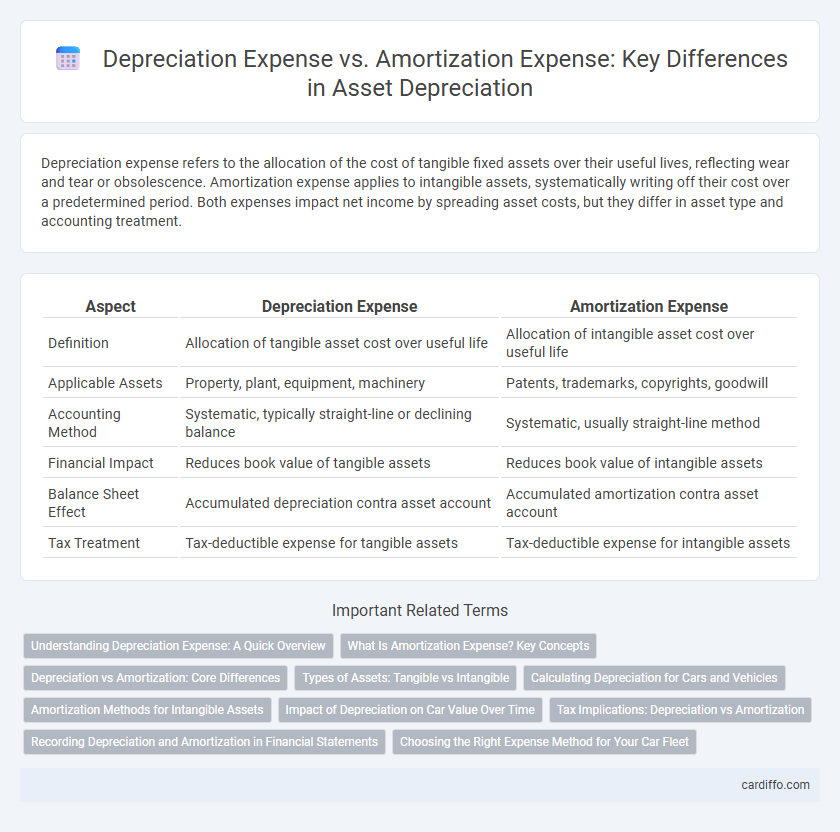

Depreciation expense refers to the allocation of the cost of tangible fixed assets over their useful lives, reflecting wear and tear or obsolescence. Amortization expense applies to intangible assets, systematically writing off their cost over a predetermined period. Both expenses impact net income by spreading asset costs, but they differ in asset type and accounting treatment.

Table of Comparison

| Aspect | Depreciation Expense | Amortization Expense |

|---|---|---|

| Definition | Allocation of tangible asset cost over useful life | Allocation of intangible asset cost over useful life |

| Applicable Assets | Property, plant, equipment, machinery | Patents, trademarks, copyrights, goodwill |

| Accounting Method | Systematic, typically straight-line or declining balance | Systematic, usually straight-line method |

| Financial Impact | Reduces book value of tangible assets | Reduces book value of intangible assets |

| Balance Sheet Effect | Accumulated depreciation contra asset account | Accumulated amortization contra asset account |

| Tax Treatment | Tax-deductible expense for tangible assets | Tax-deductible expense for intangible assets |

Understanding Depreciation Expense: A Quick Overview

Depreciation expense represents the allocation of the cost of tangible fixed assets like machinery, buildings, and vehicles over their useful lives, reflecting their usage and wear. It follows systematic methods such as straight-line or declining balance to match expense recognition with revenue generation periods. This accounting practice ensures accurate financial reporting by gradually reducing the asset's book value in line with its operational lifespan.

What Is Amortization Expense? Key Concepts

Amortization expense refers to the systematic allocation of the cost of an intangible asset over its useful life, reflecting the consumption of economic benefits. Key concepts include the gradual expense recognition for assets such as patents, copyrights, trademarks, and goodwill, following accounting standards like GAAP or IFRS. Unlike depreciation, which applies to tangible assets, amortization expense ensures accurate matching of intangible asset costs with related revenue periods.

Depreciation vs Amortization: Core Differences

Depreciation expense refers to the allocation of the cost of tangible fixed assets, such as machinery and buildings, over their useful lives, whereas amortization expense applies to intangible assets like patents and copyrights. Depreciation typically uses methods like straight-line or declining balance to systematically reduce asset value, while amortization usually employs a straight-line approach. The core difference lies in the asset types involved--tangible for depreciation and intangible for amortization--and the accounting treatment that reflects asset consumption or expiration over time.

Types of Assets: Tangible vs Intangible

Depreciation expense applies to tangible assets such as machinery, buildings, and vehicles, reflecting the allocation of their cost over useful life due to wear and tear. Amortization expense, on the other hand, pertains to intangible assets like patents, trademarks, and copyrights, spreading their cost systematically over their estimated useful life. Understanding the distinction between these expenses is crucial for accurate financial reporting and asset valuation.

Calculating Depreciation for Cars and Vehicles

Depreciation expense for cars and vehicles is calculated using methods such as the straight-line, declining balance, or units of production approaches, based on the vehicle's initial cost, estimated salvage value, and useful life. Unlike amortization expense, which applies primarily to intangible assets, depreciation expense allocates the tangible asset's cost over time to reflect wear, tear, and obsolescence. Accurate calculation of vehicle depreciation is essential for tax reporting, financial statements, and fleet management efficiency.

Amortization Methods for Intangible Assets

Amortization expense applies to intangible assets such as patents, copyrights, and trademarks, utilizing systematic methods like the straight-line method to allocate cost over the asset's useful life. The straight-line amortization method evenly spreads the cost, ensuring consistent expense recognition throughout the asset's duration. Other methods, though less common for intangible assets, may include units-of-production or sum-of-the-years-digits if they better match the asset's consumption pattern.

Impact of Depreciation on Car Value Over Time

Depreciation expense represents the allocation of a vehicle's cost over its useful life, directly reducing the car's book value on financial statements each year. This expense reflects the wear and tear, usage, and aging of the vehicle, causing the market value of the car to decrease progressively over time. Unlike amortization expense, which applies to intangible assets, depreciation specifically impacts tangible assets like automobiles, influencing resale value and tax deductions.

Tax Implications: Depreciation vs Amortization

Depreciation expense allows businesses to deduct the cost of tangible assets over their useful lives, reducing taxable income and providing significant tax deferral benefits. Amortization expense applies to intangible assets, enabling the systematic allocation of asset costs for tax purposes, often following a fixed schedule like 15 years for goodwill under IRS rules. Both methods impact tax liabilities differently, with depreciation often offering accelerated tax benefits through methods like MACRS, while amortization typically follows straight-line deductions.

Recording Depreciation and Amortization in Financial Statements

Depreciation expense reflects the systematic allocation of the cost of tangible assets such as machinery and buildings over their useful lives, while amortization expense accounts for the gradual write-off of intangible assets like patents and goodwill. Both expenses are recorded on the income statement, reducing net income, and accumulated depreciation or amortization is reported on the balance sheet as a contra asset account, offsetting the related asset's book value. Accurate recording of these expenses ensures proper matching of asset costs with revenue generation and compliance with accounting standards such as GAAP or IFRS.

Choosing the Right Expense Method for Your Car Fleet

Depreciation expense applies to tangible assets like vehicles, allocating the car fleet's cost over its useful life to capture wear and tear accurately. Amortization expense is reserved for intangible assets, making depreciation the appropriate method for fleet vehicles. Selecting depreciation ensures precise financial reporting and tax benefits related to your car fleet's usage and lifespan.

Depreciation Expense vs Amortization Expense Infographic

cardiffo.com

cardiffo.com