The Actual Expense Method calculates vehicle depreciation by tracking all costs, including fuel, maintenance, insurance, and depreciation based on the vehicle's purchase price and use, providing a precise deduction amount. The Standard Mileage Rate offers a simplified deduction by multiplying the miles driven for business by a fixed rate set by the IRS, which includes an allowance for depreciation. Choosing the Actual Expense Method benefits those with higher vehicle-related expenses, while the Standard Mileage Rate suits taxpayers seeking convenience and lower record-keeping requirements.

Table of Comparison

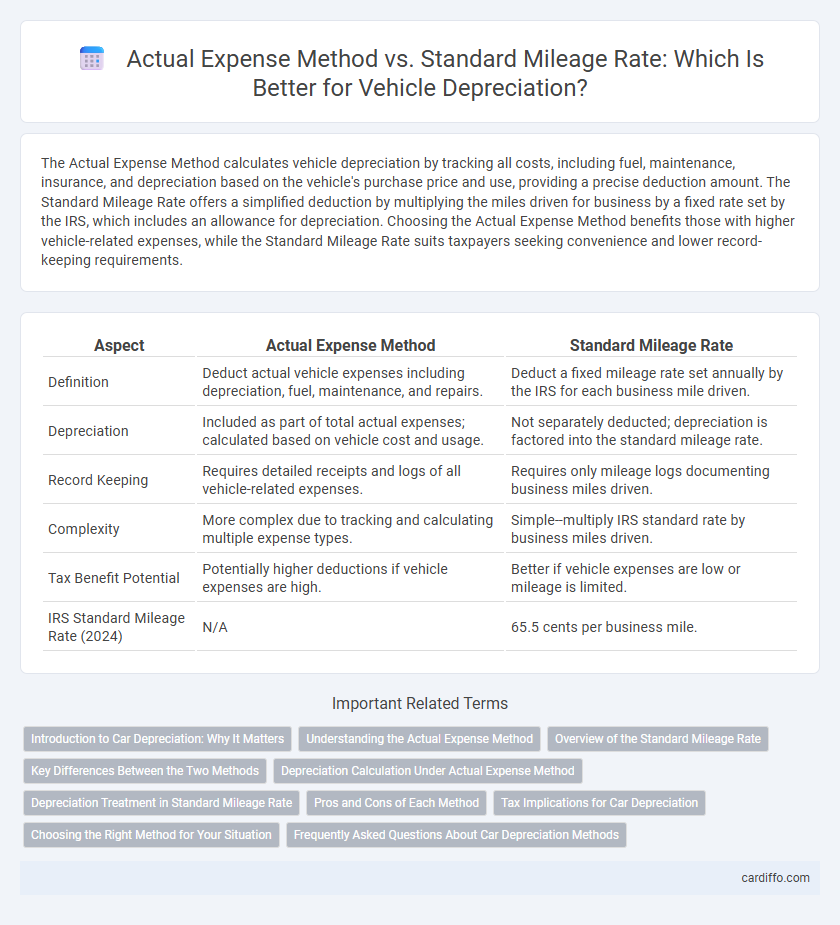

| Aspect | Actual Expense Method | Standard Mileage Rate |

|---|---|---|

| Definition | Deduct actual vehicle expenses including depreciation, fuel, maintenance, and repairs. | Deduct a fixed mileage rate set annually by the IRS for each business mile driven. |

| Depreciation | Included as part of total actual expenses; calculated based on vehicle cost and usage. | Not separately deducted; depreciation is factored into the standard mileage rate. |

| Record Keeping | Requires detailed receipts and logs of all vehicle-related expenses. | Requires only mileage logs documenting business miles driven. |

| Complexity | More complex due to tracking and calculating multiple expense types. | Simple--multiply IRS standard rate by business miles driven. |

| Tax Benefit Potential | Potentially higher deductions if vehicle expenses are high. | Better if vehicle expenses are low or mileage is limited. |

| IRS Standard Mileage Rate (2024) | N/A | 65.5 cents per business mile. |

Introduction to Car Depreciation: Why It Matters

Car depreciation plays a critical role in accurately calculating vehicle expenses for tax deductions, with the Actual Expense Method allowing taxpayers to claim depreciation based on the car's purchase price and usage, reflecting true wear and tear. The Standard Mileage Rate simplifies this by applying a fixed rate per mile, inherently including depreciation without itemizing individual costs. Understanding how depreciation affects deductible expenses ensures optimal tax benefits and compliance with IRS regulations.

Understanding the Actual Expense Method

The Actual Expense Method requires tracking all vehicle-related expenses, including fuel, maintenance, insurance, and depreciation, to determine the deductible amount for business use. This approach allows for a more precise deduction based on real costs incurred, but demands accurate recordkeeping and expense documentation throughout the tax year. Understanding depreciation under this method involves calculating the vehicle's loss in value attributable to business use, typically using the Modified Accelerated Cost Recovery System (MACRS) over the asset's recovery period.

Overview of the Standard Mileage Rate

The Standard Mileage Rate simplifies vehicle expense deductions by allowing taxpayers to multiply the business miles driven by the IRS-established rate, which incorporates depreciation, maintenance, gas, and insurance costs. For 2024, the IRS standard mileage rate is 65.5 cents per mile, designed to reflect average vehicle expense components, including depreciation. This method eliminates the need to track actual vehicle expenses, providing a straightforward alternative to the Actual Expense Method for calculating deductible vehicle costs.

Key Differences Between the Two Methods

The Actual Expense Method calculates vehicle depreciation based on the vehicle's purchase price, useful life, and mileage, allowing taxpayers to deduct actual costs such as gas, repairs, insurance, and depreciation. The Standard Mileage Rate simplifies deduction by applying a fixed rate per mile driven, incorporating depreciation and all vehicle-related expenses into one rate set annually by the IRS. Key differences include the complexity of record-keeping, with the Actual Expense Method requiring detailed receipts and logs, while the Standard Mileage Rate demands only mileage tracking.

Depreciation Calculation Under Actual Expense Method

Depreciation calculation under the Actual Expense Method involves determining the vehicle's cost basis, subtracting the salvage value, and then allocating the depreciation over the useful life using methods such as straight-line or accelerated depreciation. This approach allows for precise tracking of actual wear and tear, reflecting the vehicle's real depreciation expense according to IRS guidelines. Depreciation under the Actual Expense Method often results in higher deductible amounts compared to the Standard Mileage Rate, especially for high-cost or heavily used vehicles.

Depreciation Treatment in Standard Mileage Rate

The Standard Mileage Rate method incorporates depreciation as a fixed component within its per-mile calculation, simplifying record-keeping by avoiding separate depreciation tracking. This method assumes average wear and tear, allocating a standardized depreciation amount without itemizing actual asset cost or loss in value. In contrast, the Actual Expense Method requires detailed depreciation calculations based on the vehicle's purchase price, useful life, and residual value for precise expense reporting.

Pros and Cons of Each Method

The Actual Expense Method allows for detailed deduction of vehicle-related costs, including depreciation, maintenance, and fuel, providing potentially higher tax savings for drivers with significant expenses but requires meticulous record-keeping and receipts. The Standard Mileage Rate offers simplicity and ease of use, calculating deductions based on a fixed rate per mile driven, which may result in lower deductions if actual costs exceed the standard rate. Choosing between these methods depends on individual driving patterns, expense levels, and the ability to maintain comprehensive records for maximum tax benefit.

Tax Implications for Car Depreciation

The Actual Expense Method allows taxpayers to deduct the actual costs of vehicle depreciation based on the asset's purchase price and IRS depreciation schedules, maximizing deductions for high-value vehicles. In contrast, the Standard Mileage Rate allocates a fixed per-mile deduction that includes a depreciation component, simplifying record-keeping but often resulting in lower depreciation write-offs. Choosing between these methods impacts tax liability by influencing the total deductible depreciation expenses claimed on Schedule C or Form 2106.

Choosing the Right Method for Your Situation

Selecting between the Actual Expense Method and the Standard Mileage Rate depends on factors such as vehicle usage, maintenance costs, and record-keeping preferences. The Actual Expense Method requires detailed documentation of all vehicle-related expenses, potentially maximizing deductions for high-cost repairs and fuel consumption. Conversely, the Standard Mileage Rate offers a simplified deduction based on IRS-set rates, ideal for taxpayers seeking ease without tracking individual expenses.

Frequently Asked Questions About Car Depreciation Methods

The Actual Expense Method requires tracking all vehicle-related expenses, including depreciation, fuel, maintenance, and insurance, allowing for precise deduction calculation based on actual costs. The Standard Mileage Rate simplifies deduction by applying a fixed rate per mile driven, which already incorporates depreciation costs, eliminating the need to calculate individual vehicle expenses. Taxpayers often ask which method yields greater deductions, how to switch methods during the year, and which records to maintain for IRS compliance when claiming car depreciation.

Actual Expense Method vs Standard Mileage Rate Infographic

cardiffo.com

cardiffo.com