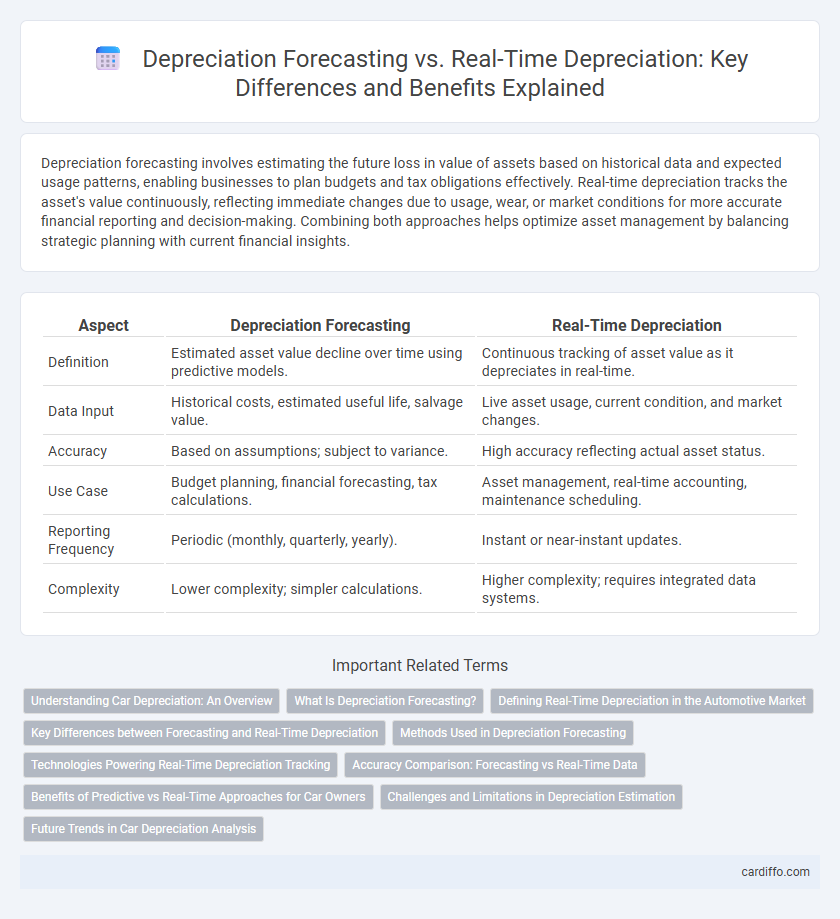

Depreciation forecasting involves estimating the future loss in value of assets based on historical data and expected usage patterns, enabling businesses to plan budgets and tax obligations effectively. Real-time depreciation tracks the asset's value continuously, reflecting immediate changes due to usage, wear, or market conditions for more accurate financial reporting and decision-making. Combining both approaches helps optimize asset management by balancing strategic planning with current financial insights.

Table of Comparison

| Aspect | Depreciation Forecasting | Real-Time Depreciation |

|---|---|---|

| Definition | Estimated asset value decline over time using predictive models. | Continuous tracking of asset value as it depreciates in real-time. |

| Data Input | Historical costs, estimated useful life, salvage value. | Live asset usage, current condition, and market changes. |

| Accuracy | Based on assumptions; subject to variance. | High accuracy reflecting actual asset status. |

| Use Case | Budget planning, financial forecasting, tax calculations. | Asset management, real-time accounting, maintenance scheduling. |

| Reporting Frequency | Periodic (monthly, quarterly, yearly). | Instant or near-instant updates. |

| Complexity | Lower complexity; simpler calculations. | Higher complexity; requires integrated data systems. |

Understanding Car Depreciation: An Overview

Car depreciation forecasting uses historical data and market trends to estimate future vehicle value loss, aiding buyers and sellers in making informed decisions. Real-time depreciation reflects current market conditions, including demand fluctuations and economic factors, providing an up-to-date valuation. Understanding both methods helps optimize timing for purchase or sale and enhances financial planning related to car ownership.

What Is Depreciation Forecasting?

Depreciation forecasting estimates the future loss in value of assets based on historical data, usage patterns, and market trends to assist in budgeting and financial planning. It leverages predictive analytics and accounting models to project asset depreciation expenses over specific periods, aiding in accurate financial reporting and asset management. This approach contrasts with real-time depreciation, which records asset value changes as they occur, providing immediate but less predictive financial insights.

Defining Real-Time Depreciation in the Automotive Market

Real-time depreciation in the automotive market refers to the dynamic calculation of a vehicle's value loss using up-to-date data from market trends, mileage, and condition assessments. This approach contrasts with traditional depreciation forecasting, which relies on historical averages and fixed schedules. Real-time depreciation enables more accurate pricing for dealerships, insurers, and buyers by reflecting current market conditions and vehicle-specific factors instantaneously.

Key Differences between Forecasting and Real-Time Depreciation

Depreciation forecasting estimates asset value loss over time using historical data and predictive algorithms, aiding in budget planning and financial projections. Real-time depreciation calculates asset value decline based on current usage and condition, offering up-to-date accuracy for immediate decision-making. Forecasting emphasizes long-term trends, while real-time depreciation provides instant insights reflecting actual asset performance.

Methods Used in Depreciation Forecasting

Depreciation forecasting primarily employs methods such as straight-line, declining balance, and units of production to estimate asset value decline over time. These methods utilize historical data, estimated useful life, and residual value to project future depreciation expenses accurately. Real-time depreciation, in contrast, adjusts calculations continuously based on up-to-date asset usage and market conditions, providing more precise financial insights.

Technologies Powering Real-Time Depreciation Tracking

Real-time depreciation tracking leverages advanced technologies like IoT sensors, machine learning algorithms, and cloud computing to provide continuous, accurate asset value updates. These technologies enable dynamic asset management by capturing usage data and condition changes instantly, unlike traditional forecasting methods that rely on periodic estimates and historical data. Integrating real-time data analytics with ERP systems enhances precision in financial reporting and asset lifecycle management, optimizing decision-making processes.

Accuracy Comparison: Forecasting vs Real-Time Data

Depreciation forecasting relies on predictive models using historical asset data and assumptions about future usage, which can introduce estimation errors and reduce accuracy over time. Real-time depreciation calculates asset value adjustments continuously based on current usage, condition, and market factors, resulting in more precise and up-to-date financial reporting. Comparing both, real-time depreciation provides greater accuracy by reflecting actual asset wear and market changes, whereas forecasting is prone to discrepancies due to its reliance on static projections.

Benefits of Predictive vs Real-Time Approaches for Car Owners

Predictive depreciation forecasting allows car owners to anticipate vehicle value declines based on historical data and market trends, enabling informed decisions on buying, selling, or trading vehicles proactively. Real-time depreciation tracking offers accurate, instant updates reflecting current market conditions and vehicle usage, ensuring owners have precise asset valuations at any moment. Using predictive models can optimize financial planning and negotiation strategies, while real-time data enhances transparency and responsiveness to market fluctuations.

Challenges and Limitations in Depreciation Estimation

Depreciation forecasting involves predicting asset value decline over time using models that often face limitations from market volatility, changes in asset usage, and unexpected wear and tear. Real-time depreciation provides ongoing adjustments based on actual asset conditions but struggles with data accuracy, sensor reliability, and integration complexities. Both methods encounter challenges in capturing true economic value due to fluctuating residual values and evolving regulatory requirements.

Future Trends in Car Depreciation Analysis

Future trends in car depreciation analysis emphasize the integration of real-time depreciation data driven by advanced telematics and AI algorithms, enabling more precise vehicle valuation. Depreciation forecasting models increasingly leverage machine learning to predict resale values based on dynamic factors such as mileage, condition, market demand, and macroeconomic indicators. This shift from traditional forecasting to real-time analytics enhances accuracy in depreciation estimation, supporting better decision-making for buyers, sellers, and fleet managers.

Depreciation Forecasting vs Real-Time Depreciation Infographic

cardiffo.com

cardiffo.com