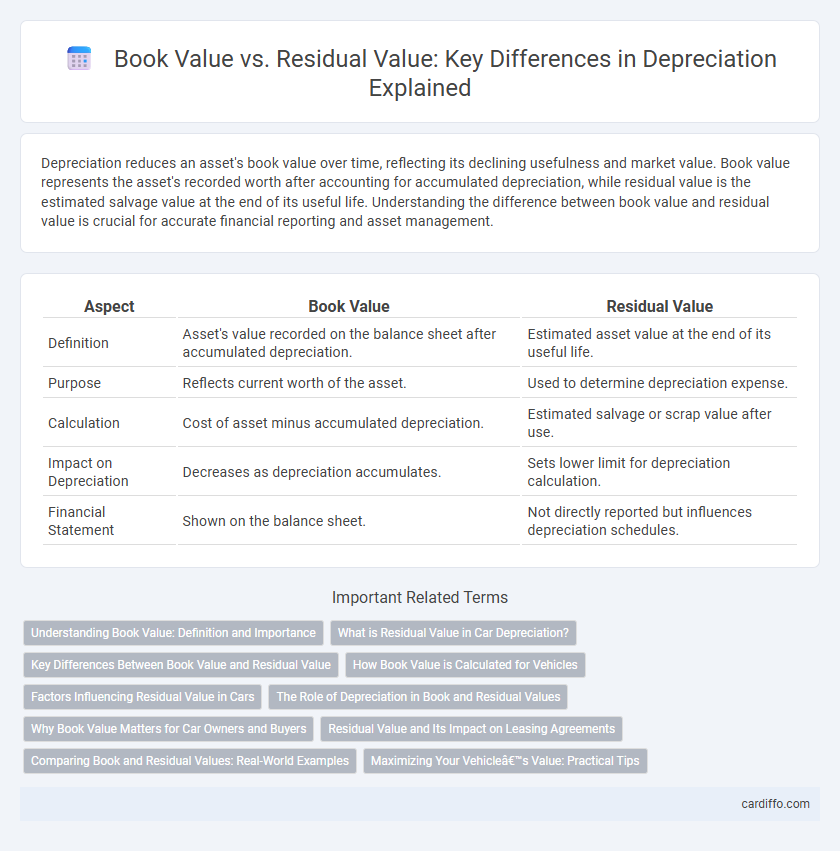

Depreciation reduces an asset's book value over time, reflecting its declining usefulness and market value. Book value represents the asset's recorded worth after accounting for accumulated depreciation, while residual value is the estimated salvage value at the end of its useful life. Understanding the difference between book value and residual value is crucial for accurate financial reporting and asset management.

Table of Comparison

| Aspect | Book Value | Residual Value |

|---|---|---|

| Definition | Asset's value recorded on the balance sheet after accumulated depreciation. | Estimated asset value at the end of its useful life. |

| Purpose | Reflects current worth of the asset. | Used to determine depreciation expense. |

| Calculation | Cost of asset minus accumulated depreciation. | Estimated salvage or scrap value after use. |

| Impact on Depreciation | Decreases as depreciation accumulates. | Sets lower limit for depreciation calculation. |

| Financial Statement | Shown on the balance sheet. | Not directly reported but influences depreciation schedules. |

Understanding Book Value: Definition and Importance

Book value represents the asset's recorded value on the balance sheet after accounting for accumulated depreciation, reflecting its current worth to the business. It is crucial for accurate financial reporting, asset management, and assessing depreciation impact over time. Understanding book value enables companies to make informed decisions regarding asset replacement and investment strategies.

What is Residual Value in Car Depreciation?

Residual value in car depreciation represents the estimated amount a vehicle is worth at the end of its useful life or lease term, reflecting the expected market value after accounting for wear, mileage, and aging. It differs from book value, which is the vehicle's value recorded on the accounting books after deducting accumulated depreciation. Accurate residual value estimation is critical for leasing agreements, resale pricing, and calculating depreciation expenses.

Key Differences Between Book Value and Residual Value

Book value represents the asset's recorded value on the balance sheet after accounting for accumulated depreciation, reflecting the net cost over time. Residual value, also known as salvage value, is the estimated amount an asset is expected to be worth at the end of its useful life. Key differences include book value fluctuating annually with depreciation charges, while residual value remains a fixed estimate used to calculate total depreciation expense.

How Book Value is Calculated for Vehicles

Book value for vehicles is calculated by subtracting accumulated depreciation from the original purchase price, reflecting the asset's current worth on the balance sheet. This calculation accounts for the vehicle's usage, age, and wear, providing a realistic valuation over time. Residual value, often predetermined, represents the estimated salvage or resale value at the end of the asset's useful life, differing from the fluctuating book value during ownership.

Factors Influencing Residual Value in Cars

Residual value in cars is influenced by factors such as brand reputation, vehicle condition, mileage, and market demand. Economic trends, technological advancements, and changes in fuel efficiency standards also significantly affect the projected resale price. Understanding these variables helps accurately estimate a car's residual value compared to its book value during depreciation calculations.

The Role of Depreciation in Book and Residual Values

Depreciation systematically reduces an asset's book value over its useful life, reflecting the asset's consumption and wear. The book value represents the asset's net carrying amount, calculated as its original cost minus accumulated depreciation. Residual value, also known as salvage value, is the estimated amount an asset is expected to be worth at the end of its useful life, serving as the baseline for calculating total depreciation.

Why Book Value Matters for Car Owners and Buyers

Book value represents the current worth of a car after accounting for depreciation, directly influencing insurance claims and resale prices. Residual value is an estimate of a car's worth at the end of a lease or its useful life, often used for financing decisions. Understanding book value helps car owners make informed decisions about maintenance, trade-ins, and potential financial losses while guiding buyers on fair market prices.

Residual Value and Its Impact on Leasing Agreements

Residual value represents the estimated worth of an asset at the end of a lease term, directly influencing lease payment calculations and financial planning. Accurate determination of residual value ensures realistic asset depreciation, affecting lessee's cost-efficiency and lessor's risk management. Variations in residual value assumptions can significantly alter the total lease expense, impacting balance sheet representations and tax deductions.

Comparing Book and Residual Values: Real-World Examples

Book value represents the asset's recorded worth after accounting for accumulated depreciation, while residual value is the estimated salvage amount at the end of its useful life. For example, a company may purchase machinery for $100,000 with a residual value of $10,000; after five years, its book value might be $30,000 based on depreciation schedules, highlighting the difference between accounting valuation and expected market salvage. Understanding this comparison helps businesses accurately plan asset replacement strategies and financial forecasts.

Maximizing Your Vehicle’s Value: Practical Tips

Book value represents the current worth of your vehicle after accounting for depreciation, while residual value is the estimated future value at the end of a lease or ownership period. Maximizing your vehicle's value involves regular maintenance, timely repairs, and keeping detailed service records to preserve both book and residual values. Protect your vehicle from excessive wear and environmental damage to enhance its resale potential and lease-end residual value.

Book Value vs Residual Value Infographic

cardiffo.com

cardiffo.com