Depreciation allowance refers to the annual tax deduction that property owners can claim for the wear and tear of their depreciable assets, reducing taxable income over the asset's useful life. Depreciation recapture occurs when the asset is sold, and the IRS requires taxpayers to report the previously deducted depreciation as ordinary income, increasing the tax liability. Understanding the difference is crucial for accurate tax planning and minimizing unexpected tax burdens upon asset disposal.

Table of Comparison

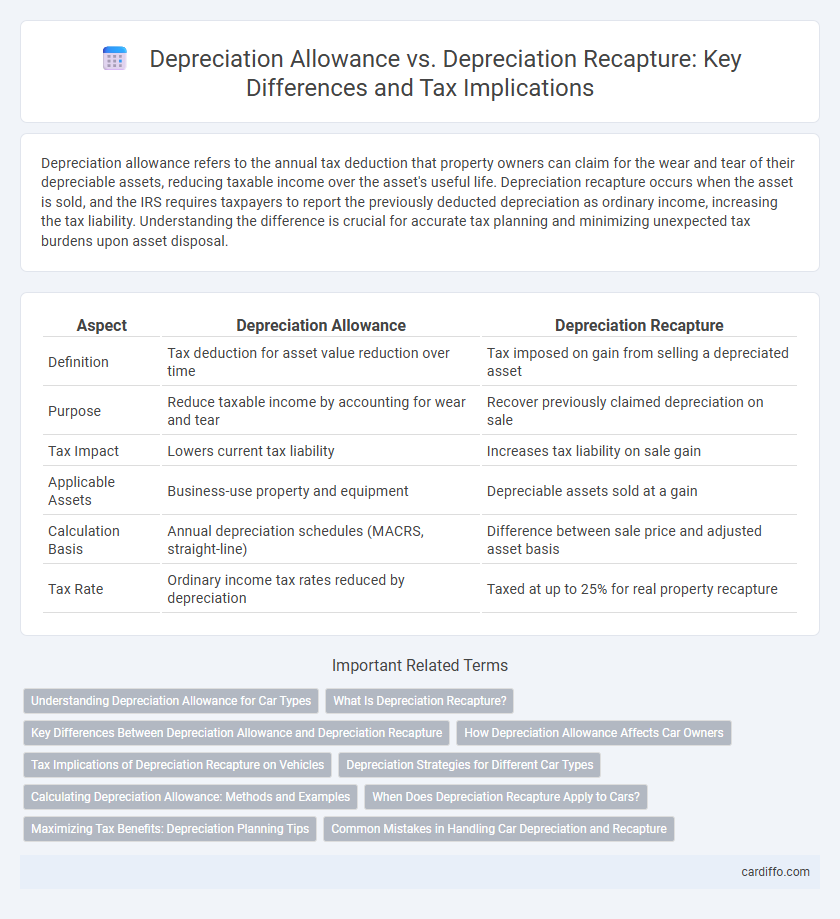

| Aspect | Depreciation Allowance | Depreciation Recapture |

|---|---|---|

| Definition | Tax deduction for asset value reduction over time | Tax imposed on gain from selling a depreciated asset |

| Purpose | Reduce taxable income by accounting for wear and tear | Recover previously claimed depreciation on sale |

| Tax Impact | Lowers current tax liability | Increases tax liability on sale gain |

| Applicable Assets | Business-use property and equipment | Depreciable assets sold at a gain |

| Calculation Basis | Annual depreciation schedules (MACRS, straight-line) | Difference between sale price and adjusted asset basis |

| Tax Rate | Ordinary income tax rates reduced by depreciation | Taxed at up to 25% for real property recapture |

Understanding Depreciation Allowance for Car Types

Depreciation allowance for car types enables businesses to deduct the cost of vehicle use over time, reflecting the asset's wear and tear in financial statements and tax filings. Different car types, such as passenger vehicles, SUVs, and trucks, may have distinct depreciation limits and eligibility criteria set by tax authorities, impacting the allowable deduction amount each year. Understanding these rules helps optimize tax benefits while ensuring compliance with regulations governing business vehicle depreciation.

What Is Depreciation Recapture?

Depreciation recapture is the process where the IRS taxes the gain realized from the sale of an asset to the extent of prior depreciation deductions taken, effectively recovering the tax benefits previously claimed. When a depreciated asset is sold for more than its adjusted basis, but less than its original cost, the recaptured amount is taxed as ordinary income rather than at capital gains rates. This mechanism ensures that taxpayers do not receive double tax benefits from both depreciation deductions and capital gains treatment on the sale proceeds.

Key Differences Between Depreciation Allowance and Depreciation Recapture

Depreciation allowance refers to the annual deduction taxpayers can claim on assets to account for wear and tear, reducing taxable income over the asset's useful life. Depreciation recapture occurs when the asset is sold, and the IRS taxes the gain attributable to the previously claimed depreciation deductions, often at a higher rate than capital gains. Key differences include timing--depreciation allowance reduces taxable income during ownership, while recapture triggers a tax event upon sale--and the tax treatment, with allowance lowering income annually and recapture potentially increasing tax liability at disposition.

How Depreciation Allowance Affects Car Owners

Depreciation allowance allows car owners to reduce their taxable income by accounting for the vehicle's loss in value over time, thereby lowering their overall tax liability. This tax deduction is particularly beneficial for business owners who use their car for work purposes, as it directly decreases their taxable profit. However, when the car is sold, depreciation recapture may require owners to pay tax on the previously deducted depreciation amounts, impacting the net financial benefit.

Tax Implications of Depreciation Recapture on Vehicles

Depreciation allowance reduces taxable income by accounting for vehicle wear and tear over time, lowering initial tax liability. Depreciation recapture triggers taxation on the gain from the sale of a depreciated vehicle, where the IRS taxes the recovered depreciation at ordinary income rates. Understanding depreciation recapture is crucial for vehicle owners to accurately anticipate tax implications when disposing of business-use vehicles.

Depreciation Strategies for Different Car Types

Depreciation allowance varies based on the car type, with luxury vehicles often subject to stricter limits compared to standard passenger cars, affecting tax deductions over the asset's useful life. Depreciation recapture occurs when a depreciated vehicle is sold at a price higher than its adjusted basis, triggering taxable income proportional to prior depreciation claimed. Optimal depreciation strategies for different car types consider factors like vehicle purpose, usage, and anticipated resale value to minimize tax burden and maximize financial efficiency.

Calculating Depreciation Allowance: Methods and Examples

Calculating depreciation allowance involves using methods such as the straight-line, declining balance, and units of production to allocate the asset's cost over its useful life. For example, under the straight-line method, the annual depreciation expense is determined by subtracting the asset's salvage value from its purchase price and dividing by the useful life in years. Accurate calculation of depreciation allowance is crucial for tax purposes and financial reporting, ensuring proper expense recognition and compliance with accounting standards.

When Does Depreciation Recapture Apply to Cars?

Depreciation recapture applies to cars when a vehicle used for business purposes is sold for more than its depreciated value, triggering tax on the gain up to the total amount of depreciation previously claimed. The IRS requires recapturing depreciation on passenger vehicles, often classified under the luxury car limits, where depreciation deductions have been taken on business use. This tax rule ensures that the tax benefit received from depreciation allowance is partially or fully offset by recognizing gain upon sale or disposition of the car.

Maximizing Tax Benefits: Depreciation Planning Tips

Maximizing tax benefits through strategic depreciation planning involves balancing depreciation allowance and managing depreciation recapture. Utilizing the full depreciation allowance reduces taxable income in the early years of an asset's life, while anticipating depreciation recapture ensures preparedness for taxable gains upon asset sale. Employing methods like Section 179 and bonus depreciation, combined with targeted holding periods, optimizes overall tax efficiency and cash flow management.

Common Mistakes in Handling Car Depreciation and Recapture

Misunderstanding the difference between depreciation allowance and depreciation recapture often leads to incorrect tax filings, as many taxpayers fail to properly track and report the accumulated depreciation when selling a vehicle. Confusing the depreciation allowance, which reduces taxable income annually, with depreciation recapture, which taxes the gain on the sale of the vehicle up to the amount of prior depreciation, results in understated tax liability. Common errors also include neglecting to adjust the vehicle's basis for prior depreciation and failing to include recapture income on the tax return, causing compliance issues with the IRS.

Depreciation Allowance vs Depreciation Recapture Infographic

cardiffo.com

cardiffo.com