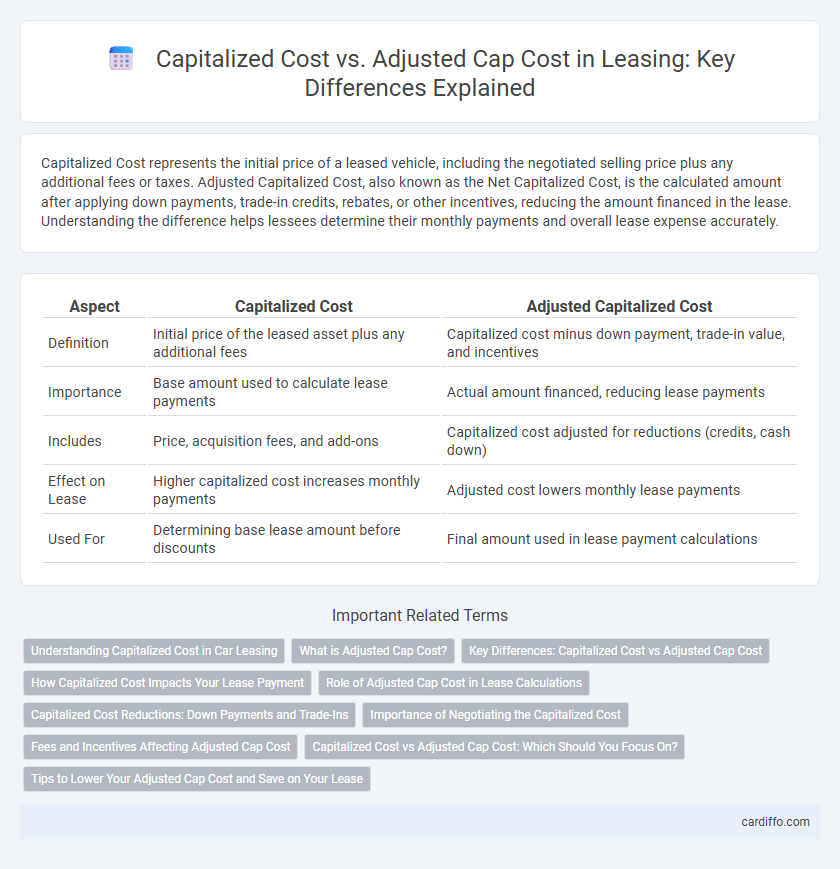

Capitalized Cost represents the initial price of a leased vehicle, including the negotiated selling price plus any additional fees or taxes. Adjusted Capitalized Cost, also known as the Net Capitalized Cost, is the calculated amount after applying down payments, trade-in credits, rebates, or other incentives, reducing the amount financed in the lease. Understanding the difference helps lessees determine their monthly payments and overall lease expense accurately.

Table of Comparison

| Aspect | Capitalized Cost | Adjusted Capitalized Cost |

|---|---|---|

| Definition | Initial price of the leased asset plus any additional fees | Capitalized cost minus down payment, trade-in value, and incentives |

| Importance | Base amount used to calculate lease payments | Actual amount financed, reducing lease payments |

| Includes | Price, acquisition fees, and add-ons | Capitalized cost adjusted for reductions (credits, cash down) |

| Effect on Lease | Higher capitalized cost increases monthly payments | Adjusted cost lowers monthly lease payments |

| Used For | Determining base lease amount before discounts | Final amount used in lease payment calculations |

Understanding Capitalized Cost in Car Leasing

Capitalized Cost in car leasing represents the agreed-upon price of the vehicle plus any additional fees or taxes included in the lease agreement. Adjusted Capitalized Cost is the Capitalized Cost minus down payments, trade-in credits, or rebates applied before calculating monthly lease payments. Understanding these terms helps lessees accurately assess the initial cost basis and negotiate better lease terms.

What is Adjusted Cap Cost?

Adjusted Capitalized Cost in a lease refers to the negotiated selling price of the vehicle after accounting for any trade-in allowances, rebates, or incentives. It represents the actual amount financed through the lease, which is usually lower than the initial capitalized cost. Understanding Adjusted Cap Cost is crucial because it directly affects lease payments and overall lease affordability.

Key Differences: Capitalized Cost vs Adjusted Cap Cost

Capitalized Cost represents the initial agreed-upon price of a leased vehicle, including the negotiated price plus any additional fees and taxes. Adjusted Capitalized Cost deducts any down payments, trade-in credits, and rebates from the Capitalized Cost, effectively reducing the amount financed through the lease. Understanding these distinctions is crucial for accurately calculating lease payments and determining the true cost of leasing a vehicle.

How Capitalized Cost Impacts Your Lease Payment

Capitalized cost, often referred to as the "cap cost," is the negotiated price of the vehicle plus any additional fees or costs, serving as the starting point for calculating your lease payments. A lower capitalized cost reduces the overall amount financed in the lease, directly decreasing monthly payments by lessening the depreciation and finance charges. Understanding how capitalized cost affects your lease payment helps you negotiate better terms and manage costs throughout your lease tenure.

Role of Adjusted Cap Cost in Lease Calculations

Adjusted Capitalized Cost represents the negotiated capitalized cost of a lease vehicle after incorporating incentives, trade-in allowances, and other reductions, directly influencing monthly lease payments. It plays a critical role in lease calculations by determining the base amount on which depreciation and finance charges are applied, thereby impacting the total lease cost. Lower Adjusted Capitalized Cost results in reduced monthly payments and overall lease expense, making it essential for lessees to negotiate effectively.

Capitalized Cost Reductions: Down Payments and Trade-Ins

Capitalized cost reduction directly lowers the lease's capitalized cost, which is the negotiated price of the vehicle used to calculate lease payments. Down payments and trade-ins serve as primary methods of capitalized cost reductions, effectively decreasing the amount financed through the lease. Lower capitalized costs result in reduced monthly lease payments, enhancing affordability and reducing overall lease expenses.

Importance of Negotiating the Capitalized Cost

Negotiating the capitalized cost is crucial in a lease agreement as it directly affects monthly lease payments and the overall lease expense. The capitalized cost represents the vehicle's starting price, while the adjusted capitalized cost reflects negotiated deductions like trade-in value and incentives, reducing the lease base. Securing a lower capitalized cost ensures significant savings over the lease term by minimizing depreciation amounts and finance charges.

Fees and Incentives Affecting Adjusted Cap Cost

Adjusted Capitalized Cost is derived from the initial Capitalized Cost by factoring in fees and incentives that directly affect the vehicle's selling price. Fees such as acquisition charges and registration fees typically increase the Adjusted Cap Cost, while manufacturer rebates and dealer incentives effectively reduce it. Understanding the impact of these fees and incentives is crucial for accurately calculating lease payments and overall lease affordability.

Capitalized Cost vs Adjusted Cap Cost: Which Should You Focus On?

Capitalized Cost represents the initial price of the leased asset plus any additional fees or taxes, forming the baseline for lease calculations. Adjusted Capitalized Cost modifies this amount by subtracting incentives, trade-in credits, or rebates, directly impacting monthly lease payments. Focusing on Adjusted Capitalized Cost provides a more accurate understanding of your true lease expense than the original Capitalized Cost.

Tips to Lower Your Adjusted Cap Cost and Save on Your Lease

Negotiating a lower purchase price and minimizing add-ons can effectively reduce your adjusted capitalized cost, saving you money on your lease. Carefully review fees such as acquisition charges and avoid unnecessary warranties or insurance to keep costs down. Securing a higher trade-in value or making a sizable down payment also lowers the adjusted cap cost, resulting in more affordable monthly lease payments.

Capitalized Cost vs Adjusted Cap Cost Infographic

cardiffo.com

cardiffo.com