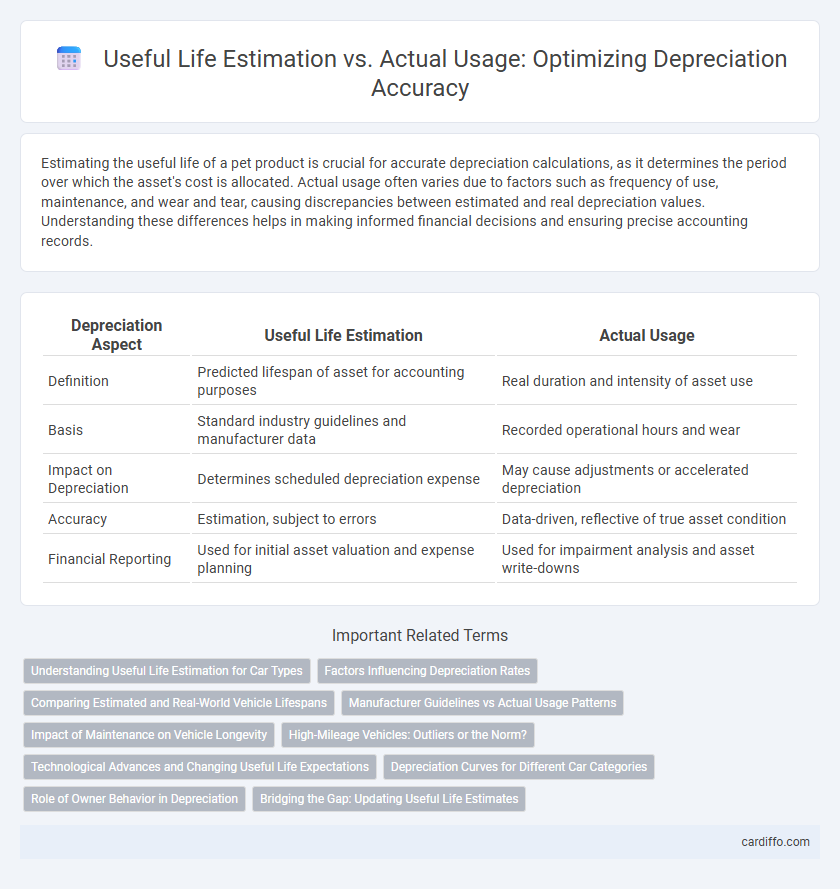

Estimating the useful life of a pet product is crucial for accurate depreciation calculations, as it determines the period over which the asset's cost is allocated. Actual usage often varies due to factors such as frequency of use, maintenance, and wear and tear, causing discrepancies between estimated and real depreciation values. Understanding these differences helps in making informed financial decisions and ensuring precise accounting records.

Table of Comparison

| Depreciation Aspect | Useful Life Estimation | Actual Usage |

|---|---|---|

| Definition | Predicted lifespan of asset for accounting purposes | Real duration and intensity of asset use |

| Basis | Standard industry guidelines and manufacturer data | Recorded operational hours and wear |

| Impact on Depreciation | Determines scheduled depreciation expense | May cause adjustments or accelerated depreciation |

| Accuracy | Estimation, subject to errors | Data-driven, reflective of true asset condition |

| Financial Reporting | Used for initial asset valuation and expense planning | Used for impairment analysis and asset write-downs |

Understanding Useful Life Estimation for Car Types

Useful life estimation for car types plays a critical role in calculating accurate depreciation expenses by predicting the duration a vehicle will be economically viable. Differences in usage patterns, maintenance, and driving conditions often cause actual usage to diverge from the estimated useful life, impacting residual value and financial reporting. Accurate assessment methods tailored to specific car models and their typical operational environments improve the alignment between estimated useful life and actual asset performance.

Factors Influencing Depreciation Rates

Depreciation rates are influenced by the disparity between useful life estimation and actual usage, where underestimated wear and tear accelerate asset value decline. Factors such as operational intensity, maintenance quality, and environmental conditions directly impact the depreciation speed beyond initial projections. Accurate assessment of these variables is crucial for aligning book value with real asset condition and optimizing financial reporting.

Comparing Estimated and Real-World Vehicle Lifespans

Useful life estimation for vehicles typically relies on manufacturer guidelines and industry averages, often projecting a lifespan of 8 to 15 years. Real-world usage reveals significant variance due to factors such as driving conditions, maintenance quality, and technological advancements that can either shorten or extend actual vehicle lifespans. Comparing estimated useful life with actual usage highlights the importance of adjusting depreciation schedules to reflect practical wear and tear, ensuring more accurate asset valuation and financial planning.

Manufacturer Guidelines vs Actual Usage Patterns

Manufacturer guidelines for useful life estimation provide a standardized timeframe for asset depreciation, but actual usage patterns often diverge due to variations in operating conditions and maintenance practices. These discrepancies can lead to either accelerated or delayed depreciation, impacting financial reporting accuracy and asset valuation. Incorporating real-world usage data alongside manufacturer estimates ensures more precise depreciation schedules and better reflects asset performance.

Impact of Maintenance on Vehicle Longevity

Accurate useful life estimation of a vehicle significantly depends on understanding its actual usage patterns and maintenance quality. Regular maintenance, including timely oil changes, tire rotations, and brake inspections, extends a vehicle's operational lifespan beyond standard depreciation schedules. Poor or irregular maintenance accelerates wear and tear, leading to faster depreciation and reduced asset value.

High-Mileage Vehicles: Outliers or the Norm?

High-mileage vehicles often challenge traditional useful life estimations, as actual usage can significantly exceed anticipated limits, leading to accelerated depreciation. In some cases, these vehicles serve as outliers by demonstrating exceptional durability, while for others, excessive mileage reveals the limitations of standard depreciation models. Accurate depreciation accounting requires integrating real-world mileage data to adjust useful life benchmarks and reflect true wear and tear.

Technological Advances and Changing Useful Life Expectations

Estimating useful life for asset depreciation often fluctuates due to rapid technological advances that render equipment obsolete faster than anticipated. Companies must continuously reassess asset longevity expectations to align depreciation schedules with actual usage patterns and market innovation cycles. Failure to adjust for shortened useful life can lead to overstated asset values and inaccurate financial reporting.

Depreciation Curves for Different Car Categories

Depreciation curves vary significantly across car categories, reflecting differences in useful life estimation versus actual usage patterns. Luxury vehicles often exhibit steeper initial depreciation curves due to higher market value declines, while economy cars tend to have more gradual depreciation aligned with consistent usage. Understanding these category-specific depreciation trends helps in more accurate asset valuation and financial forecasting.

Role of Owner Behavior in Depreciation

Owner behavior significantly impacts the accuracy of useful life estimation in depreciation, as variations in maintenance patterns, usage intensity, and operational conditions directly affect asset wear and tear. Discrepancies between estimated useful life and actual usage often arise due to inconsistent owner practices, leading to accelerated depreciation or extended asset viability. Understanding these behavioral patterns allows for more precise depreciation schedules, enhancing financial reporting accuracy and asset management.

Bridging the Gap: Updating Useful Life Estimates

Accurate depreciation hinges on regularly updating useful life estimates to reflect actual usage patterns, as discrepancies between projected and real asset utilization can significantly distort financial statements. Bridging this gap requires continuous monitoring of asset performance data and adjusting the estimated useful life based on wear, technological advances, and operational intensity. Implementing dynamic depreciation schedules ensures alignment with economic reality, enhancing asset valuation and improving financial reporting accuracy.

Useful Life Estimation vs Actual Usage Infographic

cardiffo.com

cardiffo.com