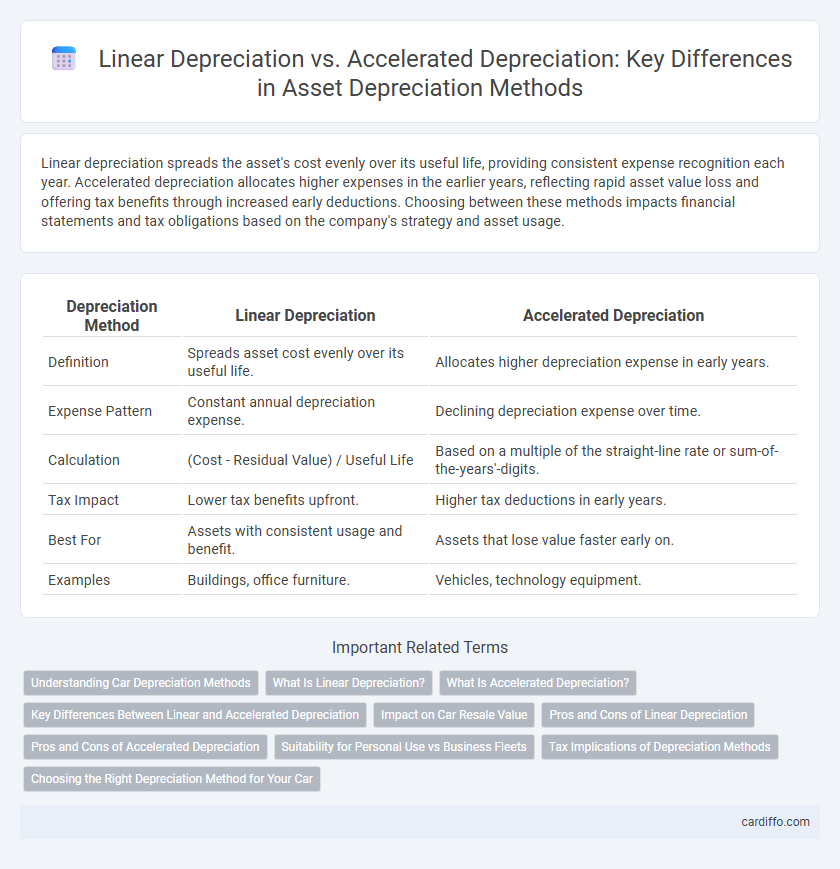

Linear depreciation spreads the asset's cost evenly over its useful life, providing consistent expense recognition each year. Accelerated depreciation allocates higher expenses in the earlier years, reflecting rapid asset value loss and offering tax benefits through increased early deductions. Choosing between these methods impacts financial statements and tax obligations based on the company's strategy and asset usage.

Table of Comparison

| Depreciation Method | Linear Depreciation | Accelerated Depreciation |

|---|---|---|

| Definition | Spreads asset cost evenly over its useful life. | Allocates higher depreciation expense in early years. |

| Expense Pattern | Constant annual depreciation expense. | Declining depreciation expense over time. |

| Calculation | (Cost - Residual Value) / Useful Life | Based on a multiple of the straight-line rate or sum-of-the-years'-digits. |

| Tax Impact | Lower tax benefits upfront. | Higher tax deductions in early years. |

| Best For | Assets with consistent usage and benefit. | Assets that lose value faster early on. |

| Examples | Buildings, office furniture. | Vehicles, technology equipment. |

Understanding Car Depreciation Methods

Car depreciation methods impact the value of vehicles differently over time, with linear depreciation allocating an equal expense each year based on the car's initial cost and useful life. Accelerated depreciation methods, such as double declining balance, front-load expenses, reducing taxable income more significantly in earlier years and reflecting the faster loss of value experienced by many cars initially. Choosing the appropriate method affects financial statements, tax benefits, and accurate asset valuation for both personal and business vehicles.

What Is Linear Depreciation?

Linear depreciation allocates an equal expense amount over the useful life of an asset, ensuring consistent reduction in value each accounting period. This method calculates depreciation by subtracting the asset's residual value from its original cost, then dividing by its estimated lifespan. It offers straightforward financial planning and stable expense recognition for fixed assets.

What Is Accelerated Depreciation?

Accelerated Depreciation is a method that allows higher depreciation expenses in the early years of an asset's useful life, reducing taxable income more significantly upfront. Common techniques include Double Declining Balance and Sum-of-the-Years'-Digits, which allocate larger expenses initially compared to Linear Depreciation's equal annual allocation. This approach benefits businesses by improving cash flow and aligning depreciation with faster asset obsolescence or usage patterns.

Key Differences Between Linear and Accelerated Depreciation

Linear depreciation evenly allocates an asset's cost over its useful life, resulting in consistent annual expense amounts. Accelerated depreciation methods, such as double declining balance, record higher expenses in the early years and lower expenses later, reflecting faster loss of value. The key difference lies in the timing of expense recognition, impacting tax benefits and financial reporting strategies.

Impact on Car Resale Value

Linear depreciation results in a consistent decline in car value over time, providing predictable resale value estimates for owners. Accelerated depreciation, often used for tax advantages, significantly lowers the car's book value in the initial years, which can reduce perceived resale value when selling early. Buyers may consider accelerated depreciation as an indicator of higher wear or usage, potentially impacting the car's market price negatively compared to linear depreciation.

Pros and Cons of Linear Depreciation

Linear depreciation offers consistent expense allocation, simplifying budgeting and financial forecasting by evenly spreading the asset's cost over its useful life. It enhances clarity and predictability in financial statements but may underestimate expense in early years when asset utility or maintenance costs are higher. This method is less suitable for assets experiencing rapid obsolescence or higher initial wear, potentially leading to mismatched expense recognition and financial performance.

Pros and Cons of Accelerated Depreciation

Accelerated depreciation allows businesses to write off asset costs faster, reducing taxable income significantly in the early years of an asset's life and improving short-term cash flow. However, this method results in lower depreciation expenses in later years, potentially leading to higher tax liabilities over time. While it benefits companies seeking immediate tax relief, accelerated depreciation may complicate financial forecasting due to fluctuating expense patterns.

Suitability for Personal Use vs Business Fleets

Linear depreciation is well-suited for personal use assets, offering consistent expense allocation and simplified tax reporting, making it ideal for individuals with predictable asset usage. Accelerated depreciation benefits business fleets by front-loading expenses, improving cash flow and tax advantages during the initial years when vehicles experience higher wear and operational costs. Companies managing large fleets prefer accelerated methods such as MACRS or double declining balance to optimize financial performance and asset replacement schedules.

Tax Implications of Depreciation Methods

Linear depreciation spreads asset costs evenly over its useful life, resulting in consistent annual tax deductions that simplify financial planning. Accelerated depreciation methods, such as double declining balance, offer larger upfront tax deductions, reducing taxable income more significantly in the early years of an asset's life. This accelerated approach can improve cash flow by deferring tax liabilities, which is advantageous for businesses aiming to reinvest savings or manage short-term financial needs.

Choosing the Right Depreciation Method for Your Car

Choosing the right depreciation method for your car depends on how you use it and your financial goals. Linear depreciation spreads the cost evenly over the vehicle's useful life, making it ideal for consistent usage, while accelerated depreciation front-loads expenses, which benefits those who seek faster tax deductions or have higher initial wear and tear. Evaluating factors like mileage, usage intensity, and tax strategy helps determine whether straight-line or accelerated depreciation maximizes your car's financial efficiency.

Linear Depreciation vs Accelerated Depreciation Infographic

cardiffo.com

cardiffo.com