Fair market value represents the price a willing buyer would pay a willing seller under normal conditions, reflecting the true worth of a vehicle. Trade-in value is typically lower, as dealerships offer this amount considering reconditioning costs and resale margins. Understanding the difference between these values is crucial for pet owners managing depreciation when trading in a vehicle.

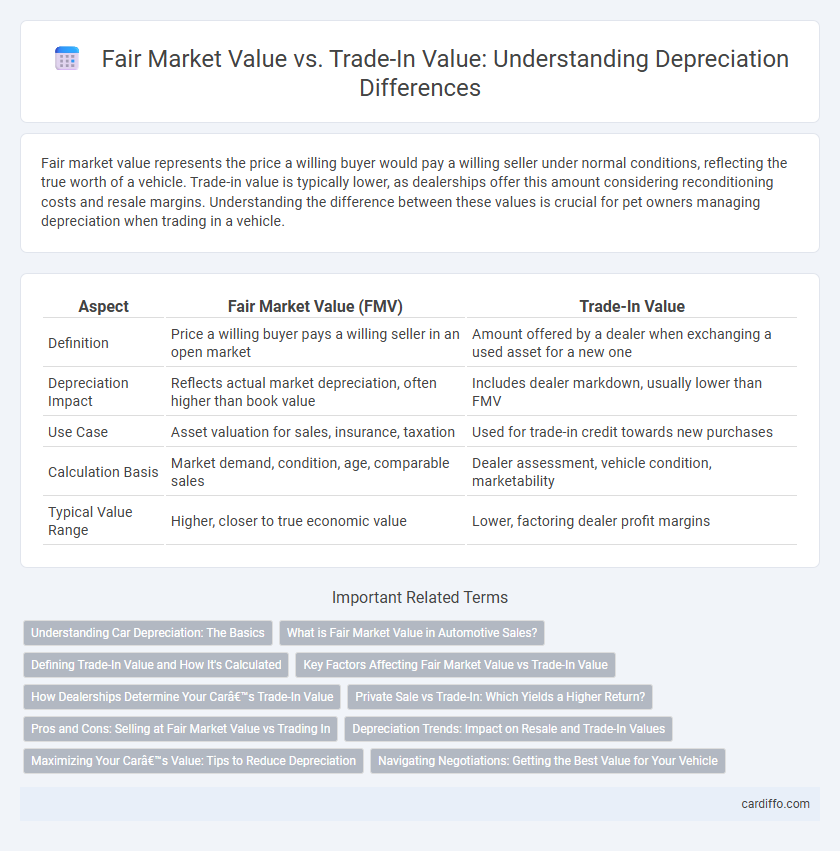

Table of Comparison

| Aspect | Fair Market Value (FMV) | Trade-In Value |

|---|---|---|

| Definition | Price a willing buyer pays a willing seller in an open market | Amount offered by a dealer when exchanging a used asset for a new one |

| Depreciation Impact | Reflects actual market depreciation, often higher than book value | Includes dealer markdown, usually lower than FMV |

| Use Case | Asset valuation for sales, insurance, taxation | Used for trade-in credit towards new purchases |

| Calculation Basis | Market demand, condition, age, comparable sales | Dealer assessment, vehicle condition, marketability |

| Typical Value Range | Higher, closer to true economic value | Lower, factoring dealer profit margins |

Understanding Car Depreciation: The Basics

Fair Market Value represents the price a vehicle would sell for under normal conditions between willing buyers and sellers, reflecting current market demand. Trade-In Value typically falls below the Fair Market Value, accounting for dealer costs, reconditioning, and immediate resale potential. Understanding the difference is crucial for accurately assessing car depreciation and negotiating vehicle sales or trades effectively.

What is Fair Market Value in Automotive Sales?

Fair Market Value in automotive sales represents the estimated price a vehicle would fetch in an open and competitive market between a willing buyer and seller, both having reasonable knowledge of the car's condition and history. This value is typically determined using comprehensive data such as recent sales of similar vehicles, vehicle condition, mileage, and market demand. Unlike Trade-In Value, which is often lower and influenced by dealer costs and profit margins, Fair Market Value reflects a more accurate representation of the car's worth in a private sale.

Defining Trade-In Value and How It's Calculated

Trade-in value is the amount a dealer offers for a used vehicle when trading it in for another vehicle, typically calculated based on the vehicle's condition, mileage, age, and current market demand. Unlike fair market value, which represents the price a seller can expect in an open market, trade-in value tends to be lower due to dealer overhead and the need for resale profit. Calculating trade-in value often involves using valuation tools like Kelley Blue Book or NADA guides, adjusted for local market conditions and specific vehicle factors.

Key Factors Affecting Fair Market Value vs Trade-In Value

Fair Market Value (FMV) typically reflects the price a vehicle would fetch in an open and competitive market, influenced by factors such as current market demand, vehicle condition, mileage, and regional sales trends. Trade-In Value is generally lower because dealers account for reconditioning costs, wholesale market fluctuations, and desired profit margins when offering a price. Key factors affecting both values include the car's age, overall condition, maintenance history, and prevailing market conditions, but FMV tends to be higher due to its broader buyer base and less overhead cost adjustments.

How Dealerships Determine Your Car’s Trade-In Value

Dealerships determine your car's trade-in value by assessing factors such as current market demand, vehicle condition, mileage, and depreciation rates rather than solely relying on the fair market value. They analyze recent sales of similar vehicles, considering regional pricing trends and wholesaler offers, which often results in a trade-in value lower than the fair market value. This method ensures dealerships account for reconditioning costs and potential resale margins when calculating the trade-in offer.

Private Sale vs Trade-In: Which Yields a Higher Return?

Private sales typically yield a higher return on a depreciated vehicle compared to trade-ins due to the direct negotiation between buyer and seller, allowing for a price closer to the vehicle's fair market value. Trade-in values are generally lower because dealerships account for reconditioning costs, potential profit margins, and market demand fluctuations. Understanding the disparity between fair market value and trade-in value is crucial for maximizing return during vehicle depreciation.

Pros and Cons: Selling at Fair Market Value vs Trading In

Selling at Fair Market Value typically yields a higher return since the price reflects current market demand, allowing owners to maximize their asset's worth. However, it requires more effort in negotiation, finding buyers, and completing transactions, which can be time-consuming and uncertain. Trading in offers convenience and speed, often resulting in a lower payout due to dealer discounts, but it simplifies the process by avoiding private sale hassles and providing immediate cash or credit toward a new purchase.

Depreciation Trends: Impact on Resale and Trade-In Values

Fair Market Value (FMV) typically reflects an asset's current worth based on market demand, while Trade-In Value (TIV) often factors in immediate resale potential and dealer margins, resulting in a lower offer. Depreciation trends significantly influence both FMV and TIV, with accelerated depreciation in the first few years causing trade-in values to drop sharply compared to fair market prices. Understanding these trends helps sellers anticipate lower trade-in offers relative to resale values due to rapid value decline and market liquidity differences.

Maximizing Your Car’s Value: Tips to Reduce Depreciation

Maximizing your car's value involves understanding the difference between fair market value and trade-in value, as trade-in offers are typically lower due to dealer margins and reconditioning costs. Regular maintenance, keeping detailed service records, and avoiding modifications can help maintain higher fair market value, which reflects what a private buyer is willing to pay. Selling privately rather than trading in often results in less depreciation loss and a better return on investment.

Navigating Negotiations: Getting the Best Value for Your Vehicle

Understanding the distinction between Fair Market Value (FMV) and Trade-In Value is crucial when negotiating the sale of a depreciated vehicle. FMV represents the estimated price a vehicle would fetch in the open market, while Trade-In Value typically reflects a dealer's offer, often lower to accommodate reconditioning and resale profit margins. Focusing on obtaining multiple quotes and leveraging FMV data from sources like Kelley Blue Book or Edmunds empowers sellers to negotiate more effectively and secure the best possible trade-in deal.

Fair Market Value vs Trade-In Value Infographic

cardiffo.com

cardiffo.com