Cap Cost Reduction lowers the initial capitalized cost of a lease, directly reducing monthly depreciation fees and overall lease payments. Depreciation fees represent the loss in vehicle value over the lease term and form the bulk of the monthly payment. A larger Cap Cost Reduction decreases the depreciation fee, making the lease more affordable by lowering the amount financed.

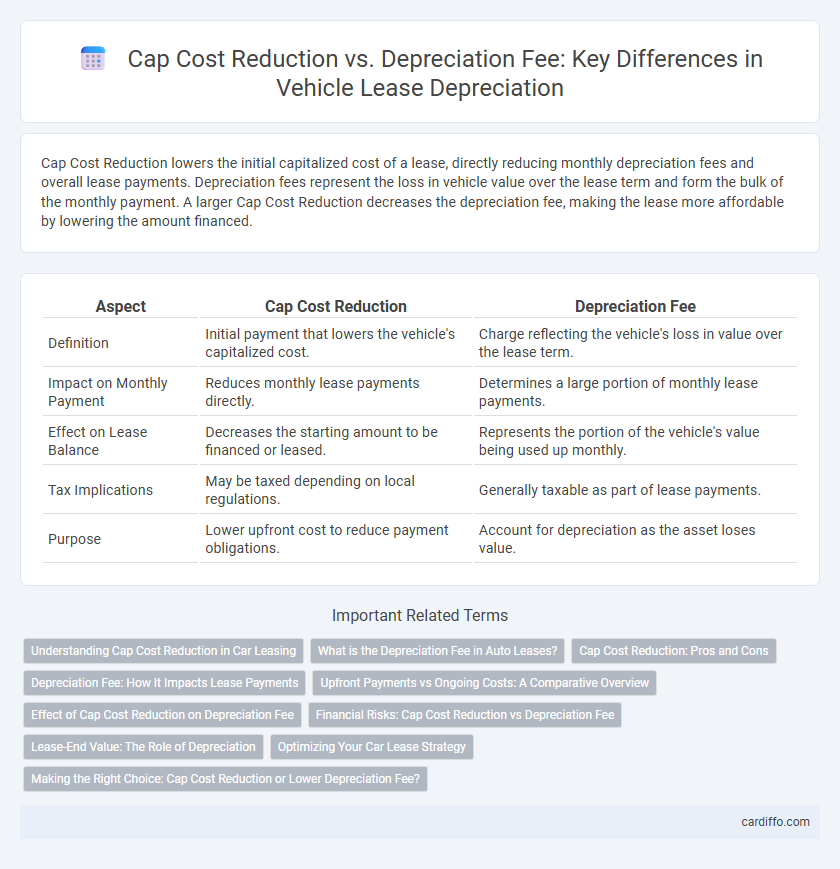

Table of Comparison

| Aspect | Cap Cost Reduction | Depreciation Fee |

|---|---|---|

| Definition | Initial payment that lowers the vehicle's capitalized cost. | Charge reflecting the vehicle's loss in value over the lease term. |

| Impact on Monthly Payment | Reduces monthly lease payments directly. | Determines a large portion of monthly lease payments. |

| Effect on Lease Balance | Decreases the starting amount to be financed or leased. | Represents the portion of the vehicle's value being used up monthly. |

| Tax Implications | May be taxed depending on local regulations. | Generally taxable as part of lease payments. |

| Purpose | Lower upfront cost to reduce payment obligations. | Account for depreciation as the asset loses value. |

Understanding Cap Cost Reduction in Car Leasing

Cap Cost Reduction in car leasing lowers the upfront amount financed, directly reducing monthly lease payments and overall interest costs. Unlike the depreciation fee, which reflects the vehicle's value lost over the lease term, Cap Cost Reduction applies as a down payment that decreases the adjusted capitalized cost. This upfront payment enhances lease affordability by minimizing the principal balance subject to depreciation and finance charges.

What is the Depreciation Fee in Auto Leases?

The depreciation fee in auto leases represents the portion of a vehicle's value that decreases over the lease term, which the lessee repays as part of monthly payments. It is calculated by subtracting the vehicle's residual value at lease-end from its initial capitalized cost, divided by the lease duration. Understanding the depreciation fee helps lessees gauge how much value the car loses during their lease and influences overall lease affordability.

Cap Cost Reduction: Pros and Cons

Cap Cost Reduction lowers the initial lease amount, reducing monthly payments and overall interest but decreases the amount refundable if the vehicle is totaled or stolen. It improves cash flow by minimizing upfront financial commitment but risks losing money if early lease termination occurs. Balancing reduced monthly fees with potential financial exposure is crucial in deciding whether to apply Cap Cost Reduction in a lease agreement.

Depreciation Fee: How It Impacts Lease Payments

Depreciation fee directly impacts lease payments by representing the vehicle's estimated loss in value over the lease term, which the lessee effectively finances. This fee is calculated based on the difference between the vehicle's capitalized cost and its residual value at lease-end. Higher depreciation fees result in increased monthly payments, making understanding this component essential for managing overall lease costs.

Upfront Payments vs Ongoing Costs: A Comparative Overview

Cap Cost Reduction represents an upfront payment that lowers the principal amount of a lease or loan, directly reducing monthly depreciation fees and overall finance charges. Depreciation fee, calculated based on the vehicle's expected loss in value over the lease term, constitutes an ongoing cost that spreads the expense evenly across monthly payments. Understanding the balance between a larger upfront Cap Cost Reduction and manageable monthly depreciation fees helps optimize cash flow and total cost of ownership.

Effect of Cap Cost Reduction on Depreciation Fee

Cap cost reduction directly lowers the vehicle's adjusted capitalized cost, which in turn reduces the depreciation fee in lease calculations. A lower depreciation fee means lease payments decrease since less value is lost over the term. Effectively, cap cost reduction minimizes the amount subject to depreciation, optimizing monthly lease expenses.

Financial Risks: Cap Cost Reduction vs Depreciation Fee

Cap Cost Reduction lowers the initial financed amount, reducing monthly payments but increases financial risk if the vehicle is totaled early, as the upfront payment is less likely to be recovered. Depreciation Fee reflects the vehicle's actual value loss over the lease term, aligning monthly costs with the asset's real-time worth and minimizing exposure to negative equity. Comparing these, Cap Cost Reduction transfers risk to the lessee upfront, while the Depreciation Fee spreads the risk evenly, improving financial predictability throughout the lease period.

Lease-End Value: The Role of Depreciation

Cap Cost Reduction lowers the initial lease amount, reducing monthly payments but does not affect the vehicle's depreciated value at lease-end. Depreciation Fee represents the true lease-end value loss, calculated by the difference between the vehicle's capitalized cost and its residual value. Understanding depreciation's role helps lessees anticipate lease-end costs and negotiate better terms based on expected residual values.

Optimizing Your Car Lease Strategy

Cap Cost Reduction lowers the adjusted capitalized cost of your leased vehicle, directly reducing monthly lease payments by minimizing the amount depreciated over the lease term. The Depreciation Fee represents the portion of the vehicle's value lost during the lease and is a primary component of your monthly payment calculation. Strategically balancing Cap Cost Reduction with expected Depreciation Fee optimizes your car lease payments and overall financial efficiency.

Making the Right Choice: Cap Cost Reduction or Lower Depreciation Fee?

Choosing between a Cap Cost Reduction and a lower Depreciation Fee depends on your financial goals and cash flow preferences. A higher Cap Cost Reduction reduces your principal balance, leading to lower monthly payments, while a lower Depreciation Fee spreads out the vehicle's loss in value more evenly, impacting long-term costs. Evaluating factors like upfront cash availability, lease term, and anticipated vehicle usage ensures an informed decision that optimizes total lease expenses.

Cap Cost Reduction vs Depreciation Fee Infographic

cardiffo.com

cardiffo.com