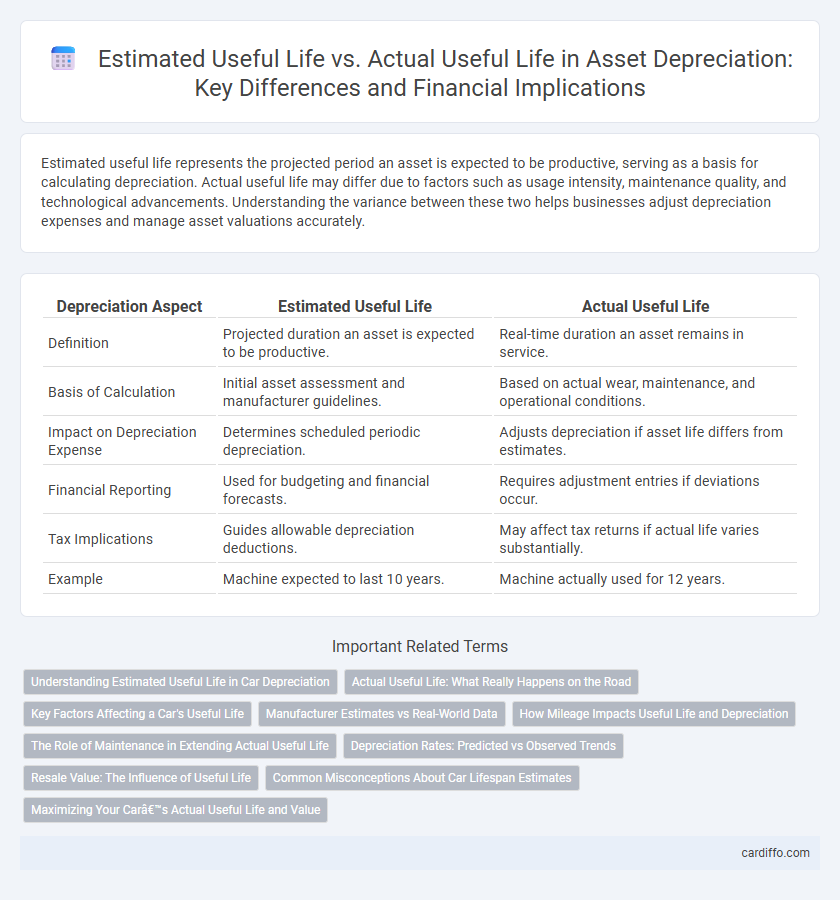

Estimated useful life represents the projected period an asset is expected to be productive, serving as a basis for calculating depreciation. Actual useful life may differ due to factors such as usage intensity, maintenance quality, and technological advancements. Understanding the variance between these two helps businesses adjust depreciation expenses and manage asset valuations accurately.

Table of Comparison

| Depreciation Aspect | Estimated Useful Life | Actual Useful Life |

|---|---|---|

| Definition | Projected duration an asset is expected to be productive. | Real-time duration an asset remains in service. |

| Basis of Calculation | Initial asset assessment and manufacturer guidelines. | Based on actual wear, maintenance, and operational conditions. |

| Impact on Depreciation Expense | Determines scheduled periodic depreciation. | Adjusts depreciation if asset life differs from estimates. |

| Financial Reporting | Used for budgeting and financial forecasts. | Requires adjustment entries if deviations occur. |

| Tax Implications | Guides allowable depreciation deductions. | May affect tax returns if actual life varies substantially. |

| Example | Machine expected to last 10 years. | Machine actually used for 12 years. |

Understanding Estimated Useful Life in Car Depreciation

Estimated Useful Life in car depreciation refers to the predicted period during which a vehicle is expected to provide economic value before it becomes obsolete or uneconomical to maintain. This estimation impacts the annual depreciation expense, influencing financial reporting and tax calculations. Actual Useful Life may vary due to factors like usage, maintenance, and market conditions, but starting with a well-researched estimate ensures more accurate asset valuation and budgeting.

Actual Useful Life: What Really Happens on the Road

Actual useful life reflects the true duration an asset remains operational and productive beyond initial estimates. Factors such as usage intensity, maintenance quality, and environmental conditions directly influence this period, often causing deviations from the estimated useful life. Understanding actual useful life enables more accurate financial forecasting, asset management, and depreciation expense recognition.

Key Factors Affecting a Car's Useful Life

Key factors affecting a car's useful life include driving habits, maintenance frequency, and environmental conditions. High mileage and harsh driving environments typically reduce the actual useful life compared to the estimated useful life. Proper maintenance and moderate usage can extend the car's lifespan beyond initial depreciation estimates.

Manufacturer Estimates vs Real-World Data

Manufacturer estimates of useful life often rely on controlled testing environments and standardized usage assumptions, which may not reflect real-world operating conditions. Actual useful life is influenced by factors such as maintenance quality, usage intensity, and environmental conditions, leading to variance from initial projections. Analyzing real-world data can provide more accurate depreciation schedules and asset management strategies.

How Mileage Impacts Useful Life and Depreciation

Mileage plays a critical role in determining the actual useful life of assets such as vehicles and machinery, often causing it to diverge from the estimated useful life. Higher mileage accelerates wear and tear, leading to increased depreciation rates and reduced asset value over time. Accurate tracking of mileage enhances depreciation expense calculations, ensuring financial statements reflect realistic asset condition and value.

The Role of Maintenance in Extending Actual Useful Life

Maintenance plays a critical role in extending the actual useful life of an asset beyond its estimated useful life by preventing wear and delaying deterioration. Regular inspections, timely repairs, and proper servicing reduce the risk of unexpected breakdowns and enhance asset reliability. Effective maintenance strategies contribute directly to depreciation calculations by potentially lowering annual depreciation expenses due to prolonged asset usability.

Depreciation Rates: Predicted vs Observed Trends

Depreciation rates often differ between estimated useful life and actual useful life due to unforeseen operational conditions and asset usage intensity. Predicted depreciation schedules typically assume uniform wear and tear, while observed trends reveal accelerated or decelerated asset value reduction influenced by maintenance and technological changes. Companies must adjust depreciation methods to reflect real-world asset performance and ensure accurate financial reporting.

Resale Value: The Influence of Useful Life

Resale value significantly impacts the calculation of both estimated and actual useful life in asset depreciation. A longer estimated useful life typically reduces annual depreciation expense by spreading the cost over more years, while a high resale value decreases the depreciable base, altering the asset's net book value. Variations between estimated and actual useful life affect financial reporting accuracy, with changes in resale value influencing reassessment of depreciation schedules.

Common Misconceptions About Car Lifespan Estimates

Estimated useful life often differs significantly from a car's actual useful life due to factors like maintenance quality, driving habits, and environmental conditions. Many assume that the manufacturer's lifespan estimate is a fixed measure, but real-world usage can extend or shorten a vehicle's longevity. Understanding the gap between estimated and actual useful life is crucial for accurate depreciation calculations and informed financial decisions regarding car ownership.

Maximizing Your Car’s Actual Useful Life and Value

Maximizing your car's actual useful life involves regular maintenance, timely repairs, and proper driving habits that prevent excessive wear and tear, ultimately preserving its value beyond initial depreciation estimates. While estimated useful life serves as a guideline for financial planning, extending the actual useful life can reduce long-term ownership costs and delay significant depreciation. Investing in quality parts and adhering to manufacturer recommendations directly contributes to sustaining the vehicle's performance and resale value.

Estimated Useful Life vs Actual Useful Life Infographic

cardiffo.com

cardiffo.com