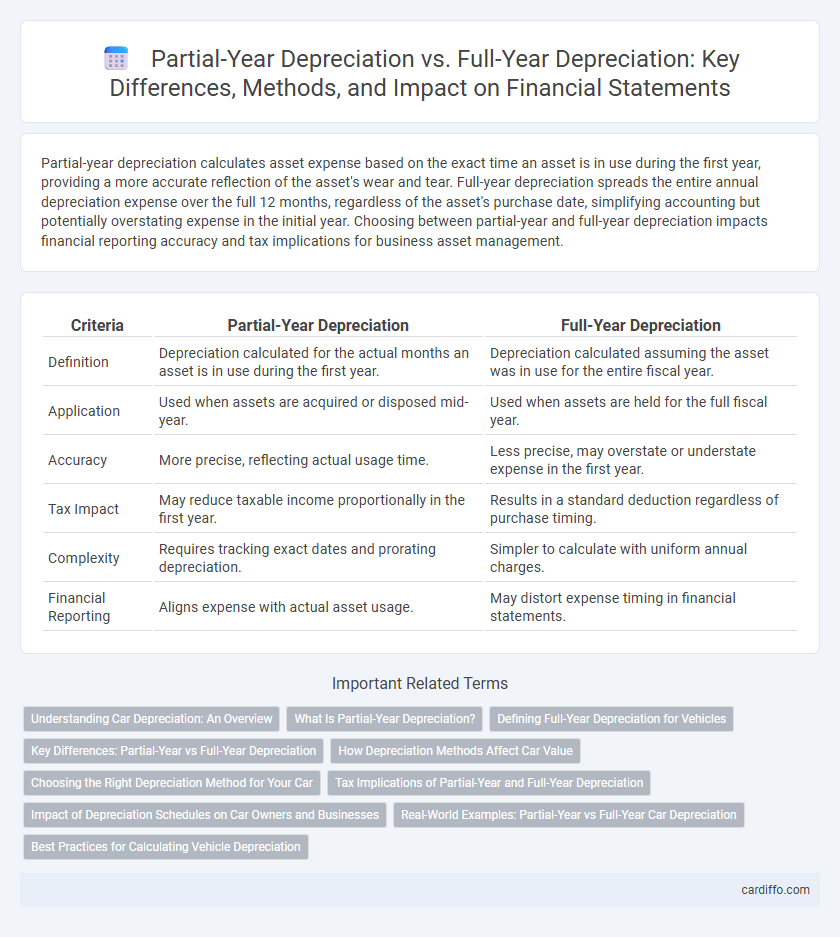

Partial-year depreciation calculates asset expense based on the exact time an asset is in use during the first year, providing a more accurate reflection of the asset's wear and tear. Full-year depreciation spreads the entire annual depreciation expense over the full 12 months, regardless of the asset's purchase date, simplifying accounting but potentially overstating expense in the initial year. Choosing between partial-year and full-year depreciation impacts financial reporting accuracy and tax implications for business asset management.

Table of Comparison

| Criteria | Partial-Year Depreciation | Full-Year Depreciation |

|---|---|---|

| Definition | Depreciation calculated for the actual months an asset is in use during the first year. | Depreciation calculated assuming the asset was in use for the entire fiscal year. |

| Application | Used when assets are acquired or disposed mid-year. | Used when assets are held for the full fiscal year. |

| Accuracy | More precise, reflecting actual usage time. | Less precise, may overstate or understate expense in the first year. |

| Tax Impact | May reduce taxable income proportionally in the first year. | Results in a standard deduction regardless of purchase timing. |

| Complexity | Requires tracking exact dates and prorating depreciation. | Simpler to calculate with uniform annual charges. |

| Financial Reporting | Aligns expense with actual asset usage. | May distort expense timing in financial statements. |

Understanding Car Depreciation: An Overview

Car depreciation calculates the reduction in vehicle value over time, affected by factors like usage, age, and market conditions. Partial-year depreciation accounts for the exact period the car is owned within a fiscal year, providing a more precise expense allocation compared to full-year depreciation that assumes ownership for the entire year. Understanding these methods helps accurately assess car value depreciation for tax or resale purposes.

What Is Partial-Year Depreciation?

Partial-year depreciation calculates asset depreciation expenses based on the exact time the asset was in use during the fiscal year rather than a full 12 months. This method aligns depreciation costs with asset utilization, providing a more accurate reflection of asset value and tax deductions for assets acquired or disposed of mid-year. It contrasts with full-year depreciation, which assumes an entire year of asset use regardless of the actual purchase or disposal date.

Defining Full-Year Depreciation for Vehicles

Full-year depreciation for vehicles calculates the entire annual depreciation expense regardless of the purchase date within the fiscal year. This method applies a fixed rate based on the vehicle's cost, spreading the depreciation evenly over the asset's useful life. It simplifies accounting processes by avoiding prorated calculations for partial ownership periods.

Key Differences: Partial-Year vs Full-Year Depreciation

Partial-year depreciation calculates asset depreciation based on the actual time the asset is in service during the first year, resulting in a prorated expense, whereas full-year depreciation applies the entire annual depreciation amount regardless of the acquisition date. The key difference lies in accuracy and tax reporting: partial-year better reflects true asset usage and expense allocation, while full-year simplifies accounting but may overstate expenses initially. For tax purposes, partial-year depreciation aligns with IRS guidelines on mid-year or mid-month conventions, ensuring compliance and precise financial statements.

How Depreciation Methods Affect Car Value

Partial-year depreciation calculates asset value reduction based on the actual months of ownership within the fiscal year, resulting in a more precise and often lower depreciation expense compared to full-year depreciation, which assumes a full year's usage regardless of purchase date. Cars depreciate faster in the initial years, so the chosen method significantly impacts the book value reported, affecting resale value and tax deductions. Typically, partial-year depreciation aligns better with real market value fluctuations, offering a more accurate reflection of a vehicle's worth over time.

Choosing the Right Depreciation Method for Your Car

Partial-year depreciation reflects the actual time a car is used during the first year, providing more accurate expense allocation compared to full-year depreciation, which assumes a full 12 months of use regardless of the purchase date. For new vehicles acquired late in the fiscal year, partial-year depreciation prevents overstating expenses, enhancing tax accuracy and financial reporting. Evaluate your car's acquisition date and usage patterns to choose the depreciation method that maximizes tax benefits while aligning with accounting principles.

Tax Implications of Partial-Year and Full-Year Depreciation

Partial-year depreciation allows businesses to claim a pro-rated deduction based on the asset's actual usage period within the tax year, potentially reducing taxable income more accurately in the acquisition year. Full-year depreciation assumes the asset was in service for the entire year, maximizing first-year deductions but possibly overstating expenses if the asset was purchased late in the year. Tax implications differ as partial-year depreciation aligns deductions with asset utilization, while full-year depreciation accelerates deductions, impacting tax liability timing and cash flow management.

Impact of Depreciation Schedules on Car Owners and Businesses

Partial-year depreciation allows car owners and businesses to more accurately match the expense with the asset's actual usage during the fiscal year, reducing tax burden in the acquisition year. Full-year depreciation simplifies accounting by allocating the entire annual depreciation expense regardless of purchase date, which can overstate costs for partial-year asset use. Choosing the appropriate depreciation schedule directly affects cash flow management and financial reporting accuracy in automotive-related assets.

Real-World Examples: Partial-Year vs Full-Year Car Depreciation

Partial-year depreciation for cars accounts for the exact months a vehicle is owned within the fiscal year, resulting in a proportional expense reduction, such as recognizing depreciation on a vehicle purchased in September only for four months of that year. Full-year depreciation assumes an asset is used for the entire year, even if acquired mid-year, inflating the annual depreciation expense, which can distort asset valuation and tax calculations. Real-world applications show that partial-year depreciation provides more accurate financial reporting and tax deductions for vehicles bought or sold during the year.

Best Practices for Calculating Vehicle Depreciation

When calculating vehicle depreciation, using partial-year depreciation accurately reflects the asset's usage within the fiscal year by allocating expense based on the acquisition date, ensuring precise matching of costs and revenues. Full-year depreciation, while simpler, can overstate depreciation expense if the vehicle was purchased mid-year, leading to inaccurate financial reporting. Best practices recommend adopting partial-year methods such as the half-month or half-year convention to improve expense allocation and tax compliance.

Partial-Year Depreciation vs Full-Year Depreciation Infographic

cardiffo.com

cardiffo.com