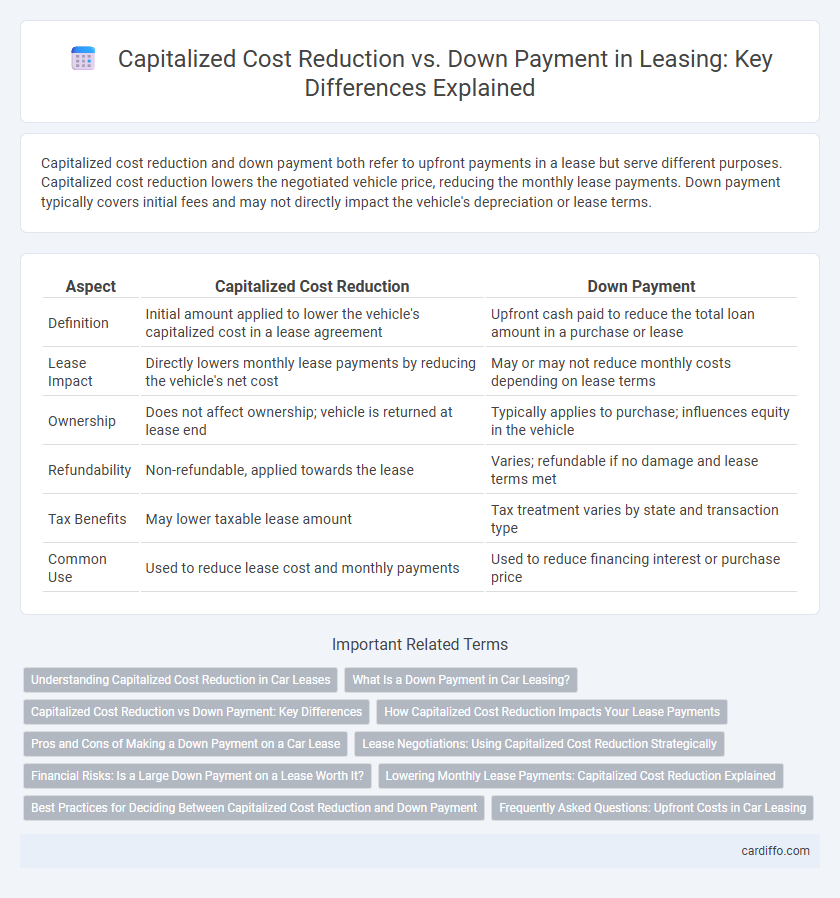

Capitalized cost reduction and down payment both refer to upfront payments in a lease but serve different purposes. Capitalized cost reduction lowers the negotiated vehicle price, reducing the monthly lease payments. Down payment typically covers initial fees and may not directly impact the vehicle's depreciation or lease terms.

Table of Comparison

| Aspect | Capitalized Cost Reduction | Down Payment |

|---|---|---|

| Definition | Initial amount applied to lower the vehicle's capitalized cost in a lease agreement | Upfront cash paid to reduce the total loan amount in a purchase or lease |

| Lease Impact | Directly lowers monthly lease payments by reducing the vehicle's net cost | May or may not reduce monthly costs depending on lease terms |

| Ownership | Does not affect ownership; vehicle is returned at lease end | Typically applies to purchase; influences equity in the vehicle |

| Refundability | Non-refundable, applied towards the lease | Varies; refundable if no damage and lease terms met |

| Tax Benefits | May lower taxable lease amount | Tax treatment varies by state and transaction type |

| Common Use | Used to reduce lease cost and monthly payments | Used to reduce financing interest or purchase price |

Understanding Capitalized Cost Reduction in Car Leases

Capitalized cost reduction in car leases refers to the upfront amount paid to lower the vehicle's capitalized cost, directly reducing monthly lease payments and overall financing charges. Unlike a down payment, which may simply be a portion of the purchase price, the capitalized cost reduction specifically decreases the lease's base value on which depreciation and rent charges are calculated. Understanding this distinction helps lessees effectively manage costs and improve lease affordability.

What Is a Down Payment in Car Leasing?

A down payment in car leasing is an upfront payment made to reduce the total capitalized cost of the lease, directly lowering monthly lease payments. This initial amount, also known as capitalized cost reduction, decreases the principal on which depreciation and interest charges are calculated. Unlike a purchase down payment, a lease down payment primarily affects the overall lease structure rather than ownership equity.

Capitalized Cost Reduction vs Down Payment: Key Differences

Capitalized Cost Reduction directly lowers the negotiated price of the leased vehicle, effectively reducing the amount financed and decreasing monthly lease payments. A down payment, while similar in upfront cost, acts as an initial payment toward the lease but does not change the vehicle's capitalized cost, often resulting in less impact on monthly lease amounts. Understanding these differences is essential for lessees aiming to optimize lease terms and total cost of ownership.

How Capitalized Cost Reduction Impacts Your Lease Payments

Capitalized Cost Reduction directly lowers the capitalized cost of the leased vehicle, which decreases the overall lease amount used to calculate your monthly payments. A higher Capitalized Cost Reduction reduces the lease balance, resulting in lower monthly lease payments compared to making a standard down payment. Unlike a down payment that primarily reduces upfront costs, Capitalized Cost Reduction impacts both the depreciation and finance charges included in your lease calculation, optimizing long-term payment savings.

Pros and Cons of Making a Down Payment on a Car Lease

Making a down payment on a car lease, also known as a capitalized cost reduction, lowers the monthly lease payments by reducing the amount financed, which can improve affordability. However, a larger down payment increases upfront costs and carries the risk of losing money if the vehicle is stolen or totaled early in the lease term since these funds are generally non-refundable. Opting for a smaller or no down payment preserves cash flow but results in higher monthly payments and potentially negative equity if the lease is terminated prematurely.

Lease Negotiations: Using Capitalized Cost Reduction Strategically

Capitalized cost reduction lowers the vehicle's negotiated price, directly decreasing monthly lease payments and overall lease cost more effectively than a simple down payment. In lease negotiations, strategically applying capitalized cost reduction enhances bargaining power by reducing the amount financed without increasing risk of loss if the vehicle is totaled or stolen. Employing this method optimizes lease terms, improves cash flow management, and minimizes potential financial exposure during the lease period.

Financial Risks: Is a Large Down Payment on a Lease Worth It?

A large down payment, often termed capitalized cost reduction in leasing, lowers monthly lease payments but increases upfront financial risk by tying substantial funds that may not be recoverable if the vehicle is totaled or stolen. Unlike purchasing, where a down payment builds equity, lease payments primarily cover depreciation and usage, making excessive capitalized cost reductions less beneficial. Financially, concentrating funds elsewhere or opting for minimal upfront payments preserves liquidity and mitigates risk without significantly impacting overall lease cost.

Lowering Monthly Lease Payments: Capitalized Cost Reduction Explained

A capitalized cost reduction directly lowers the vehicle's capitalized cost, which reduces the depreciation portion of the monthly lease payments. This upfront payment is applied to the lease value rather than being a refundable down payment, resulting in consistently lower monthly costs throughout the lease term. A higher capitalized cost reduction effectively decreases the amount financed, making monthly lease payments more affordable.

Best Practices for Deciding Between Capitalized Cost Reduction and Down Payment

Evaluating capitalized cost reduction versus a down payment requires analyzing overall lease terms and monthly payment impact to maximize financial efficiency. Capitalized cost reduction directly lowers the adjusted capitalized cost, reducing lease payments and money factor interest, whereas a down payment typically influences upfront cash flow without altering depreciation. Best practices include assessing your cash availability, lease duration, and expected vehicle value to determine which option minimizes total lease expenses and optimizes monthly affordability.

Frequently Asked Questions: Upfront Costs in Car Leasing

Capitalized cost reduction and down payment both reduce the initial amount financed in a car lease but serve different purposes. The capitalized cost reduction lowers the negotiated price of the vehicle, directly decreasing monthly lease payments, while the down payment covers upfront fees and may reduce the amount due at signing. Frequently asked questions highlight that capitalized cost reductions are not always required, but a down payment is often necessary to secure the lease and cover taxes, fees, and the first month's payment.

Capitalized Cost Reduction vs Down Payment Infographic

cardiffo.com

cardiffo.com