's trade-in value or equity. Trade-ins impact total lease cost and potential tax benefits differently compared to cash down payments, making the financial implications distinct for each option.

Pros and Cons of Using a Trade-In for Lease

Using a trade-in for a lease reduces upfront cash requirements and simplifies the transaction by rolling the vehicle's value into the lease deal, lowering monthly payments. However, trade-in values may be less than private sale offers, and excessive wear or damage can reduce the trade-in credit, potentially negating savings. Dealers might also factor in trade-in equity into the lease terms, which could increase overall costs compared to a straightforward cash down payment.

Advantages and Disadvantages of Cash Down Payments

Cash down payments in lease agreements reduce monthly installment amounts, lowering overall interest costs and improving cash flow management. However, large upfront cash requirements can limit liquidity and pose a financial risk if the leased asset is returned early or depreciates faster than expected. This approach may benefit lessees with available capital seeking lower monthly expenses but is less advantageous for those prioritizing flexibility and minimal initial outlay.

How Trade-Ins Affect Your Lease Agreement

Trade-ins can significantly reduce your lease payments by lowering the capitalized cost, which directly affects your monthly installments and overall lease value. The trade-in vehicle's appraised value is applied as a down payment, decreasing the amount financed in the lease agreement. This process can also shorten the lease term or improve the likelihood of leasing a higher-end vehicle within your budget.

Financial Impact: Trade-In vs Cash Down

Trading in a vehicle when leasing can reduce monthly payments by lowering the capitalized cost, resulting in decreased overall lease expenses compared to a cash down payment. A cash down payment directly reduces the lease principal, but funds used upfront may limit liquidity and investment opportunities. Evaluating the net financial impact requires comparing potential interest savings and tax benefits associated with each option to optimize total lease cost efficiency.

Which Option Lowers Lease Payments More?

Choosing a trade-in over a cash down payment typically lowers monthly lease payments more effectively by reducing the capitalized cost of the vehicle. Trade-in value directly decreases the lease amount financed, spreading the savings evenly across all payments. Cash down payments reduce monthly costs initially but risk total loss if the vehicle is totaled or stolen, making trade-ins a smarter option for lowering lease payments.

Tax Implications: Trade-In vs Cash Down

When comparing trade-in versus cash down in a lease agreement, the tax implications vary significantly by state and transaction structure. Trade-ins typically reduce the capitalized cost of the lease vehicle before tax is applied, potentially lowering the sales tax paid on the lease. Cash down payments do not reduce the taxable amount of the vehicle price, resulting in higher sales tax compared to trade-ins, depending on jurisdiction.

When to Choose Trade-In Over Cash Down

Choose a trade-in over cash down when aiming to reduce monthly lease payments without immediate cash outflow. Trade-ins provide instant equity credit toward the new lease, lowering the capitalized cost and making the lease more affordable. This option is especially beneficial if the current vehicle's trade-in value is substantial and you prefer preserving cash liquidity.

Expert Tips for Deciding: Trade-In or Cash Down

Experts recommend evaluating the residual value of your current vehicle and the total lease cost when deciding between a trade-in or cash down payment. A high-value trade-in can reduce monthly lease payments more effectively than a lump-sum cash down, improving overall cost efficiency. Consider factors like depreciation rates, credit score impact, and lease terms to maximize financial benefits in your lease agreement.

Trade-In vs Cash Down Infographic

cardiffo.com

cardiffo.com