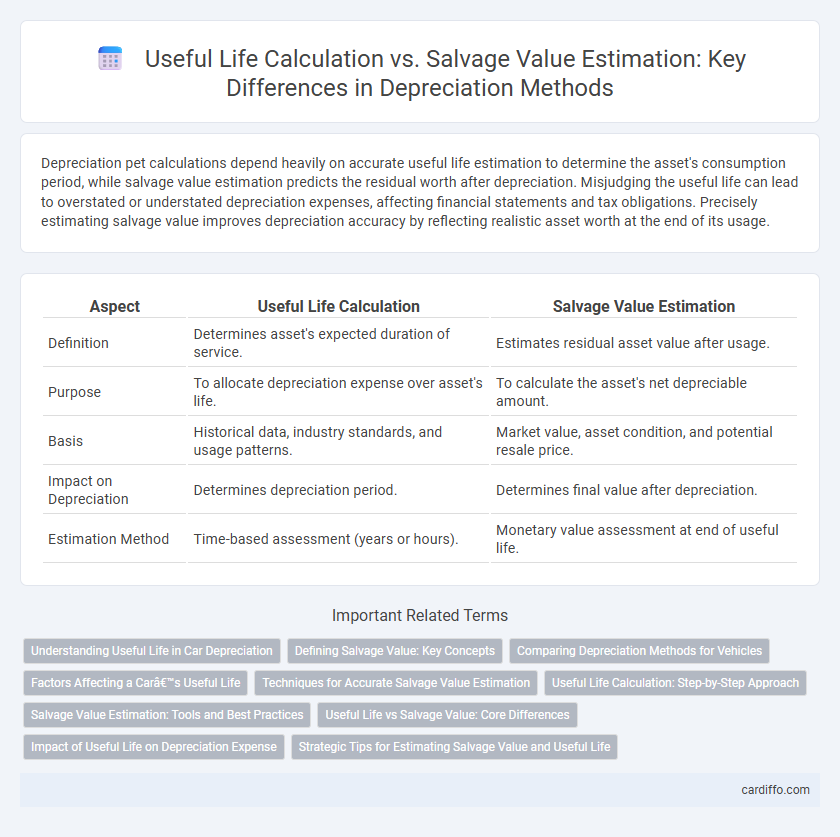

Depreciation pet calculations depend heavily on accurate useful life estimation to determine the asset's consumption period, while salvage value estimation predicts the residual worth after depreciation. Misjudging the useful life can lead to overstated or understated depreciation expenses, affecting financial statements and tax obligations. Precisely estimating salvage value improves depreciation accuracy by reflecting realistic asset worth at the end of its usage.

Table of Comparison

| Aspect | Useful Life Calculation | Salvage Value Estimation |

|---|---|---|

| Definition | Determines asset's expected duration of service. | Estimates residual asset value after usage. |

| Purpose | To allocate depreciation expense over asset's life. | To calculate the asset's net depreciable amount. |

| Basis | Historical data, industry standards, and usage patterns. | Market value, asset condition, and potential resale price. |

| Impact on Depreciation | Determines depreciation period. | Determines final value after depreciation. |

| Estimation Method | Time-based assessment (years or hours). | Monetary value assessment at end of useful life. |

Understanding Useful Life in Car Depreciation

Useful life in car depreciation refers to the estimated period during which a vehicle is expected to remain functional and economically viable. Accurate calculation of useful life is crucial for determining depreciation expenses and impacts the overall valuation of the car over time. Salvage value estimation complements this by predicting the residual worth of the vehicle at the end of its useful life, but understanding useful life is fundamental for aligning depreciation schedules with real-world usage.

Defining Salvage Value: Key Concepts

Salvage value is the estimated residual amount an asset will realize at the end of its useful life, critically influencing depreciation expense calculations. Accurate salvage value estimation involves assessing market conditions, asset condition, and potential resale value to avoid over- or under-depreciation. Defining salvage value precisely ensures reliable financial reporting and affects asset replacement planning.

Comparing Depreciation Methods for Vehicles

Comparing depreciation methods for vehicles requires careful consideration of both useful life calculation and salvage value estimation, as these factors directly influence expense recognition. The straight-line method evenly allocates depreciation over the estimated useful life, assuming consistent vehicle usage, while the declining balance method accelerates depreciation, reflecting higher costs in early years and adjusting for salvage value. Accurate estimation of salvage value ensures realistic residual worth, impacting the total depreciation expense and aligning financial reporting with asset utilization patterns.

Factors Affecting a Car’s Useful Life

Factors affecting a car's useful life include mileage, maintenance frequency, driving conditions, and technological obsolescence, which directly influence depreciation rates and overall asset valuation. Accurate useful life calculation considers these variables to determine the optimal depreciation schedule, while salvage value estimation depends on residual condition and market demand for used vehicles. Understanding both aspects ensures precise financial reporting and effective asset management.

Techniques for Accurate Salvage Value Estimation

Techniques for accurate salvage value estimation include market analysis, which assesses the residual value based on comparable asset sales and industry trends, and condition assessment, involving a detailed inspection to evaluate wear and tear. Historical data analysis helps predict the asset's end value by examining previous depreciation patterns and maintenance records. Utilizing expert appraisals and incorporating technological tools like valuation software enhances precision in estimating the salvage value, ensuring more reliable depreciation calculations.

Useful Life Calculation: Step-by-Step Approach

Useful life calculation begins by analyzing asset type, historical usage patterns, and operating conditions to estimate the period the asset will remain productive. Key factors include manufacturer guidelines, industry standards, and past maintenance records, which help determine expected wear and tear over time. This step-by-step evaluation ensures accurate depreciation scheduling, optimizing financial reporting and tax compliance.

Salvage Value Estimation: Tools and Best Practices

Salvage value estimation relies on tools such as market analysis, historical data, and asset condition assessments to predict an asset's residual worth at the end of its useful life. Employing best practices includes regularly updating estimates based on market trends, utilizing depreciation calculators, and consulting industry benchmarks for accuracy. Accurate salvage value estimation is critical for precise depreciation expense calculation, impacting financial reporting and tax obligations.

Useful Life vs Salvage Value: Core Differences

Useful life calculation determines the period an asset is expected to generate economic benefits, directly impacting the depreciation expense distribution over time. Salvage value estimation predicts the residual amount recoverable at the end of the asset's useful life, influencing the total depreciable cost. The core difference lies in useful life defining the time frame for expense recognition, while salvage value sets the asset's end-of-life book value for depreciation purposes.

Impact of Useful Life on Depreciation Expense

The useful life directly affects the depreciation expense by determining the period over which an asset's cost is allocated, with a longer useful life resulting in lower annual depreciation charges. In contrast, salvage value estimation influences the depreciable base but has less effect on the timing and amount of expense recognized each year. Accurately estimating useful life ensures precise matching of asset costs to revenue generation periods, optimizing financial analysis and asset management.

Strategic Tips for Estimating Salvage Value and Useful Life

Accurate useful life calculation relies on analyzing historical asset performance and industry standards to predict the period an asset will remain productive. Estimating salvage value requires assessing market conditions, potential disposal costs, and residual asset worth at the end of useful life. Leveraging asset maintenance records and consulting expert appraisals enhances precision in depreciation expense forecasting.

Useful Life Calculation vs Salvage Value Estimation Infographic

cardiffo.com

cardiffo.com