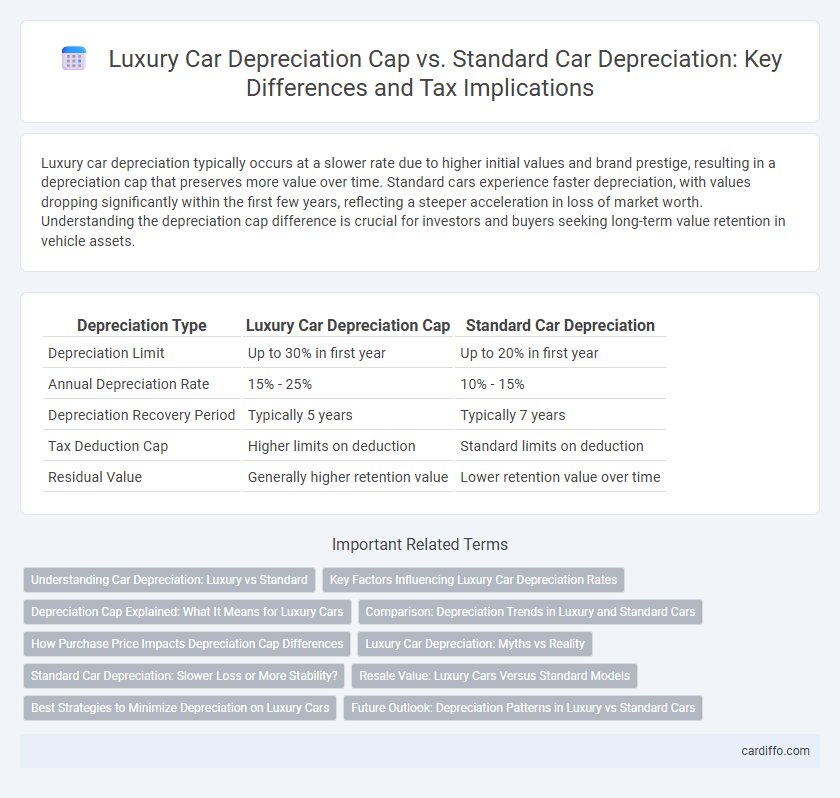

Luxury car depreciation typically occurs at a slower rate due to higher initial values and brand prestige, resulting in a depreciation cap that preserves more value over time. Standard cars experience faster depreciation, with values dropping significantly within the first few years, reflecting a steeper acceleration in loss of market worth. Understanding the depreciation cap difference is crucial for investors and buyers seeking long-term value retention in vehicle assets.

Table of Comparison

| Depreciation Type | Luxury Car Depreciation Cap | Standard Car Depreciation |

|---|---|---|

| Depreciation Limit | Up to 30% in first year | Up to 20% in first year |

| Annual Depreciation Rate | 15% - 25% | 10% - 15% |

| Depreciation Recovery Period | Typically 5 years | Typically 7 years |

| Tax Deduction Cap | Higher limits on deduction | Standard limits on deduction |

| Residual Value | Generally higher retention value | Lower retention value over time |

Understanding Car Depreciation: Luxury vs Standard

Luxury cars typically experience a faster initial depreciation rate compared to standard vehicles, often losing 50-60% of their value within the first three years. Standard cars generally have a steadier depreciation curve, averaging around 40-45% loss over the same period, making them more cost-effective for long-term ownership. Understanding these depreciation caps helps buyers assess true ownership costs and make informed decisions when comparing luxury versus standard car investments.

Key Factors Influencing Luxury Car Depreciation Rates

Luxury car depreciation rates are significantly influenced by factors such as brand prestige, advanced technology integration, and limited production runs, which often result in slower value decline compared to standard vehicles. Key determinants include initial purchase price, maintenance costs, market demand, and the vehicle's exclusivity. While standard cars typically depreciate steadily based on mileage and age, luxury cars may experience sharper drops due to high repair expenses and market fluctuations in luxury demand.

Depreciation Cap Explained: What It Means for Luxury Cars

A depreciation cap limits the amount of value lost on a luxury car during lease or financing, helping to stabilize monthly payments and reduce financial risk for lessees. Luxury cars typically have higher depreciation caps compared to standard cars due to their faster and steeper loss in market value. Understanding the depreciation cap is crucial for luxury car buyers to accurately assess total cost of ownership and residual value projections.

Comparison: Depreciation Trends in Luxury and Standard Cars

Luxury cars typically experience a higher initial depreciation rate, losing up to 40% of their value within the first year compared to 20-30% for standard cars. Over a five-year period, luxury vehicles often retain only 30-40% of their original value, whereas standard cars maintain around 50-60%. This significant difference in depreciation trends impacts resale value, insurance costs, and overall cost of ownership for both vehicle categories.

How Purchase Price Impacts Depreciation Cap Differences

Luxury car depreciation caps are significantly influenced by higher purchase prices, resulting in larger absolute depreciation limits compared to standard cars. The initial cost directly affects the cap thresholds, allowing luxury vehicles to retain greater value over time before hitting depreciation limits. This price-depreciation relationship creates distinct financial implications for tax calculations and resale value assessments between luxury and standard vehicles.

Luxury Car Depreciation: Myths vs Reality

Luxury car depreciation is often misunderstood, with myths exaggerating its rapid loss in value compared to standard cars. In reality, while luxury cars do depreciate faster initially due to higher purchase prices and specialized features, their cap on depreciation can be more favorable over time because luxury brands maintain stronger resale value through brand prestige and limited production. Data from automotive resale markets shows luxury vehicles retain approximately 40-60% of their value after 5 years, contrasting with standard cars that typically depreciate down to 30-50%.

Standard Car Depreciation: Slower Loss or More Stability?

Standard car depreciation typically experiences a slower loss in value compared to luxury cars, offering more stability over time. Factors such as broader market demand, lower initial prices, and higher fuel efficiency contribute to steadier resale values. This stability makes standard cars a more predictable investment for long-term ownership and resale.

Resale Value: Luxury Cars Versus Standard Models

Luxury car depreciation typically occurs at a faster rate than standard car models, significantly impacting resale value over time. While luxury vehicles may boast higher initial prices, their market value often declines more steeply due to factors like advanced technology obsolescence and higher maintenance costs. Standard cars tend to retain value better, offering more consistent resale prices and lower depreciation caps, making them a more economical choice for long-term ownership.

Best Strategies to Minimize Depreciation on Luxury Cars

Luxury car depreciation caps often limit the deductible amount annually, making strategic purchase decisions and meticulous maintenance essential to preserve value. Utilizing certified pre-owned luxury vehicles and opting for limited-edition models can slow depreciation rates compared to standard cars, which typically depreciate faster due to mass production and lower market demand. Regular servicing at authorized dealerships and maintaining detailed service records enhance resale value, effectively minimizing depreciation on luxury cars.

Future Outlook: Depreciation Patterns in Luxury vs Standard Cars

Luxury car depreciation typically exhibits a steeper initial decline compared to standard cars, driven by higher premium pricing and rapid technological advancements. Future outlooks indicate that luxury vehicles may retain value better over time due to increased demand for exclusive features and limited editions, while standard cars experience more consistent but gradual depreciation. Market trends suggest that evolving consumer preferences and sustainability regulations will further differentiate depreciation patterns between luxury and standard cars in the coming years.

Luxury Car Depreciation Cap vs Standard Car Depreciation Infographic

cardiffo.com

cardiffo.com