Leasing a new car offers the advantage of the latest technology, manufacturer warranties, and lower maintenance costs, ensuring a hassle-free driving experience. In contrast, leasing a used car generally comes with lower monthly payments, making it a more budget-friendly option for those seeking affordability. Evaluating long-term expenses, depreciation rates, and warranty coverage helps determine which leasing choice aligns best with individual financial goals and driving needs.

Table of Comparison

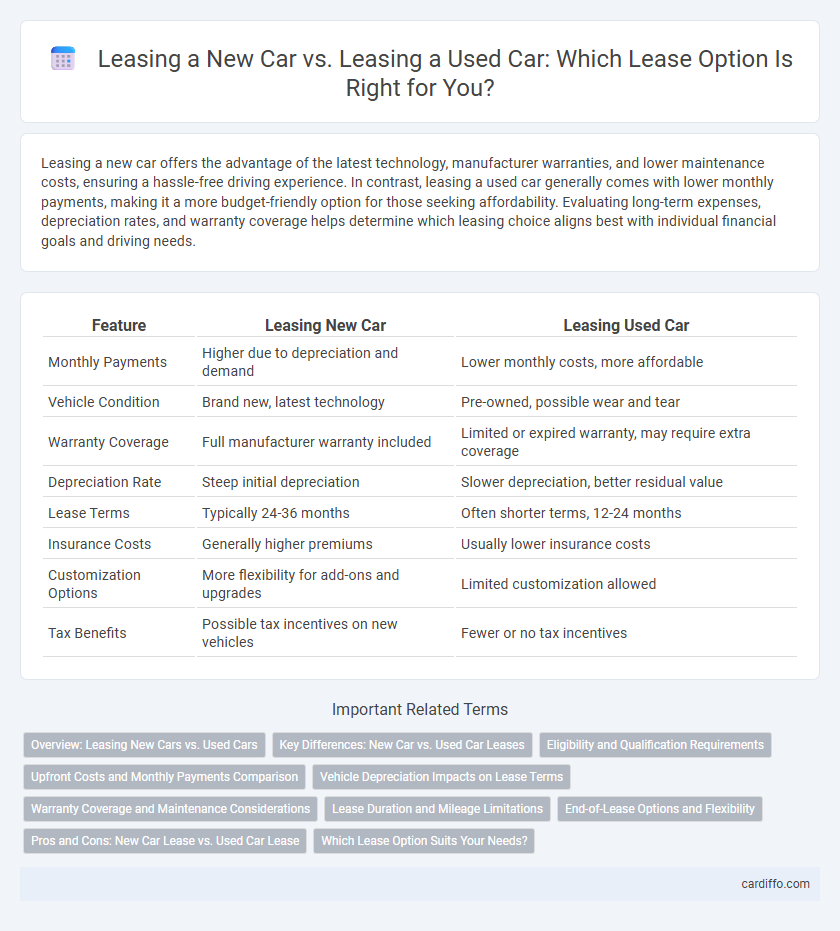

| Feature | Leasing New Car | Leasing Used Car |

|---|---|---|

| Monthly Payments | Higher due to depreciation and demand | Lower monthly costs, more affordable |

| Vehicle Condition | Brand new, latest technology | Pre-owned, possible wear and tear |

| Warranty Coverage | Full manufacturer warranty included | Limited or expired warranty, may require extra coverage |

| Depreciation Rate | Steep initial depreciation | Slower depreciation, better residual value |

| Lease Terms | Typically 24-36 months | Often shorter terms, 12-24 months |

| Insurance Costs | Generally higher premiums | Usually lower insurance costs |

| Customization Options | More flexibility for add-ons and upgrades | Limited customization allowed |

| Tax Benefits | Possible tax incentives on new vehicles | Fewer or no tax incentives |

Overview: Leasing New Cars vs. Used Cars

Leasing new cars offers the latest models with full warranties, advanced technology, and lower maintenance costs, making them ideal for drivers seeking cutting-edge features and reliability. Used car leases typically come with lower monthly payments and can provide better depreciation value but may have higher maintenance risks and limited warranty coverage. Understanding these factors helps consumers balance upfront cost savings against long-term benefits when choosing between new and used car leases.

Key Differences: New Car vs. Used Car Leases

Leasing a new car typically offers lower maintenance costs, higher residual values, and access to the latest technology and safety features compared to leasing a used car. Used car leases often have lower monthly payments but may involve higher interest rates and less favorable warranty coverage. Understanding these differences helps consumers balance initial costs, depreciation rates, and potential repair expenses when deciding between new and used car leases.

Eligibility and Qualification Requirements

Leasing a new car typically requires a higher credit score, often above 700, to qualify for favorable terms, while leasing a used car may have more flexible credit requirements but higher interest rates. Income verification, stable employment, and a good debt-to-income ratio are important eligibility factors for both new and used car leases. Some lessors may impose stricter covenants or shorter lease terms on used cars due to increased depreciation risks and maintenance concerns.

Upfront Costs and Monthly Payments Comparison

Leasing a new car typically involves higher upfront costs such as down payments, acquisition fees, and first-month premiums compared to leasing a used car, which often has lower or waived initial fees. Monthly payments on new car leases are generally higher due to the vehicle's higher depreciation and market value, whereas used car leases benefit from reduced monthly rates driven by slower depreciation. Consumers seeking lower immediate financial outlay and monthly expenses may prefer used car leasing, while those desiring the latest models with warranty coverage might opt for new car leases despite the increased costs.

Vehicle Depreciation Impacts on Lease Terms

Leasing a new car typically involves higher monthly payments due to greater initial depreciation within the first few years, directly impacting lease terms such as residual value and money factor. Used car leases often feature lower monthly costs since the vehicle has already undergone significant depreciation, allowing for more favorable lease structure and residual value calculations. Understanding depreciation trends is crucial for selecting lease options that balance cost efficiency and vehicle value retention.

Warranty Coverage and Maintenance Considerations

Leasing a new car typically includes comprehensive manufacturer warranty coverage, often covering major repairs and routine maintenance for the lease term, reducing out-of-pocket expenses. Leasing a used car may offer limited or expired warranty coverage, requiring lessees to consider potential repair costs and the need for extended warranty packages or service contracts. Maintenance considerations for new car leases generally involve scheduled services covered by the lease, whereas used car leases might demand additional budgeting for unexpected maintenance and wear-and-tear repairs.

Lease Duration and Mileage Limitations

Leasing a new car typically offers shorter lease durations of 24 to 36 months with mileage limits ranging from 10,000 to 15,000 miles annually, catering to drivers who prefer the latest models and predictable maintenance costs. Used car leases often have longer terms, sometimes extending beyond 36 months, but come with stricter mileage restrictions and potentially higher wear-and-tear fees due to the vehicle's prior usage. Choosing between new and used car leases requires balancing lease length preferences against mileage allowances and associated cost implications.

End-of-Lease Options and Flexibility

Leasing a new car typically offers more flexible end-of-lease options, including the ability to purchase the vehicle at a predetermined price or upgrade to the latest model with minimal fees. Used car leases often have stricter terms and fewer incentives, limiting options such as early buyout or lease extension. Understanding the differences in residual values and mileage allowances is crucial for maximizing flexibility and minimizing end-of-lease costs.

Pros and Cons: New Car Lease vs. Used Car Lease

Leasing a new car offers the advantage of the latest technology, full warranty coverage, and lower maintenance costs, but typically involves higher monthly payments and initial fees. Used car leases provide more affordable payments and reduced depreciation impact, yet may have limited warranty protection and increased risk of repairs. Choosing between a new car lease and a used car lease requires balancing cost savings against potential maintenance and reliability concerns.

Which Lease Option Suits Your Needs?

Leasing a new car typically offers lower maintenance costs, the latest technology, and manufacturer warranties, making it ideal for drivers seeking reliability and the newest features. Leasing a used car can provide lower monthly payments and reduced depreciation, appealing to budget-conscious individuals who prioritize affordability over having the latest model. Assess your driving habits, financial situation, and desire for modern amenities to determine whether a new or used car lease best suits your needs.

Leasing New Car vs Leasing Used Car Infographic

cardiffo.com

cardiffo.com