A One-Pay Lease requires a single upfront payment covering the entire lease term, often resulting in lower overall costs and simpler budgeting. In contrast, a Multiple Payment Lease spreads the payments over months, providing more flexibility but potentially increasing the total expense due to finance charges. Choosing between the two depends on cash flow preferences and financial goals.

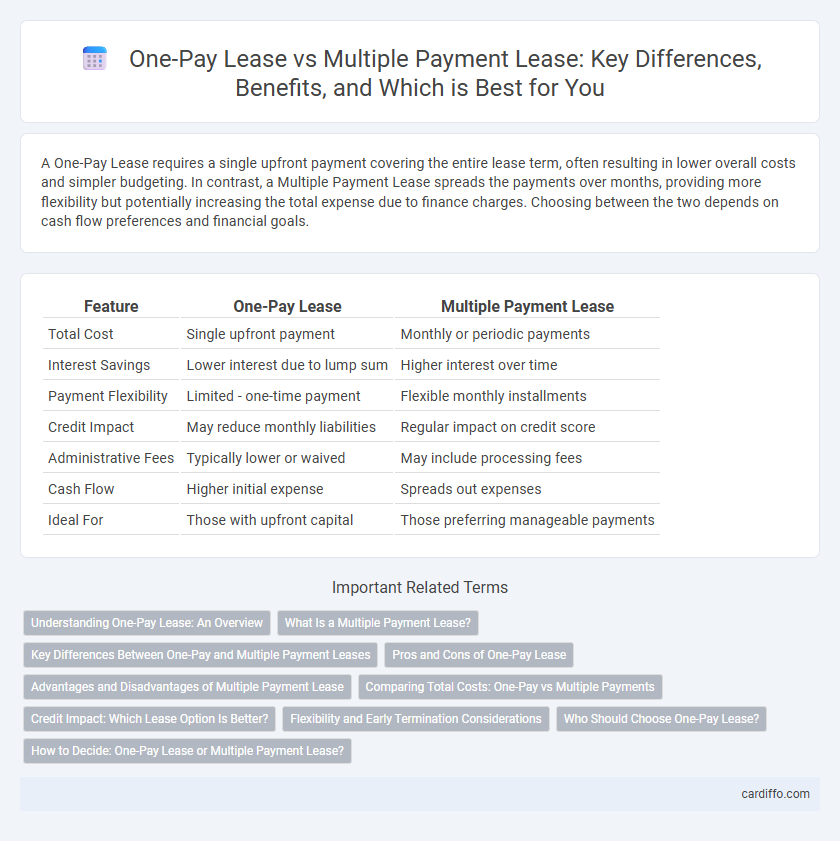

Table of Comparison

| Feature | One-Pay Lease | Multiple Payment Lease |

|---|---|---|

| Total Cost | Single upfront payment | Monthly or periodic payments |

| Interest Savings | Lower interest due to lump sum | Higher interest over time |

| Payment Flexibility | Limited - one-time payment | Flexible monthly installments |

| Credit Impact | May reduce monthly liabilities | Regular impact on credit score |

| Administrative Fees | Typically lower or waived | May include processing fees |

| Cash Flow | Higher initial expense | Spreads out expenses |

| Ideal For | Those with upfront capital | Those preferring manageable payments |

Understanding One-Pay Lease: An Overview

One-pay lease requires a single upfront payment covering the entire lease term, often resulting in lower overall cost and interest compared to multiple payment leases. This option reduces monthly billing complexities and can provide potential savings through reduced finance charges and dealer incentives. Understanding the total financial commitment and impact on cash flow is essential before opting for a one-pay lease agreement.

What Is a Multiple Payment Lease?

A multiple payment lease requires lessees to make scheduled payments, typically monthly, throughout the lease term instead of a single upfront payment. This structure offers flexibility by spreading out costs, improving cash flow management for individuals or businesses leasing equipment or vehicles. Multiple payment leases often include interest or finance charges, making total lease costs higher compared to one-pay leases.

Key Differences Between One-Pay and Multiple Payment Leases

One-Pay leases require a single, upfront payment covering the entire lease term, resulting in lower total lease costs due to reduced finance charges. Multiple Payment leases spread lease payments monthly or quarterly, offering greater cash flow flexibility but typically involving higher overall costs. Key differences include payment timing, total cost savings, and the impact on cash flow management for lessees.

Pros and Cons of One-Pay Lease

A One-Pay Lease requires a single upfront payment covering the entire lease term, often resulting in lower total costs due to reduced interest and fees. It minimizes monthly billing hassles and can improve the lessee's credit profile by eliminating the risk of missed payments. However, the substantial initial expense may strain cash flow and reduce financial flexibility compared to spreading costs over multiple payments.

Advantages and Disadvantages of Multiple Payment Lease

Multiple Payment Leases offer the advantage of spreading out payments over time, enhancing cash flow management and reducing the immediate financial burden for lessees. They provide flexibility by allowing lessees to budget monthly or quarterly, which can be beneficial for businesses with fluctuating revenue streams. However, multiple payments often result in higher total costs due to added interest or fees compared to One-Pay Leases, and the administrative effort increases with the need to manage multiple transactions.

Comparing Total Costs: One-Pay vs Multiple Payments

One-pay leases typically require a large upfront payment, resulting in lower total lease costs due to reduced finance charges and fees compared to multiple payment leases. Multiple payment leases spread costs over time but often include higher total interest and fees, increasing the overall expense. Evaluating total lease costs involves comparing upfront discounts and long-term finance charges to determine the most cost-effective option.

Credit Impact: Which Lease Option Is Better?

One-pay leases typically cause a temporary but significant impact on credit utilization, showing a large upfront payment that may reduce available credit lines on your report. Multiple payment leases spread out monthly payments, resulting in consistent, manageable credit activity that can positively influence your credit score over time. Choosing between these lease options depends on your current credit profile and how you prefer your credit utilization and payment history to be reflected on your credit report.

Flexibility and Early Termination Considerations

One-Pay Lease offers the advantage of a single upfront payment, providing predictable costs and often lower overall expenses, but it limits flexibility for early termination as refunds are rare or minimal. Multiple Payment Lease spreads costs over monthly installments, enhancing flexibility by allowing easier termination options, though potential early termination fees and remaining payments may apply. Evaluating these lease types depends on preferences for payment structure, long-term commitment, and penalties associated with early lease termination.

Who Should Choose One-Pay Lease?

A One-Pay Lease benefits individuals with sufficient upfront capital who prefer to avoid interest accumulation and monthly billing, often resulting in lower overall lease costs. It suits financially disciplined lessees seeking simplicity and those with high credit scores to maximize potential savings. Business owners and lessees aiming for predictable expenses with minimal administrative effort also find One-Pay Leases ideal.

How to Decide: One-Pay Lease or Multiple Payment Lease?

Choosing between a One-Pay Lease and a Multiple Payment Lease depends on your financial stability and cash flow preferences. One-Pay Leases often provide lower overall costs due to upfront payment discounts, making them ideal for those with sufficient liquidity. Multiple Payment Leases offer greater monthly budgeting flexibility, preferred by individuals or businesses prioritizing steady cash flow over lump-sum savings.

One-Pay Lease vs Multiple Payment Lease Infographic

cardiffo.com

cardiffo.com