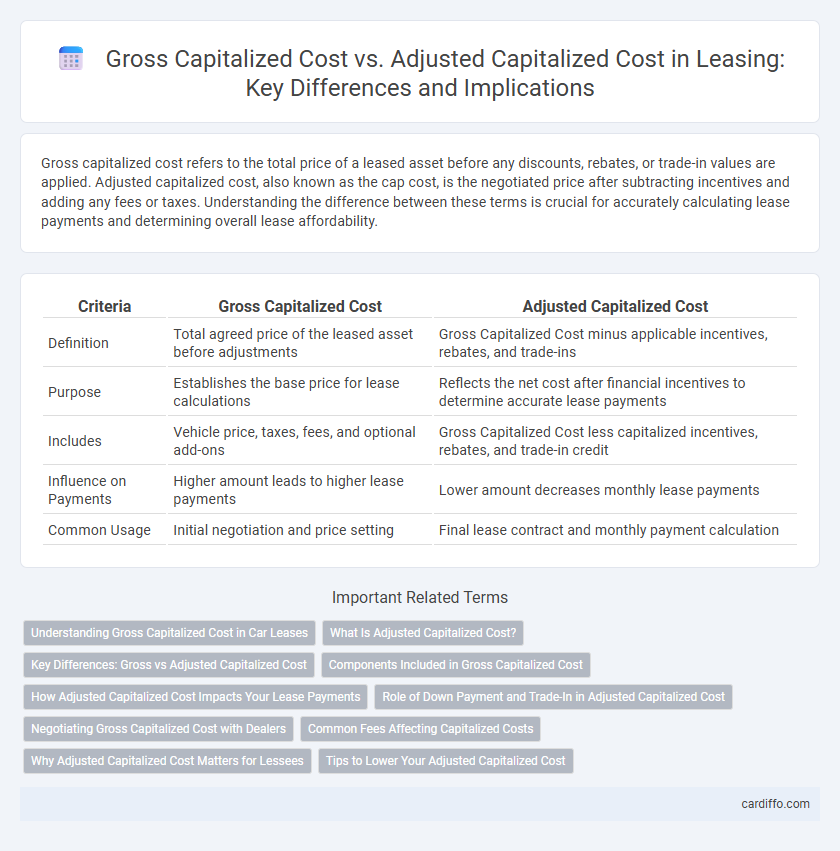

Gross capitalized cost refers to the total price of a leased asset before any discounts, rebates, or trade-in values are applied. Adjusted capitalized cost, also known as the cap cost, is the negotiated price after subtracting incentives and adding any fees or taxes. Understanding the difference between these terms is crucial for accurately calculating lease payments and determining overall lease affordability.

Table of Comparison

| Criteria | Gross Capitalized Cost | Adjusted Capitalized Cost |

|---|---|---|

| Definition | Total agreed price of the leased asset before adjustments | Gross Capitalized Cost minus applicable incentives, rebates, and trade-ins |

| Purpose | Establishes the base price for lease calculations | Reflects the net cost after financial incentives to determine accurate lease payments |

| Includes | Vehicle price, taxes, fees, and optional add-ons | Gross Capitalized Cost less capitalized incentives, rebates, and trade-in credit |

| Influence on Payments | Higher amount leads to higher lease payments | Lower amount decreases monthly lease payments |

| Common Usage | Initial negotiation and price setting | Final lease contract and monthly payment calculation |

Understanding Gross Capitalized Cost in Car Leases

Gross Capitalized Cost in car leases represents the total agreed-upon value of the vehicle before applying any cap cost reductions, such as down payments, trade-in credits, or rebates. This amount serves as the baseline for calculating lease payments, including depreciation and interest charges over the lease term. Understanding the distinction between Gross Capitalized Cost and Adjusted Capitalized Cost is crucial for accurately assessing monthly lease expenses and negotiating favorable lease terms.

What Is Adjusted Capitalized Cost?

Adjusted Capitalized Cost in a lease refers to the Gross Capitalized Cost minus any capitalized cost reductions, such as down payments, trade-in credits, or rebates. This figure represents the net amount financed through the lease, directly impacting monthly lease payments. Understanding Adjusted Capitalized Cost is crucial for accurately determining lease payment obligations and comparing lease offers.

Key Differences: Gross vs Adjusted Capitalized Cost

Gross Capitalized Cost represents the total initial price of a leased vehicle including MSRP, fees, and options before any discounts or incentives. Adjusted Capitalized Cost reflects the Gross Capitalized Cost minus any capitalized cost reductions such as down payments, trade-in credits, and manufacturer rebates. The key difference lies in Adjusted Capitalized Cost providing a more accurate basis for calculating lease payments by accounting for these deductions.

Components Included in Gross Capitalized Cost

Gross Capitalized Cost in a lease includes the negotiated price of the vehicle, acquisition fees, and any capitalized add-ons such as extended warranties or service contracts. It reflects the total capitalized value before applying any down payments, trade-in credits, or incentives. This comprehensive cost forms the basis for calculating lease payments and depreciation charges.

How Adjusted Capitalized Cost Impacts Your Lease Payments

Adjusted Capitalized Cost directly affects your lease payments by incorporating negotiated fees, trade-in values, and applicable incentives, thereby lowering the total amount financed. A lower adjusted capitalized cost reduces your monthly lease payments and the overall lease expense. Understanding how these adjustments modify the capitalized cost can help you negotiate a more affordable lease agreement.

Role of Down Payment and Trade-In in Adjusted Capitalized Cost

Gross Capitalized Cost represents the total price of a leased vehicle before any discounts, incentives, or reductions are applied. Adjusted Capitalized Cost subtracts the down payment and trade-in value from the Gross Capitalized Cost, lowering the amount on which lease payments are calculated. The down payment and trade-in effectively reduce the lease principal, decreasing monthly payments and overall lease cost.

Negotiating Gross Capitalized Cost with Dealers

Negotiating the Gross Capitalized Cost with dealers is crucial because it represents the vehicle's starting price before fees, taxes, and incentives are applied. Lowering the Gross Capitalized Cost directly reduces monthly lease payments and overall lease expenses. Understanding invoice prices and dealer holdbacks gives lessees leverage to secure a more favorable adjusted capitalized cost.

Common Fees Affecting Capitalized Costs

Common fees affecting gross capitalized cost in a lease include the vehicle's negotiated price, acquisition fees, and any optional extras or packages selected. Adjusted capitalized cost reflects the gross capitalized cost minus lease incentives, rebates, and down payments applied to reduce the lessee's financing amount. Understanding these fees is crucial for accurately calculating monthly lease payments and the overall lease expense.

Why Adjusted Capitalized Cost Matters for Lessees

Adjusted Capitalized Cost matters for lessees because it reflects the true negotiated value of the leased asset after incorporating incentives, trade-ins, and lender fees, impacting monthly lease payments directly. Unlike Gross Capitalized Cost, which is the initial asking price, the adjusted figure provides a more accurate basis for calculating lease depreciation and rent charges. Understanding this distinction helps lessees optimize lease terms and potentially reduce overall leasing expenses.

Tips to Lower Your Adjusted Capitalized Cost

Lowering your adjusted capitalized cost in a lease begins with negotiating the gross capitalized cost, which includes the vehicle price and any additional fees. Request dealer incentives, rebates, and consider trading in your old vehicle to reduce the initial amount. Carefully reviewing and disputing unnecessary fees can further decrease the adjusted capitalized cost, minimizing your monthly lease payments.

Gross Capitalized Cost vs Adjusted Capitalized Cost Infographic

cardiffo.com

cardiffo.com