A balloon lease requires a large payment at the end of the term, significantly reducing monthly installments compared to a regular lease, which spreads payments evenly throughout the lease period. This structure offers lower monthly costs but higher financial risk at lease-end, whereas a regular lease provides predictable payments with little to no lump-sum obligation. Choosing between a balloon lease and a regular lease depends on cash flow preferences and the ability to handle the final balloon payment.

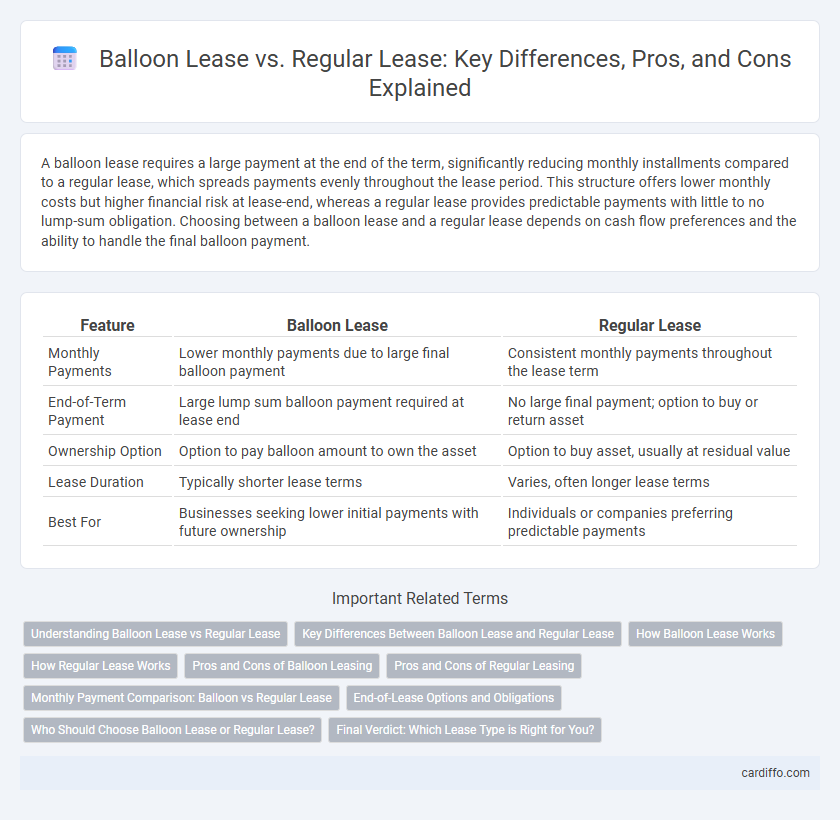

Table of Comparison

| Feature | Balloon Lease | Regular Lease |

|---|---|---|

| Monthly Payments | Lower monthly payments due to large final balloon payment | Consistent monthly payments throughout the lease term |

| End-of-Term Payment | Large lump sum balloon payment required at lease end | No large final payment; option to buy or return asset |

| Ownership Option | Option to pay balloon amount to own the asset | Option to buy asset, usually at residual value |

| Lease Duration | Typically shorter lease terms | Varies, often longer lease terms |

| Best For | Businesses seeking lower initial payments with future ownership | Individuals or companies preferring predictable payments |

Understanding Balloon Lease vs Regular Lease

A balloon lease requires smaller monthly payments with a large lump-sum payment due at the lease's end, contrasting a regular lease that spreads payments evenly throughout the term. Balloon leases offer lower initial costs but higher financial risk when the final payment is due, making budgeting crucial. Regular leases provide predictable expenses, appealing to lessees prioritizing stable cash flow without unexpected large payments.

Key Differences Between Balloon Lease and Regular Lease

Balloon leases feature lower monthly payments with a large lump-sum payment due at the lease end, contrasting with regular leases that spread payments evenly throughout the term. Balloon leases offer flexibility for businesses expecting future cash flow improvements, while regular leases provide predictable, consistent expenses. The choice depends on financial strategy, cash flow stability, and risk tolerance regarding the final balloon payment.

How Balloon Lease Works

A Balloon Lease requires lower monthly payments with a large lump-sum balloon payment due at the end of the lease term, making it ideal for businesses expecting higher cash flow in the future. During the lease, lessees pay only the depreciation and interest, reducing upfront costs compared to Regular Leases where payments are spread evenly. This structure provides flexibility and cash flow management but requires careful planning for the final balloon payment or asset refinancing.

How Regular Lease Works

A regular lease requires the lessee to make fixed monthly payments covering the vehicle's depreciation, interest, and fees over the contract term. At lease end, the lessee can return the vehicle with no further obligations or choose to purchase it at the predetermined residual value. This structure provides predictable costs without large end-of-term payments typical in balloon leases.

Pros and Cons of Balloon Leasing

Balloon leasing offers lower monthly payments compared to regular leases by deferring a large portion of the cost to the end of the term, appealing to those seeking short-term cash flow relief. However, balloon leases carry the risk of a significant lump sum payment at lease maturity, which may require refinancing, vehicle trade-in, or a lump sum settlement. This structure suits buyers confident in their ability to manage the final payment but may pose financial strain for those unprepared for the balloon amount.

Pros and Cons of Regular Leasing

Regular leasing offers predictable monthly payments and the ability to drive a new vehicle every few years, which appeals to those seeking flexibility and avoiding long-term commitment. However, it often comes with higher overall costs compared to balloon leases, and lessees may face strict mileage limits and potential penalties for excessive wear and tear. This type of lease typically lacks the large residual payment structure of balloon leases, making it less attractive for those who want lower monthly payments initially.

Monthly Payment Comparison: Balloon vs Regular Lease

Balloon leases typically offer lower monthly payments compared to regular leases because the borrower pays a smaller portion of the vehicle's depreciation during the term. Regular leases spread the depreciation evenly, resulting in higher monthly payments but no large final balloon amount. The balloon lease requires a substantial payment at the end or refinancing, impacting overall cost despite initial savings.

End-of-Lease Options and Obligations

Balloon leases require a large final payment, known as the balloon payment, which must be paid at the end of the lease term or refinanced, making end-of-lease obligations significant compared to regular leases. Regular leases typically offer straightforward end-of-lease options such as vehicle return, purchase at a predetermined price, or lease renewal without a substantial final payment. Understanding the contractual terms of balloon payments versus fixed residual values in regular leases is crucial for managing financial obligations and end-of-lease decisions.

Who Should Choose Balloon Lease or Regular Lease?

Balloon leases suit businesses or individuals seeking lower monthly payments with a large final payment, ideal for those expecting increased cash flow or intending to refinance at lease end. Regular leases fit lessees preferring predictable, evenly spaced payments and no substantial lump-sum due, benefiting those with stable budgets and steady income. Choosing between balloon and regular leases depends on cash flow management, financial goals, and risk tolerance for handling the balloon payment at lease maturity.

Final Verdict: Which Lease Type is Right for You?

Balloon leases offer lower monthly payments with a large final balloon payment, ideal for those expecting increased future income or planning to refinance. Regular leases provide consistent payments without a substantial end-of-term cost, suited for budget stability and long-term financial planning. Choosing between these lease types depends on your cash flow, financial goals, and risk tolerance.

Balloon Lease vs Regular Lease Infographic

cardiffo.com

cardiffo.com