Capitalized Cost refers to the initial price of a leased asset, including the negotiated selling price, taxes, and additional fees that form the basis for lease payments. Adjusted Capitalized Cost accounts for discounts, rebates, and trade-in allowances subtracted from the capitalized cost to reflect the net amount financed through the lease. Understanding the difference between these two values is crucial for accurately calculating monthly lease payments and overall lease expenses.

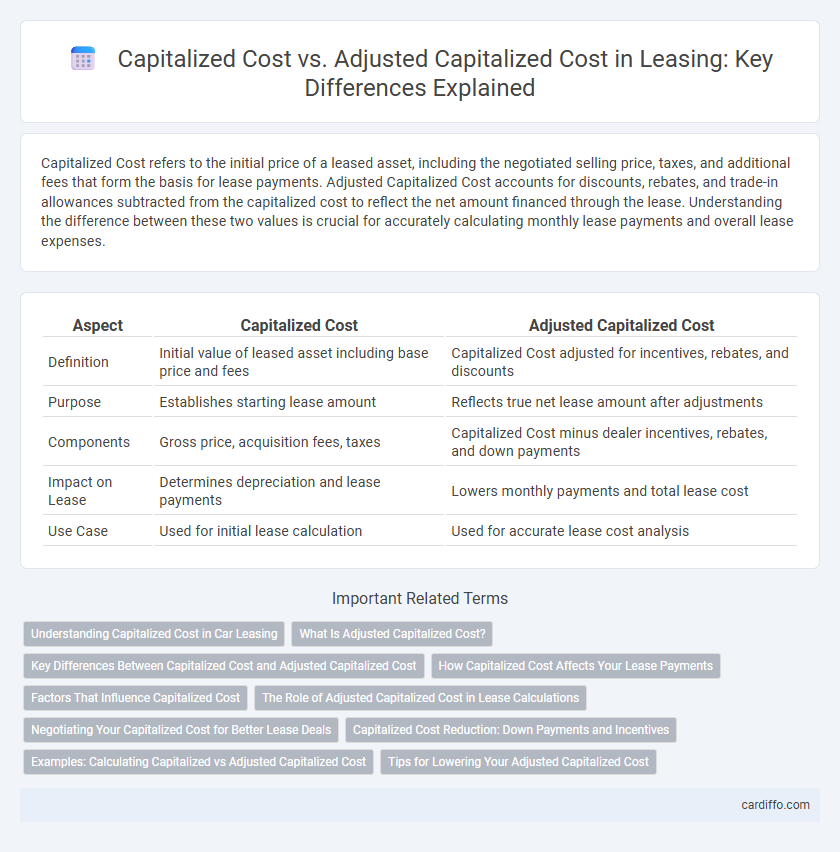

Table of Comparison

| Aspect | Capitalized Cost | Adjusted Capitalized Cost |

|---|---|---|

| Definition | Initial value of leased asset including base price and fees | Capitalized Cost adjusted for incentives, rebates, and discounts |

| Purpose | Establishes starting lease amount | Reflects true net lease amount after adjustments |

| Components | Gross price, acquisition fees, taxes | Capitalized Cost minus dealer incentives, rebates, and down payments |

| Impact on Lease | Determines depreciation and lease payments | Lowers monthly payments and total lease cost |

| Use Case | Used for initial lease calculation | Used for accurate lease cost analysis |

Understanding Capitalized Cost in Car Leasing

Capitalized Cost in car leasing represents the initial agreed-upon value of the vehicle plus any additional fees or options rolled into the lease, serving as the foundation for calculating monthly payments. Adjusted Capitalized Cost reflects the Capitalized Cost after subtracting trade-in credits, down payments, or incentives, effectively lowering the lease amount. Understanding the difference between these two values helps lessees negotiate better deals and anticipate accurate monthly lease payments.

What Is Adjusted Capitalized Cost?

Adjusted Capitalized Cost refers to the initial Capitalized Cost of a lease, which includes the negotiated price of the vehicle plus any additional fees or costs, minus any down payments or trade-in credits. This figure is crucial because it represents the net amount financed through the lease, directly affecting monthly lease payments and total lease obligation. Understanding Adjusted Capitalized Cost helps lessees accurately evaluate the financial impact of lease agreements and compare offers effectively.

Key Differences Between Capitalized Cost and Adjusted Capitalized Cost

Capitalized Cost refers to the initial negotiated price of a leased asset, including the agreed-upon selling price plus any additional fees or costs incorporated into the lease agreement. Adjusted Capitalized Cost reflects modifications made post-initial agreement, such as incentives, rebates, trade-in allowances, or down payments that reduce the overall lease cost. The key difference lies in the Adjusted Capitalized Cost providing a more accurate calculation of lease payments by accounting for financial adjustments, whereas Capitalized Cost represents the starting figure before adjustments.

How Capitalized Cost Affects Your Lease Payments

Capitalized Cost represents the negotiated price of the vehicle at lease inception and directly influences your monthly lease payments by determining the amount you finance. Adjusted Capitalized Cost factors in additional fees, incentives, or trade-in credits, effectively lowering the base amount and reducing overall lease payments. Understanding how Capitalized Cost impacts depreciation and finance charges is essential for optimizing your lease agreement and monthly costs.

Factors That Influence Capitalized Cost

Capitalized Cost in a lease is primarily influenced by the vehicle's negotiated price, trade-in value, and down payment, which collectively determine the initial amount financed. Adjusted Capitalized Cost accounts for additional factors such as manufacturer incentives, rebates, and any fees or taxes included in the lease. Understanding these elements helps lessees negotiate a lower capitalized cost, directly impacting the monthly payment and overall lease affordability.

The Role of Adjusted Capitalized Cost in Lease Calculations

Adjusted Capitalized Cost plays a crucial role in lease calculations by reflecting the true net value of the leased asset after accounting for any incentives, discounts, and trade-ins. It provides a more accurate basis for determining monthly lease payments, depreciation, and finance charges compared to the initial Capitalized Cost. Understanding Adjusted Capitalized Cost ensures lessees make informed decisions based on realistic lease obligations and cost structures.

Negotiating Your Capitalized Cost for Better Lease Deals

Negotiating your capitalized cost effectively can significantly lower monthly lease payments by reducing the vehicle's initial value used to calculate depreciation. The adjusted capitalized cost reflects incentives, trade-in credits, and fees applied after negotiation, offering a clearer picture of the lease's actual base price. Understanding and controlling both figures empowers lessees to secure better lease deals with lower overall financial commitments.

Capitalized Cost Reduction: Down Payments and Incentives

Capitalized Cost in leasing represents the initial negotiated price of the vehicle plus any additional fees, serving as the baseline for lease payments. Capitalized Cost Reduction includes down payments and manufacturer incentives that directly lower this amount, reducing the monthly lease payment and overall lease cost. Applying substantial capitalized cost reductions decreases the depreciation portion of the lease, optimizing affordability and cash flow for the lessee.

Examples: Calculating Capitalized vs Adjusted Capitalized Cost

Capitalized Cost represents the initial price of a leased asset, including the negotiated value and any additional fees like taxes or registration. Adjusted Capitalized Cost accounts for rebates, incentives, or trade-in value deducted from the Capitalized Cost to reflect the actual amount being financed through the lease. For example, if a car's price (Capitalized Cost) is $30,000 and there is a $2,000 manufacturer rebate plus a $1,000 trade-in, the Adjusted Capitalized Cost becomes $27,000, which directly affects the lease payment calculation.

Tips for Lowering Your Adjusted Capitalized Cost

Lowering your adjusted capitalized cost in a lease can significantly reduce monthly payments and overall lease expenses. Negotiate the selling price aggressively to ensure a lower starting capitalized cost, and take advantage of manufacturer incentives or rebates that directly reduce this value. Pay close attention to fees and add-ons, asking to exclude unnecessary items to minimize the adjusted capitalized cost effectively.

Capitalized Cost vs Adjusted Capitalized Cost Infographic

cardiffo.com

cardiffo.com