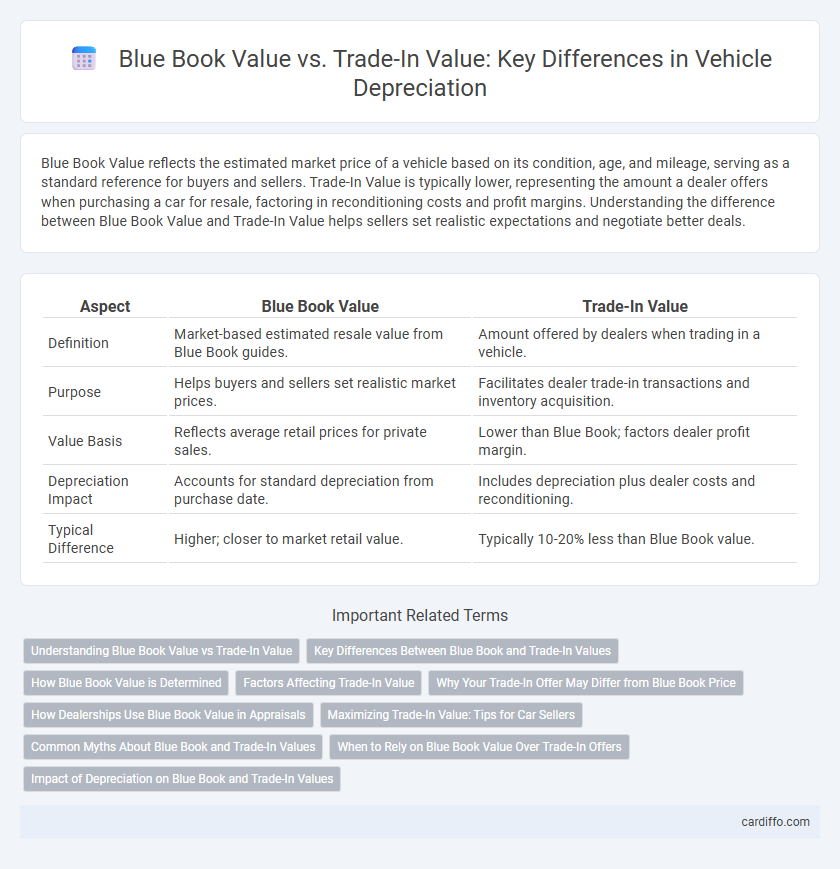

Blue Book Value reflects the estimated market price of a vehicle based on its condition, age, and mileage, serving as a standard reference for buyers and sellers. Trade-In Value is typically lower, representing the amount a dealer offers when purchasing a car for resale, factoring in reconditioning costs and profit margins. Understanding the difference between Blue Book Value and Trade-In Value helps sellers set realistic expectations and negotiate better deals.

Table of Comparison

| Aspect | Blue Book Value | Trade-In Value |

|---|---|---|

| Definition | Market-based estimated resale value from Blue Book guides. | Amount offered by dealers when trading in a vehicle. |

| Purpose | Helps buyers and sellers set realistic market prices. | Facilitates dealer trade-in transactions and inventory acquisition. |

| Value Basis | Reflects average retail prices for private sales. | Lower than Blue Book; factors dealer profit margin. |

| Depreciation Impact | Accounts for standard depreciation from purchase date. | Includes depreciation plus dealer costs and reconditioning. |

| Typical Difference | Higher; closer to market retail value. | Typically 10-20% less than Blue Book value. |

Understanding Blue Book Value vs Trade-In Value

Blue Book Value represents the estimated market value of a vehicle based on extensive market data, including age, condition, mileage, and regional demand, while Trade-In Value reflects the amount a dealer offers when exchanging a vehicle toward the purchase of another. Blue Book Value often exceeds Trade-In Value because dealers factor in reconditioning costs and profit margins. Understanding the difference between these values helps sellers set realistic expectations and negotiate effectively during vehicle transactions.

Key Differences Between Blue Book and Trade-In Values

Blue Book Value represents a standardized market estimate based on historical sales data, reflecting the fair retail price of a vehicle in optimal condition. Trade-In Value is typically lower, accounting for dealer profit margins and immediate resale costs, offering a realistic figure for selling a car directly to a dealership. The key difference lies in Blue Book's role as a guide for private sales or insurance assessments, while Trade-In Value is a practical offer influenced by dealer costs and market demand.

How Blue Book Value is Determined

Blue Book Value is determined through a systematic analysis of vehicle data including make, model, year, mileage, condition, and market trends to provide an accurate estimate of a car's worth. It incorporates regional pricing variations, historical sales data, and depreciation rates to reflect the vehicle's current market value. This value serves as a benchmark that dealerships and private sellers use to set competitive prices and negotiate fair trade-in offers.

Factors Affecting Trade-In Value

Trade-in value is influenced by vehicle condition, mileage, market demand, and regional popularity, which often causes it to differ from the Blue Book value that represents an estimated average retail price. Factors such as wear and tear, accident history, and service records directly impact trade-in offers from dealers. Seasonal trends and current fuel prices also play crucial roles in determining the vehicle's trade-in value, making it fluctuate independently from the Blue Book value.

Why Your Trade-In Offer May Differ from Blue Book Price

Trade-in offers often differ from Blue Book value due to dealer overhead costs, market demand fluctuations, and vehicle condition assessments that go beyond standard depreciation metrics. Blue Book values provide a general estimation based on average market data, while trade-in offers reflect real-time dealer inventory needs and potential repair expenses. Understanding these factors helps explain why trade-in values may be lower than Blue Book prices.

How Dealerships Use Blue Book Value in Appraisals

Dealerships rely on Blue Book Value as a benchmark during vehicle appraisals to determine fair market prices based on factors such as make, model, year, mileage, and condition. This standardized assessment helps dealerships offer competitive trade-in values while ensuring profitability in resale. Blue Book Value incorporates regional demand data and historical sales trends, distinguishing it from Trade-In Value, which may fluctuate based on the dealership's inventory needs and negotiation factors.

Maximizing Trade-In Value: Tips for Car Sellers

Maximizing trade-in value starts with understanding the difference between Blue Book value and trade-in offers, as Blue Book value reflects ideal market conditions while trade-in value often accounts for dealer costs and reconditioning. Sellers should maintain detailed service records, ensure the car is clean and in good repair, and time the trade-in when demand for the specific make and model is high to boost offers. Researching multiple dealers and negotiating based on both Blue Book and current market trends further increases the chances of obtaining a favorable trade-in value.

Common Myths About Blue Book and Trade-In Values

Blue Book Value often gets mistaken as the absolute price a vehicle will fetch, but it merely provides a baseline based on vehicle condition, mileage, and market trends, not a guaranteed sale price. Trade-In Value is typically lower than Blue Book due to dealer overhead, reconditioning costs, and immediate resale considerations. Many believe both values are fixed and universally accepted; however, they vary widely depending on geographic location, demand, and individual dealer policies.

When to Rely on Blue Book Value Over Trade-In Offers

Blue Book Value provides a standardized estimate of a vehicle's worth based on extensive market data, making it reliable for setting realistic expectations during depreciation assessments. Trade-In Value often reflects dealer incentives and immediate resale potential, which may undervalue the car when depreciation is a primary concern. Rely on Blue Book Value over trade-in offers when accuracy in tracking depreciation and long-term value trends is essential for financial planning.

Impact of Depreciation on Blue Book and Trade-In Values

Depreciation significantly reduces both Blue Book and trade-in values, but the Blue Book value typically reflects a more comprehensive assessment of market conditions and vehicle condition, resulting in a higher valuation. Trade-in values are often lower than Blue Book values because dealerships factor in immediate resale costs and profit margins, further impacted by depreciation rates specific to make, model, and age. Understanding how depreciation influences these values helps sellers and buyers make informed decisions in the used car market.

Blue Book Value vs Trade-In Value Infographic

cardiffo.com

cardiffo.com