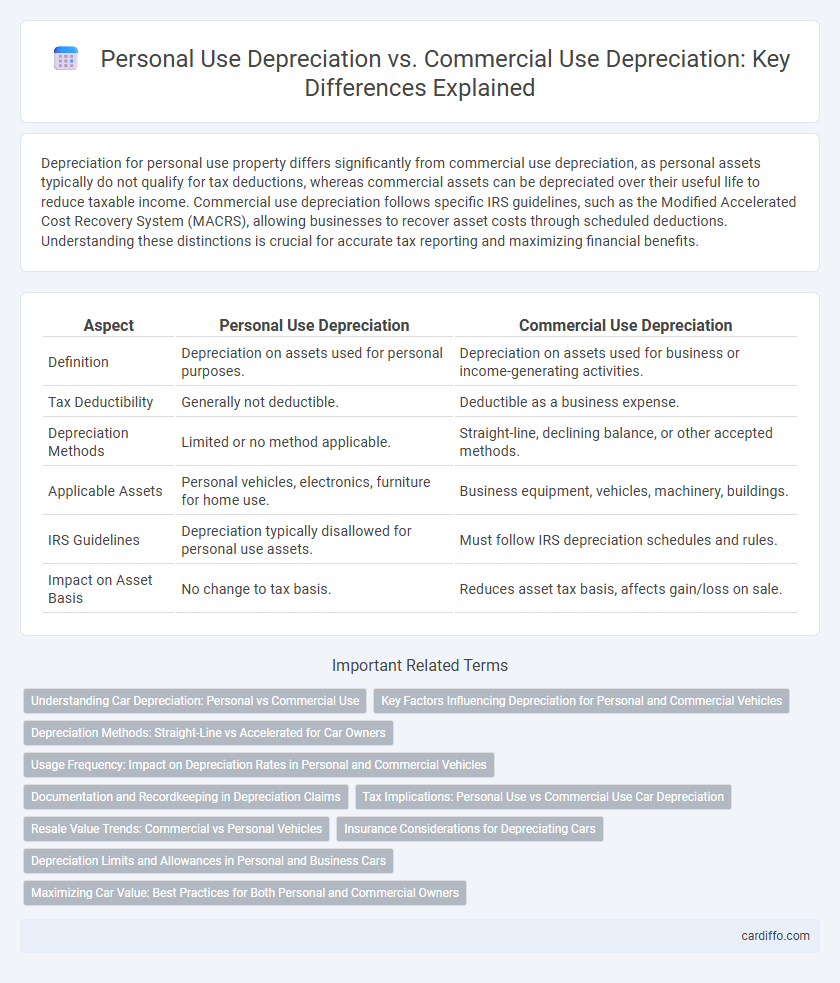

Depreciation for personal use property differs significantly from commercial use depreciation, as personal assets typically do not qualify for tax deductions, whereas commercial assets can be depreciated over their useful life to reduce taxable income. Commercial use depreciation follows specific IRS guidelines, such as the Modified Accelerated Cost Recovery System (MACRS), allowing businesses to recover asset costs through scheduled deductions. Understanding these distinctions is crucial for accurate tax reporting and maximizing financial benefits.

Table of Comparison

| Aspect | Personal Use Depreciation | Commercial Use Depreciation |

|---|---|---|

| Definition | Depreciation on assets used for personal purposes. | Depreciation on assets used for business or income-generating activities. |

| Tax Deductibility | Generally not deductible. | Deductible as a business expense. |

| Depreciation Methods | Limited or no method applicable. | Straight-line, declining balance, or other accepted methods. |

| Applicable Assets | Personal vehicles, electronics, furniture for home use. | Business equipment, vehicles, machinery, buildings. |

| IRS Guidelines | Depreciation typically disallowed for personal use assets. | Must follow IRS depreciation schedules and rules. |

| Impact on Asset Basis | No change to tax basis. | Reduces asset tax basis, affects gain/loss on sale. |

Understanding Car Depreciation: Personal vs Commercial Use

Car depreciation varies significantly between personal and commercial use due to differing usage patterns and tax regulations. Commercial vehicles typically experience accelerated depreciation because of higher mileage and operational wear, allowing businesses to claim larger tax deductions over a shorter period. Personal use vehicles depreciate more gradually, reflecting standard wear and standard mileage, resulting in slower value loss and limited tax benefits.

Key Factors Influencing Depreciation for Personal and Commercial Vehicles

Key factors influencing depreciation for personal and commercial vehicles include usage intensity, mileage accumulation, and maintenance frequency. Commercial vehicles typically experience higher depreciation rates due to increased operational demands, heavier loads, and longer hours of use, while personal vehicles depreciate slower with lighter, less frequent use. Market demand, vehicle make and model, and service history also significantly impact depreciation values in both personal and commercial contexts.

Depreciation Methods: Straight-Line vs Accelerated for Car Owners

For car owners, personal use depreciation typically uses the straight-line method, spreading the vehicle's cost evenly over its useful life, while commercial use depreciation often employs accelerated methods like MACRS to maximize early tax deductions. The straight-line method offers simplicity and consistency in expense recognition, whereas accelerated depreciation provides higher upfront write-offs that benefit businesses with significant mileage and wear on vehicles. Choosing the appropriate method depends on the purpose of vehicle use and related tax advantages under IRS guidelines.

Usage Frequency: Impact on Depreciation Rates in Personal and Commercial Vehicles

Depreciation rates differ significantly between personal and commercial vehicles due to usage frequency, with commercial vehicles experiencing accelerated depreciation because of higher mileage, constant operation, and increased wear and tear. Personal use vehicles typically depreciate slower as they undergo fewer miles per year and less intensive use, preserving resale value longer. Insurance and tax implications also vary, reflecting the differential depreciation influenced by the vehicle's operational purpose.

Documentation and Recordkeeping in Depreciation Claims

Accurate documentation and meticulous recordkeeping are crucial for differentiating personal use depreciation from commercial use depreciation claims. Commercial use assets require detailed logs, including usage percentages, dates, and maintenance records, to substantiate depreciation deductions, while personal use assets typically do not qualify for depreciation claims. Maintaining organized records such as receipts, mileage logs, and business activity reports supports compliance with IRS regulations and maximizes allowable depreciation benefits.

Tax Implications: Personal Use vs Commercial Use Car Depreciation

Depreciation on personal use vehicles is generally not deductible for tax purposes, as the IRS does not allow taxpayers to write off the decline in value for non-business assets. Commercial use car depreciation, however, qualifies for tax deductions under IRS Section 179 or MACRS, reducing taxable income based on the vehicle's business-related usage percentage. Proper documentation of mileage and vehicle usage is essential to accurately claim commercial use depreciation and comply with tax regulations.

Resale Value Trends: Commercial vs Personal Vehicles

Commercial use depreciation typically accelerates due to higher mileage and wear, causing a steeper decline in resale value compared to personal vehicles. Personal use vehicles often retain higher resale value as they generally experience less intense daily use and better maintenance. Market data shows commercial vehicles can depreciate up to 30% faster within the first three years than their personal-use counterparts.

Insurance Considerations for Depreciating Cars

Insurance considerations for depreciating cars vary significantly between personal and commercial use, affecting claim values and premium calculations. Commercial use depreciation often accelerates due to higher mileage and increased wear, leading insurers to adjust coverage limits and deductibles accordingly. Personal use vehicles typically experience slower depreciation, resulting in more stable insurance premiums and payout expectations over time.

Depreciation Limits and Allowances in Personal and Business Cars

Personal use depreciation on vehicles is limited by strict IRS caps that restrict the amount deductible each year, often resulting in lower allowable depreciation compared to commercial use. Business cars used more than 50% for business purposes qualify for accelerated depreciation methods, including Section 179 and bonus depreciation, enabling higher write-offs and faster recovery of vehicle costs. Depreciation limits for personal vehicles typically do not apply when the vehicle is used predominantly for business, which allows leveraging higher depreciation allowances aligned with business expenses.

Maximizing Car Value: Best Practices for Both Personal and Commercial Owners

Maximizing car value through depreciation strategies requires understanding the distinct tax benefits between personal use and commercial use vehicles. Commercial owners can leverage accelerated depreciation methods such as Section 179 or bonus depreciation to reduce taxable income and maintain vehicle equity, while personal use drivers benefit primarily from standard depreciation rates and careful maintenance to preserve resale value. Regularly documenting mileage, maintenance, and usage type ensures accurate depreciation tracking and optimizes tax advantages for both personal and commercial car owners.

Personal Use Depreciation vs Commercial Use Depreciation Infographic

cardiffo.com

cardiffo.com