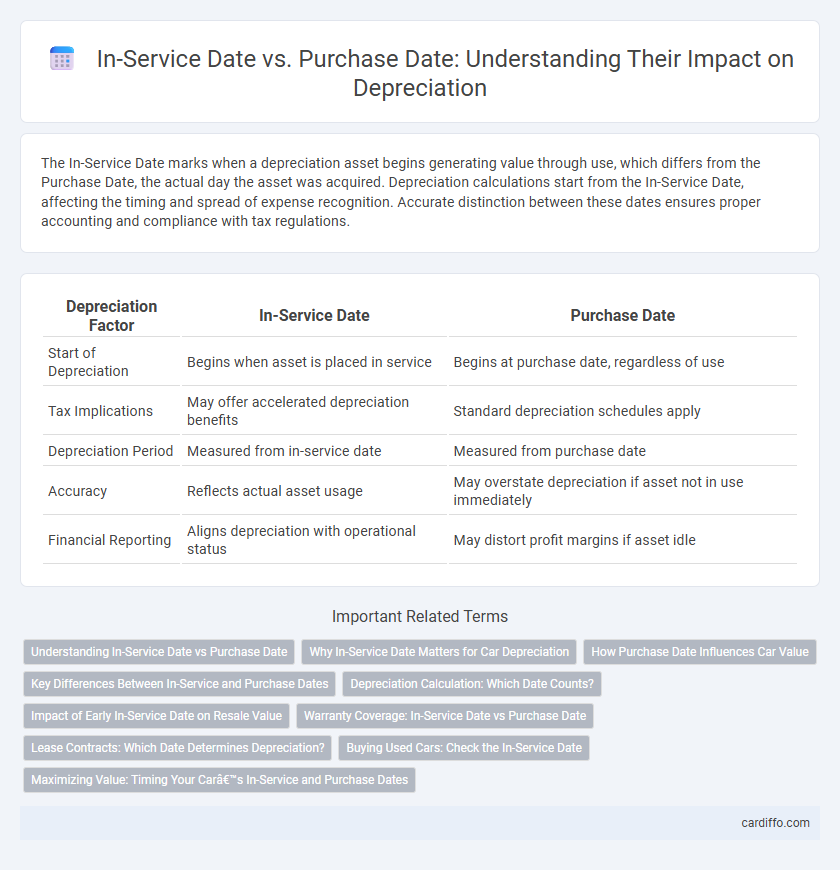

The In-Service Date marks when a depreciation asset begins generating value through use, which differs from the Purchase Date, the actual day the asset was acquired. Depreciation calculations start from the In-Service Date, affecting the timing and spread of expense recognition. Accurate distinction between these dates ensures proper accounting and compliance with tax regulations.

Table of Comparison

| Depreciation Factor | In-Service Date | Purchase Date |

|---|---|---|

| Start of Depreciation | Begins when asset is placed in service | Begins at purchase date, regardless of use |

| Tax Implications | May offer accelerated depreciation benefits | Standard depreciation schedules apply |

| Depreciation Period | Measured from in-service date | Measured from purchase date |

| Accuracy | Reflects actual asset usage | May overstate depreciation if asset not in use immediately |

| Financial Reporting | Aligns depreciation with operational status | May distort profit margins if asset idle |

Understanding In-Service Date vs Purchase Date

The in-service date marks when an asset is first placed into use, which determines the start of its depreciation period for accounting purposes. The purchase date refers to the date an asset is acquired but may precede the in-service date if the asset is held in inventory or under installation. Depreciation calculations depend on the in-service date rather than the purchase date, as it reflects the asset's actual usage and economic benefit commencement.

Why In-Service Date Matters for Car Depreciation

The in-service date determines when a car begins to depreciate for tax and accounting purposes, which can differ significantly from the purchase date. Depreciation schedules and allowable deductions are calculated starting from the in-service date, impacting financial reporting and tax liability. Accurately tracking the in-service date ensures proper compliance with IRS rules and maximizes depreciation benefits.

How Purchase Date Influences Car Value

The purchase date significantly influences a car's depreciation rate by marking the starting point for calculating loss in value over time. Vehicles bought during peak market seasons or new model releases often maintain higher resale values compared to those purchased during off-peak periods. Understanding the purchase date helps accurately assess a car's current market value and projected depreciation trajectory.

Key Differences Between In-Service and Purchase Dates

The in-service date marks when an asset begins generating economic benefits and is available for use, whereas the purchase date refers to when the asset is acquired or paid for. Depreciation calculations commence from the in-service date, impacting expense recognition and financial reporting timelines. Distinguishing these dates ensures accurate asset valuation and compliance with accounting standards like GAAP and IFRS.

Depreciation Calculation: Which Date Counts?

Depreciation calculation depends primarily on the in-service date, as this marks when the asset starts generating economic benefits. The purchase date is secondary and does not determine the commencement of depreciation. Accurate tracking of the in-service date ensures compliance with accounting standards and precise financial reporting.

Impact of Early In-Service Date on Resale Value

An early in-service date accelerates the start of an asset's depreciation schedule, reducing its book value sooner compared to its purchase date. This earlier depreciation often leads to a lower recorded value at the time of resale, potentially diminishing the asset's market appeal. Understanding the timing difference between purchase and in-service dates is crucial for accurately forecasting resale value and optimizing financial reporting.

Warranty Coverage: In-Service Date vs Purchase Date

Warranty coverage typically begins on the In-Service Date rather than the Purchase Date, affecting the effective period of asset protection and potential repair costs. Companies must align depreciation schedules with the In-Service Date to accurately reflect asset usage and warranty status for financial reporting. Misalignment between these dates may lead to discrepancies in warranty claims and asset valuation.

Lease Contracts: Which Date Determines Depreciation?

In lease contracts, depreciation is typically calculated starting from the in-service date rather than the purchase date, as this reflects when the asset begins generating economic benefits. The in-service date marks the commencement of asset usage, making it the relevant basis for allocating depreciation expense. Lease accounting standards emphasize this timing to ensure accurate matching of costs with revenue periods.

Buying Used Cars: Check the In-Service Date

When buying used cars, the in-service date is crucial for accurate depreciation calculation as it marks when the vehicle began its operational life. Depreciation schedules start from the in-service date rather than the purchase date, affecting the remaining useful life and tax deductions. Understanding this distinction helps buyers assess true asset value and optimize financial planning.

Maximizing Value: Timing Your Car’s In-Service and Purchase Dates

Maximizing depreciation benefits depends on the strategic alignment of your car's in-service date and purchase date, as the in-service date marks when depreciation begins for tax purposes. Choosing an in-service date soon after the purchase date ensures you start claiming deductions earlier, optimizing the vehicle's useful life for tax benefits. Careful planning around these dates can enhance cash flow management by accelerating depreciation expenses without violating IRS regulations.

In-Service Date vs Purchase Date Infographic

cardiffo.com

cardiffo.com