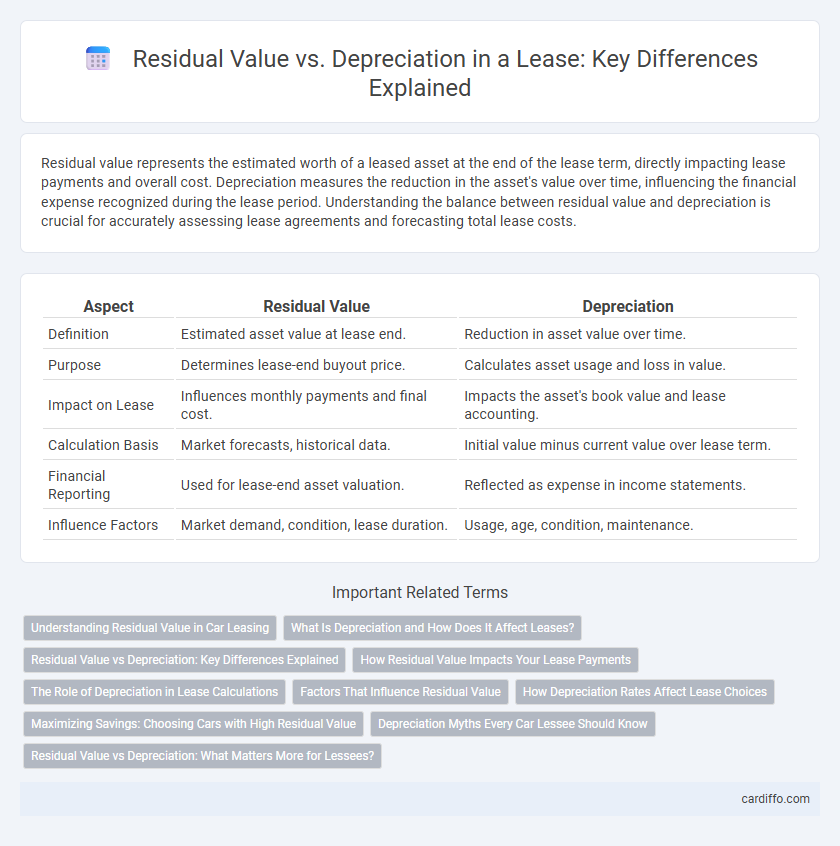

Residual value represents the estimated worth of a leased asset at the end of the lease term, directly impacting lease payments and overall cost. Depreciation measures the reduction in the asset's value over time, influencing the financial expense recognized during the lease period. Understanding the balance between residual value and depreciation is crucial for accurately assessing lease agreements and forecasting total lease costs.

Table of Comparison

| Aspect | Residual Value | Depreciation |

|---|---|---|

| Definition | Estimated asset value at lease end. | Reduction in asset value over time. |

| Purpose | Determines lease-end buyout price. | Calculates asset usage and loss in value. |

| Impact on Lease | Influences monthly payments and final cost. | Impacts the asset's book value and lease accounting. |

| Calculation Basis | Market forecasts, historical data. | Initial value minus current value over lease term. |

| Financial Reporting | Used for lease-end asset valuation. | Reflected as expense in income statements. |

| Influence Factors | Market demand, condition, lease duration. | Usage, age, condition, maintenance. |

Understanding Residual Value in Car Leasing

Residual value in car leasing represents the estimated worth of the vehicle at the end of the lease term, directly impacting monthly lease payments and overall cost. This value is determined based on factors such as the car's make, model, expected mileage, market demand, and depreciation trends. Buyers benefit from understanding residual value since a higher residual value reduces depreciation expenses included in lease payments, making leases more affordable.

What Is Depreciation and How Does It Affect Leases?

Depreciation represents the reduction in an asset's value over time due to wear and usage, directly influencing lease payments by determining the asset's residual value at lease end. The residual value is the estimated worth of the leased asset after the lease term, calculated by subtracting accumulated depreciation from the original purchase price. Accurate depreciation estimates ensure fair lease charges and help lessees and lessors assess the financial implications of the lease agreement.

Residual Value vs Depreciation: Key Differences Explained

Residual value represents the estimated worth of a leased asset at the end of the lease term, while depreciation measures the asset's loss of value over time. In leasing, residual value influences monthly payments by estimating future asset worth, whereas depreciation accounts for the cost of asset usage during the lease. Understanding the distinction between residual value and depreciation is crucial for accurate lease structuring and financial forecasting.

How Residual Value Impacts Your Lease Payments

Residual value significantly influences your lease payments by determining the vehicle's estimated worth at the end of the lease term, directly affecting monthly costs. A higher residual value lowers depreciation expense, resulting in reduced lease payments, while a lower residual value increases the amount you pay. Understanding residual value helps lease customers negotiate better terms and plan budgets accurately throughout the lease period.

The Role of Depreciation in Lease Calculations

Depreciation plays a critical role in lease calculations by determining the loss in value of the leased asset over the lease term, directly impacting the residual value. The residual value is the estimated worth of the asset at lease end, and accurate depreciation estimates ensure fair lease payments aligned with asset usage. Understanding the relationship between depreciation and residual value helps lessors set lease terms that balance risk and cost recovery.

Factors That Influence Residual Value

Residual value is primarily influenced by factors such as the asset's initial cost, expected usage, market demand for the asset at lease end, and its anticipated wear and tear. Economic conditions, technological advancements, and industry trends also significantly impact the projected residual value by affecting the asset's resale potential. Accurate estimation of residual value requires analyzing historical depreciation rates and the vehicle's maintenance history to minimize lease risk and optimize financial forecasting.

How Depreciation Rates Affect Lease Choices

Depreciation rates directly impact lease payments by determining the vehicle's value loss over the lease term, influencing the residual value and monthly costs. Higher depreciation rates lower the residual value, resulting in increased lease payments as the lessor anticipates greater loss in asset value. Understanding depreciation trends helps lessees select vehicles with favorable residual values, optimizing lease affordability and financial planning.

Maximizing Savings: Choosing Cars with High Residual Value

Choosing cars with high residual value significantly reduces depreciation costs, leading to lower lease payments and maximizing savings. Residual value represents the estimated worth of the vehicle at lease-end, directly impacting monthly lease charges. Vehicles retaining value better offer financial advantages by minimizing depreciation loss throughout the lease term.

Depreciation Myths Every Car Lessee Should Know

Depreciation is often misunderstood by car lessees, with many believing it always equals the residual value difference over the lease term. In reality, depreciation reflects the actual market value loss influenced by factors like mileage, condition, and demand, not just the initial cost minus residual value. Understanding that depreciation can vary significantly from assumptions helps lessees avoid overpaying or misjudging lease-end obligations.

Residual Value vs Depreciation: What Matters More for Lessees?

Residual value represents the estimated worth of a leased asset at the end of the lease term, directly influencing monthly lease payments by reducing the amount depreciated over time. Depreciation reflects the actual loss in asset value, determining the cost lessees bear during the lease period. For lessees, a higher residual value generally results in lower payments, making residual value more critical than depreciation in lease cost considerations.

Residual Value vs Depreciation Infographic

cardiffo.com

cardiffo.com