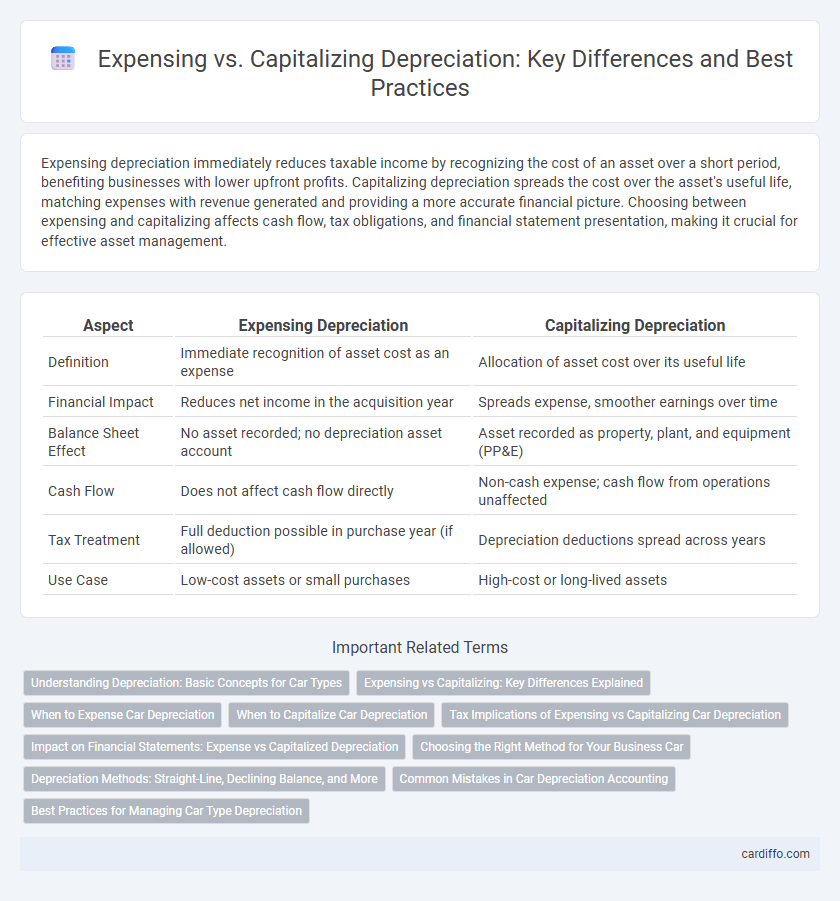

Expensing depreciation immediately reduces taxable income by recognizing the cost of an asset over a short period, benefiting businesses with lower upfront profits. Capitalizing depreciation spreads the cost over the asset's useful life, matching expenses with revenue generated and providing a more accurate financial picture. Choosing between expensing and capitalizing affects cash flow, tax obligations, and financial statement presentation, making it crucial for effective asset management.

Table of Comparison

| Aspect | Expensing Depreciation | Capitalizing Depreciation |

|---|---|---|

| Definition | Immediate recognition of asset cost as an expense | Allocation of asset cost over its useful life |

| Financial Impact | Reduces net income in the acquisition year | Spreads expense, smoother earnings over time |

| Balance Sheet Effect | No asset recorded; no depreciation asset account | Asset recorded as property, plant, and equipment (PP&E) |

| Cash Flow | Does not affect cash flow directly | Non-cash expense; cash flow from operations unaffected |

| Tax Treatment | Full deduction possible in purchase year (if allowed) | Depreciation deductions spread across years |

| Use Case | Low-cost assets or small purchases | High-cost or long-lived assets |

Understanding Depreciation: Basic Concepts for Car Types

Depreciation for cars involves allocating the vehicle's cost over its useful life, impacting financial statements differently whether expensed or capitalized. Expensing depreciation immediately reduces taxable income in the short term, while capitalizing spreads the expense over several years, matching the wear and tear of the car. Understanding the type of car and its expected usage helps determine the appropriate depreciation method, optimizing tax benefits and accurate asset valuation.

Expensing vs Capitalizing: Key Differences Explained

Expensing depreciation records the entire cost of an asset on the income statement in the period it is incurred, reducing taxable income immediately. Capitalizing depreciation allocates the asset's cost over its useful life by adding the expense to the balance sheet as an asset and gradually recognizing depreciation expense. This key difference impacts financial statements, affecting profitability metrics and tax liabilities.

When to Expense Car Depreciation

Car depreciation should be expensed when the vehicle is used primarily for personal purposes or short-term business activities, ensuring accurate reflection of operational costs in financial statements. Expensing car depreciation immediately aligns with IRS guidelines for vehicles not classified as business assets, simplifying tax reporting. This approach avoids capitalizing the asset, which is more suitable for long-term business vehicles requiring allocation of depreciation over several years.

When to Capitalize Car Depreciation

Car depreciation should be capitalized when the vehicle is used for business purposes and has a useful life extending beyond the current accounting period. Capitalizing car depreciation involves adding the vehicle's cost to the balance sheet as a fixed asset and systematically allocating the expense over its estimated useful life. This approach ensures accurate matching of expenses with revenues, reflecting the car's consumption and preserving compliance with accounting standards like GAAP or IFRS.

Tax Implications of Expensing vs Capitalizing Car Depreciation

Expensing car depreciation allows for immediate tax deductions, reducing taxable income in the year the expense is incurred, which can improve cash flow for businesses. Capitalizing car depreciation spreads the deduction over several years through depreciation schedules, potentially lowering annual taxable income more gradually and matching the vehicle's useful life. Businesses must evaluate tax strategies and financial reporting goals to determine whether expensing or capitalizing car depreciation offers the most beneficial tax impact.

Impact on Financial Statements: Expense vs Capitalized Depreciation

Expensing depreciation immediately reduces net income by recording the full cost as an expense in the current period, which impacts the income statement directly. Capitalizing depreciation spreads the cost over the useful life of the asset, appearing as a non-cash expense on the income statement while reducing the asset's book value on the balance sheet. This approach aligns expense recognition with asset usage, affecting both the income statement and balance sheet over multiple periods.

Choosing the Right Method for Your Business Car

Choosing between expensing and capitalizing depreciation depends on your business car's expected useful life and the impact on cash flow and tax benefits. Expensing allows for immediate deduction of the full cost, beneficial for short-term ownership or smaller vehicles, while capitalizing spreads the cost over several years, aligning with long-term use and generating consistent tax deductions. Consider your company's financial strategy, vehicle usage duration, and accounting policies to determine the optimal depreciation method.

Depreciation Methods: Straight-Line, Declining Balance, and More

Depreciation methods such as Straight-Line, Declining Balance, and Units of Production impact whether an asset's cost is expensed evenly over its useful life or accelerated in earlier years. The Straight-Line method allocates equal expense amounts annually, while the Declining Balance method applies a higher depreciation rate initially, matching expense with asset usage or revenue generation patterns. Choosing the appropriate depreciation method affects financial statements by influencing net income and asset book values, essential for tax reporting and investment analysis.

Common Mistakes in Car Depreciation Accounting

Common mistakes in car depreciation accounting often arise from misclassifying expenses as capital expenditures or vice versa, leading to inaccurate financial statements. Failure to consistently apply depreciation methods such as straight-line or reducing balance results in misstated asset values and distorted profit figures. Ignoring salvage value or neglecting to track accumulated depreciation further compounds errors, affecting tax calculations and depreciation schedules.

Best Practices for Managing Car Type Depreciation

Managing car type depreciation requires accurately categorizing expenses as either expensed immediately or capitalized for long-term asset management. Best practices involve capitalizing vehicle costs that extend the car's useful life or enhance its value while expensing routine maintenance and minor repairs to maintain accurate financial reporting. Implementing a consistent depreciation method, such as straight-line or declining balance, aligns with tax regulations and optimizes asset valuation.

Expensing vs Capitalizing Depreciation Infographic

cardiffo.com

cardiffo.com