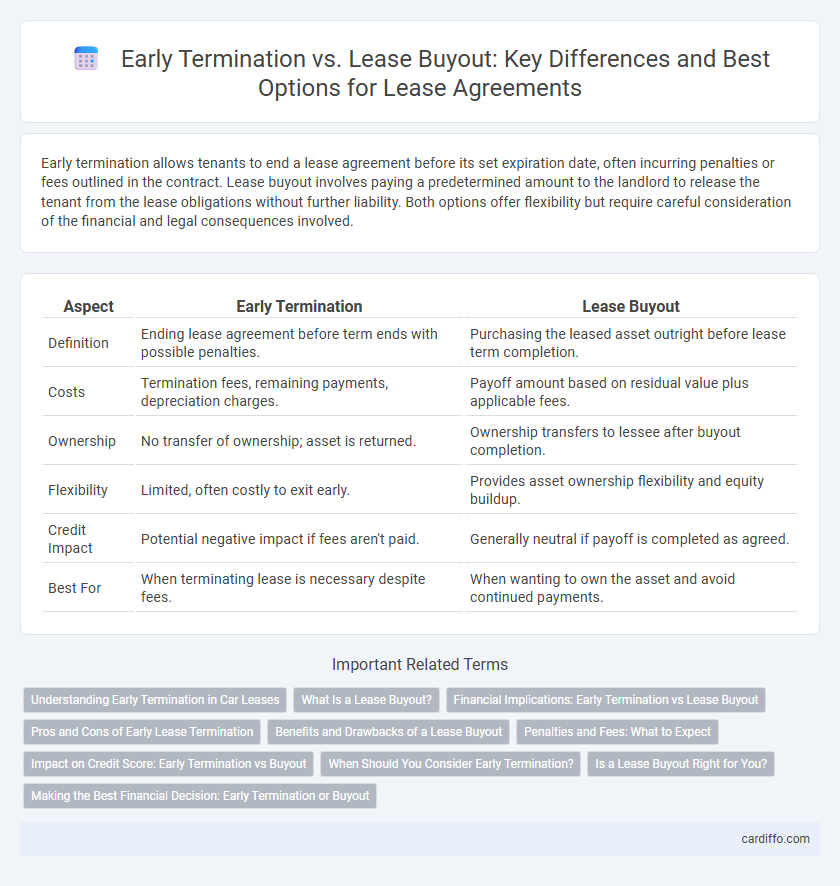

Early termination allows tenants to end a lease agreement before its set expiration date, often incurring penalties or fees outlined in the contract. Lease buyout involves paying a predetermined amount to the landlord to release the tenant from the lease obligations without further liability. Both options offer flexibility but require careful consideration of the financial and legal consequences involved.

Table of Comparison

| Aspect | Early Termination | Lease Buyout |

|---|---|---|

| Definition | Ending lease agreement before term ends with possible penalties. | Purchasing the leased asset outright before lease term completion. |

| Costs | Termination fees, remaining payments, depreciation charges. | Payoff amount based on residual value plus applicable fees. |

| Ownership | No transfer of ownership; asset is returned. | Ownership transfers to lessee after buyout completion. |

| Flexibility | Limited, often costly to exit early. | Provides asset ownership flexibility and equity buildup. |

| Credit Impact | Potential negative impact if fees aren't paid. | Generally neutral if payoff is completed as agreed. |

| Best For | When terminating lease is necessary despite fees. | When wanting to own the asset and avoid continued payments. |

Understanding Early Termination in Car Leases

Early termination in car leases occurs when a lessee ends the lease agreement before the contractual term expires, often resulting in significant fees and penalties outlined in the lease contract. Unlike lease buyouts, which allow the lessee to purchase the vehicle outright at a predetermined price, early termination typically requires settling remaining payments and possibly paying an additional early termination fee. Understanding the specific terms and costs associated with early termination is crucial for lessees to avoid unexpected financial burdens.

What Is a Lease Buyout?

A lease buyout involves paying a predetermined amount to end a vehicle lease agreement before its scheduled termination, allowing the lessee to own the car outright. This amount typically includes the remaining lease payments, the residual value of the vehicle, and any applicable fees. Understanding lease buyout terms is crucial for lessees seeking financial flexibility or wishing to avoid penalties associated with early termination.

Financial Implications: Early Termination vs Lease Buyout

Early termination fees typically incur substantial charges that can exceed the remaining lease payments, significantly impacting short-term financial obligations. Lease buyout options allow lessees to settle the lease balance upfront, often including residual value and potential penalties, which may offer more predictable financial outcomes. Evaluating the total cost of both options requires careful consideration of remaining lease duration, buyout price, and any associated fees to determine the most economically advantageous decision.

Pros and Cons of Early Lease Termination

Early lease termination allows tenants to exit a contract before its agreed end date, offering flexibility but often incurring significant penalties or fees outlined in the lease agreement. While it frees tenants from ongoing payments, this option can negatively impact credit scores and rental history if not managed properly. Compared to lease buyout, which involves paying a fixed sum to end the lease, early termination may result in unpredictable costs and legal complications depending on the lease terms.

Benefits and Drawbacks of a Lease Buyout

A lease buyout allows lessees to purchase the leased asset before the term ends, providing ownership and eliminating monthly payments, which can build equity and avoid excess mileage or wear-and-tear fees. However, buyouts typically require a substantial upfront payment or financing, which may carry higher interest rates compared to traditional loans, and could result in overpaying if the asset's market value has depreciated significantly. While early termination offers more flexibility to exit a lease contract, lease buyouts benefit those who intend to keep the asset long-term and want to avoid penalties related to lease end conditions.

Penalties and Fees: What to Expect

Early termination of a lease often involves paying significant penalties, including early termination fees typically ranging from one to three months' rent, plus potential forfeiture of the security deposit. Lease buyout options generally require a lump-sum payment that equals the remaining rent due or a predetermined buyout amount outlined in the lease agreement. Understanding these financial obligations helps tenants weigh the cost differences and avoid unexpected charges when ending a lease prematurely.

Impact on Credit Score: Early Termination vs Buyout

Early termination of a lease often results in negative marks on credit reports due to potential unpaid fees or penalties, impacting credit scores more significantly. Lease buyout typically shows as a completed financial transaction, generally having a neutral or positive effect on credit scores if payments are made promptly. Understanding these differences is crucial for maintaining a healthy credit profile during lease agreements.

When Should You Consider Early Termination?

Consider early termination when facing unexpected financial hardships, relocation, or changes in personal circumstances that make continuing the lease impractical. Early termination may offer a more straightforward exit compared to a lease buyout, which often involves paying remaining lease payments or a lump sum. Evaluating lease terms and potential penalties helps determine if early termination aligns better with your financial and lifestyle needs.

Is a Lease Buyout Right for You?

A lease buyout allows you to purchase the leased vehicle before the lease term ends, often at a pre-agreed price, providing flexibility if you want to avoid early termination fees. It can be cost-effective if the buyout price is lower than the vehicle's market value or if you plan to keep the car long-term. Evaluating your financial situation and market conditions helps determine if a lease buyout is the right option compared to early termination penalties.

Making the Best Financial Decision: Early Termination or Buyout

Evaluating early termination versus lease buyout hinges on comparing the total financial impact, including termination fees, remaining lease payments, and potential penalties. Lease buyouts often require a lump-sum payment equal to the remaining lease balance or the vehicle's residual value, which may be higher or lower than early termination costs. Analyzing monthly payments saved, depreciation rates, and personal financial goals helps determine the most cost-effective option.

Early Termination vs Lease Buyout Infographic

cardiffo.com

cardiffo.com